GS Scores

Group Selection Scores Remain In Gear

The Group Selection Scores have performed well in the first half of 2023, not an easy feat considering the abrupt style reversal that took place in January. Value and technical indicators are struggling, but the rest of the model is more than picking up the slack.

Select Industries Portfolio Shifts From Commodities To Growth

Exposure to commodities (and defense) has fallen rapidly within Select Industries. The primary beneficiaries of that reduction are growth-oriented groups.

Leuthold Select Industries Portfolio

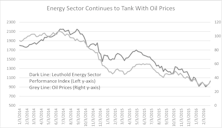

A combination of strength from Information Technology with weakness from Energy resulted in the two swapping places in our sector ranks this month.

GS Scores Successfully Navigate Choppy 2021

Industries propelling performance have been diverse; the top-five groups are from five different sectors. Commodity-oriented, retail, and financial groups have been the primary drivers. The Leuthold Select Industries equity strategy, which chooses its thematic investments from the GS Score’s Attractive range, is up 20.2% YTD through September.

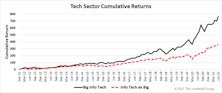

Big Time

Market environments are driven not just by industry preferences, but also by a bias toward the very largest companies. We have developed a new set of groups composed of the 10 largest companies from each sector. With several of these baskets sporting positive rankings, we felt a closer look was in order.

GS Scores Identify Successful Equity Themes In 2021

The Group Selection (GS) Scores are off to a fantastic start in 2021, and the Select Industries strategy, which takes its cues from the Attractive range, has taken full advantage.

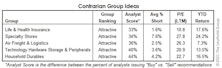

Our Most Contrarian Industry Group Ideas

Contrarian investing is difficult from both an emotional and implementation standpoint. Often the consensus is right, and industry groups are out-of-favor for a reason. As the saying goes, “Don’t be contrarian just for the sake of being a contrarian.”

Energy: A Curse And A Blessing

The Energy sector emerged as the top performer for January, a nice respite after a terrible 2020—but not exactly a good omen. Unlike in horse racing—where the concept of “early speed” has significant predictive power—the early leader in the sector-performance sweepstakes hasn’t reliably followed through in the last 30 years.

Energy: Still Too Early

Fundamentally, we don’t have much new to say on the disaster that Energy-sector equities have become. Mostly, we want to illustrate the danger of assuming that the stocks of commodity producers will necessarily follow the path of their underlying commodities.

Financials Strengthen Among GS Scores; Specialized Finance Purchased

The Financials’ Group Selection (GS) Score sector-composite rating has incrementally improved over the past five months, rising to rank #2 out of 11 sectors in late June.

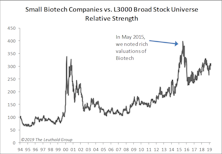

Small Cap Biotech Getting Pricey Again

In May 2015, we warned about rich valuations for small cap Biotech stocks and looked at various ways to evaluate those companies, as the majority have no approved drugs on the market, thus no revenue; therefore, valuing these companies using the conventional methodology is problematic.

Leuthold Sector Rankings; Attractive & Unattractive-Rated Industry Groups

For the fifth consecutive month, the top-three rated sectors are Health Care, Consumer Discretionary, and Info Tech. The newly launched Communication Services sector (which replaces Telecom Services) debuts with a strong ranking in fourth place. Rounding out the bottom end of the rankings are Utilities, Materials, and Real Estate.

Brick & Mortar Retail Evades October Sell-Off

Although Discretionary stocks broadly underperformed during October’s market decline, prominent amongst the very top industry group performers was a rather unexpected genre of industries—brick & mortar retail. Not only did this cohort hold up during October’s tumult, but many of the underlying stocks have been posting strong returns all year.

Sector Ranking

Health Care remains the highest-rated sector followed by Info Tech and Consumer Discretionary. These sectors have ranked among the top three since June. At the low end of the rankings are Utilities, Telecom Services, and Materials, all of which have been among the bottom three positions for three consecutive months.

GS Sector Rankings

Read this month's Sector Rankings.

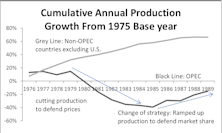

Recent Years’ Oil Price Experience Akin To 1980s’

We revisit commentary we published in 2015 regarding the late-2014 oil price crash and review why, at that time, we believed oil prices could stay at depressed levels for a longer period than most expected. Additionally, we advise avoiding two Energy sector segments: companies with high balance-sheet risk, and Energy Royalty Trusts.

