Groups

Blue Book - January 2019

Our group coverage spans most of the traditional groups as defined by Standard & Poor’s and Morgan Stanley Capital International. At times, we found ourselves in disagreement with the S&P/MSCI “standardized” group delineation, but this structure was maintained, with minimal modifications. We have, however, added additional component stocks to all groups and adopted our proprietary approach to component weightings.

Blue Book - December 2019

Our group coverage spans most of the traditional groups as defined by Standard & Poor’s and Morgan Stanley Capital International. At times, we found ourselves in disagreement with the S&P/MSCI “standardized” group delineation, but this structure was maintained, with minimal modifications.

Blue Book - November 2019

Our group coverage spans most of the traditional groups as defined by Standard & Poor’s and Morgan Stanley Capital International. At times, we found ourselves in disagreement with the S&P/MSCI “standardized” group delineation, but this structure was maintained, with minimal modifications.

Leuthold Sector Rankings; Attractive & Unattractive-Rated Industry Groups

For the fifth consecutive month, the top-three rated sectors are Health Care, Consumer Discretionary, and Info Tech. The newly launched Communication Services sector (which replaces Telecom Services) debuts with a strong ranking in fourth place. Rounding out the bottom end of the rankings are Utilities, Materials, and Real Estate.

Industry Group Dreams And Nightmares

For nearly three decades The Leuthold Group has tracked hypothetical portfolios composed of the previous year’s industry group “Dreams” and “Nightmares.”

The Case Of The Disappearing Value Premium

Market history teaches us that investors behave differently in groups than they do as individuals.

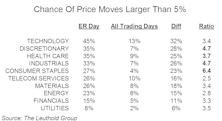

Earnings-Release Price Movement Among Sectors/Industries

Earnings season is not only important for fundamental investors, it can be equally so for quant managers. For quants that incorporate fundamental data, like us, historical trends and changes in consensus estimates may weigh heavily on model output.

Highlighted Attractive Groups

A snapshot of Automotive Parts & Equipment, Large Cap Biotechnology, and Reinsurance.

Industry Groups: No Need To Bottom-Fish

Buying global groups with strong price momentum has been a winning strategy. Will it continue?

Just Four Groups Up This Week

Best Performing Industry Groups: Restaurants, Precious Metals, Health Care Technology, Apparel Retail, and Automotive Retail

Where To Buy In The Changing Landscape Of Advertising

Select Industries makes an Advertising buy, looking for the large integrated agencies to make their best pitch.

Factor In Focus: Asset Growth Identifies Lack Of Capital Discipline

Asset growth is a factor that gets some attention, but not nearly as much as other more mainstream factors like price to earnings, earnings growth, etc.

Correlations: Digging Deeper At The Sector & Group Levels

Correlations have been extremely elevated over the past few years when compared to historical levels. The question is, which parts of the market has this impacted the most?

New Positions In Select Industries Portfolio

Two groups were purchased in the Select Industries portfolio in late October: Health Care Services and Wireless Telecommunication Services.

Checking In On Some Past Group Ideas

Updates for three groups we highlighted recently, including two domestic (Education Services and Automotive Retail), and one foreign-based thematic group, the Asia Healthy Tigers Index.

Diversified Metals & Mining—A Popular Theme Revisited

After an incredible secular rise in both metals & mining stocks and industrial metals prices, which ended in 2008 after nearly a decade of upside, we take a look at where this group stands today.

Variable Interest Entity Structure In Chinese Companies

Jun Zhu examines Chinese companies with Variable Interest Entity (VIE) structures. Investors shouldn’t be completely turned off by concerns over these structures, but it would be wise to heed the risks.

Digging Deeper With Group Level Data

This month’s “Quantitative Strategies” section presents a preliminary look at some long term trends in Valuations and Profit Margins for specific industry groups.

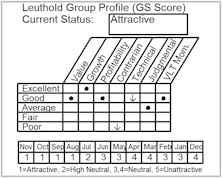

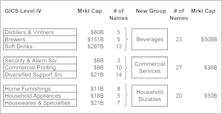

Less Is More: Refinements To Our GS Score Groups

Modest revisions were made to the industry groups that are evaluated by our GS Score framework. Driving objective was to make all groups more viable for investment consideration.

Market Correlation And Group Rotation Strategy

New data series confirms unprecedented correlations in equity markets.

January Market Action

Uncertainties are running high, and the stock market continues its struggle with a complex array of cross currents.

December Market Action

2008 is over. We expect 2009 to be better since worst-case scenarios now seem less likely to play out.

April Market Action

Relief finally came to Wall Street, not in the form of rebate checks or rate cuts, but from the strongest monthly returns since December 2003.

What Early Cycle Leadership Looks Like… An Historical Perspective

In the spirit of historical market research, we thought it would be a good time to revisit which industry groups perform best from bear market lows.

March Market Action

The moderate index level price moves from February month-end to March month-end didn’t give any indication of the wild swings that occurred during the days in between.

February Market Action

The stock market continued to trend lower in February, with most broad indexes posting losses in the 2%-3% range by month end.

January 2008 Market Action

To the extent that the January Barometer can still be trusted—and in judging its recent track record, it certainly can’t—the losses in January provide a foreboding message for the bulls in early 2008.

December Market Action

December’s bi-polar price swings had screens flashing brilliant with traditional holiday colors of red and green.

November Market Action

The venerable Wall Of Worry finally got to the stock market during November, with the major indexes losing their grip virtually right out of the gates.

October Market Action

October marked new all-time highs for the S&P 500 and Dow Jones Industrials, while mid and small cap indexes like the Russell 2000, S&P 600 and S&P Mid Cap indexes, tested, but failed to take out their July-2007 highs.

Outside The BLS, Inflation Is Alive And Well

This month’s “Of Special Interest” focuses on the inflation pressures into today’s marketplace.

August Market Action

Not even the stock market gymnastics of late-February and March of this year could rival the kind of volatility we saw in August.

July Market Action

The Major Trend Index’s bearish reading put us on the right side of the market during the second half of July.

Time For Some Defense? - Attractive AND Defensive Groups To Consider

Following the market rout of recent weeks, we imagine there are many clients sharing our nervous view of the stock market. For those clients, especially those managing long-only equity strategies, we thought it may be helpful to highlight some defensive groups that are scoring well in our group work.

June Market Action

At a time when the public remains largely sidelined, corporations, private equity, and professional investors continue to take the U.S. stock market averages higher.

May Market Action

It is getting increasingly clear that current stock market gains are being built upon the backs of corporate and private equity investors.

April Market Action

The bulls remain in command as evidenced by the fact that the broad market averages continue their ascent toward new cyclical highs (or in some cases like the DJIA and Russell 2000—new all-time highs).

Why Use Leuthold's Groups?

Clients who use our equity group work are well aware of the successful history of picking groups through the quantitative Group Selection Scores (GS Scores).

March Market Action

The stock market spent much of March trying to climb out of the hole dug back on February 27th. But to date, the primary indexes are still below late-February’s cyclical highs.