Highlighted Attractive Groups

Home Entertainment Software, Managed Health Care, and Specialized Consumer Services are among the month’s intriguing opportunities based on the current Group Selection (GS) Scores.

January’s GS Score Sector Rankings

A summary table detailing the Attractive and Unattractive sectors and industry groups going into 2017.

2016 GS Score Performance Challenges

After three consecutive years of positive performance, the Group Selection (GS) Scores struggled in 2016.

Tech: Prices (And P/E Ratios) Breaking Out

Technology has proven a bright spot in an otherwise disappointing year for our Group Selection (GS) Scores, and it sits atop the sector rankings for the third consecutive month as of October.

Time For Materials?

The Leuthold Materials sector jumped five spots to #3 in the June Group Selection (GS) rankings, its highest ranking in eight years and the first reading outside of the bottom four in almost four years.

Insurance Theme Intact Among Top GS Scores

Group Selection (GS) Score strength among insurance-related industry groups has been a long-running theme within our quantitative framework.

Highlighted Attractive Groups

Food Retail & Distributors, Leisure Products, and Trading Companies & Distributors caught our eye this month.

Our Most Contrarian Group Ideas

We use our Group Selection (GS) Scores to identify the potential for a catalyst, and to gauge the health and future performance potential of those groups out of favor by analysts.

Purchased Specialized Finance: GS Score Surges

We see solid prospects for potential industry growth; consolidation and a full-blown industry evolution have resulted in group constituents having more in common than ever before.

Bottom-Fishing In Energy: Beware Of Bankruptcy Risks

New developments have lifted sentiment toward oil and Energy names, but we caution bottom-fishers to be mindful of risks. The fundamentals in the oil patch do not yet support strong oil prices going forward.

Highlighted Attractive Groups

Highlighting Automotive Retail, Education Services and Insurance Brokers.

February GS Score Highlights

The Attractive quintile of the GS Scores became more defensive in nature; the six groups that were downgraded all sported a cyclical business model. The SI portfolio’s Homebuilding group was deactivated after its GS Score strength deteriorated fairly quickly during its disappointingly short tenure.

Tech In The Pole Position

The S&P 500 Information Technology sector has just broken out to a 15-year relative strength high, and it jumped two spots to the top scoring broad sector position. The breakout in Tech provides a rare example in which foreign market action presaged a major domestic move.

Highlighted Attractive Groups

A snapshot of Automotive Parts & Equipment, Large Cap Biotechnology, and Reinsurance.

Purchased Advertising: Global/Digital Prospects Appealing

Advertising has been in the top rankings of our Group Selection (GS) model for several months.

Automotive Retail: Still In The Driver’s Seat

We revisit this long-held industry group and explain our positive outlook going forward.

GS Score Sector Rankings, and Highlighted Attractive Groups

Health Care, Consumer Discretionary, and Financials remain the top three rated broad sectors.

Oil & Gas Refining & Marketing: New Purchase

Amidst the Energy carnage, the Oil & Gas Refining & Marketing group is the exception, having returned over 7% YTD. Refiners are able to perform well in a variety of oil price scenarios—and tend to thrive in a falling crude oil price environment.

Small/Micro Cap Biotechnology: Still Richly Valued

Despite the group’s big losses since May, the results show Small/Micro Cap Biotechs are still richly valued. As market volatility heats up, this group faces additional downside risk.

GS Score Sector Rankings, and Highlighted Attractive Groups

Advertising, Homefurnishing, Research & Consulting Services

Info Tech Sliding

IT’s overall sector rank has been falling recently. Growth has slowed, which has prompted downward earnings revisions, while valuation ratios have remained steady or gotten pricier.

Homebuilding, More Than Just Curb Appeal?

While this Consumer Discretionary group has not experienced six-plus-years of market outperformance, we think it may be poised for a late-game bounce. An overall lack of housing options may be just what this industry needs to give it a long-awaited boost.

GS Score Sector Rankings, and Highlighted Attractive Groups

Health Care, Consumer Discretionary, and Financials are the top three rated broad sectors.

The 30/30 Club!

The S&P 500 Energy sector’s latest plunge puts it down by almost a third in the last 14 months. It now belongs to an exclusive list of sectors which have declined 30% on both an absolute basis and relative to the S&P 500!