High Yield Bonds

Tactical Junk

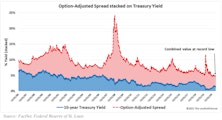

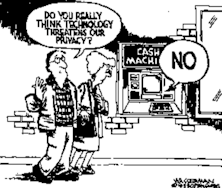

High yield bonds returned a robust 15.4% in the year ending June 30, extending a winning streak that produced a 56.4% cumulative return since the end of 2015. After a quick, severe drawdown at the height of the COVID-19 scare, junk bonds have experienced nearly ideal market conditions, heralding a return to trends that have been in place for several years. The post-pandemic move toward this record low has been a boon to high yield bond investors, but it has also created a significant risk of reversal. We believe most things in the financial markets are defined by cycles, with Treasury yields and credit spreads no exception. Tight readings for both rate series demand that we consider the possibility that a cyclical reversal could weigh on junk bond prices going forward.

Research Preview: High Yield’s Heyday

High yield corporate bonds returned over +15% for the twelve months ended June 30th, building on a strong five-year run that was interrupted by a short, but painful, drop at the onset of COVID-19. Chart 1 indicates that high yield bonds compound at a remarkably steady rate, with infrequent but severe drawdowns during times of financial stress.

An Alarming 2008 Analogy?

While breadth and leadership accompanying the upswing off February lows have been impressive, the most outstanding feature of this advance might be the confirmation provided by high yield bonds.

U.S. High Yield Corporate Bonds: Maintain Neutral

We will be looking for a good follow-through to consider an upgrade of these bonds.

Stock Market Observations

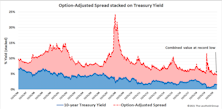

The August market break did not emerge from out of the blue. The foundation for the bear case was put in place many months before those four ugly days in late August.

U.S. Bonds

U.S. Quality Corporate Bonds & Munis Rated Favorable; High Yield Bonds Rated Neutral.

U.S. High Yield Corporate Bonds: Maintain Neutral

Although the fundamental picture remains healthy for most U.S. High Yield issuers and defaults are expected to be low, the reversal of a crowded trade could lead to further substantial losses on these bonds.

U.S. High Yield Corporate Bonds: Maintain Neutral

High yield bonds are not immune to the tapering of QE.

Rising High Yield Spreads....Implications For An Agnostic Stock Market

Link between Junk bonds and stock market seems to be indicating that stock investors are ignoring factors pushing Junk bond yields higher.

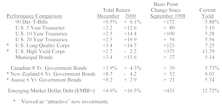

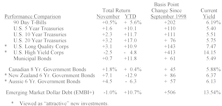

Bond Market Summary

High Yield bonds rated marginally attractive after continued spread narrowing.

Bond Market Summary

Is the Fed ready to buy Ten Year Treasuries, if necessary to stimulate the economy? This could certainly lead to another housing/refi boom, but will it be the catalyst to boost business spending/borrowing? We think not.

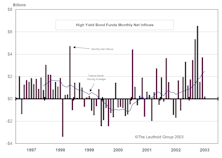

High Yield Bond Opportunity: Yield Spreads Widen, Opportunity Remains

We believe High Yield bonds remain attractive. The economy is improving and corporate profits are rebounding from depressed levels.

Bond Market Summary

The spread between Long Quality Corporates and twenty year Treasury bonds at the pinnacle is back down to a more normal range, as the Treasury shortage elimination-thesis has fallen apart due to rising budget deficits.

Bond Market Summary

High Yield bond only fixed income area strongly appealing to us, currently.

Bond Market Summary

We believe it is an opportune time to add to High Yield positions. The economy is improving and corporate profits are rebounding from depressed levels.

Bond Market Summary

Expect CPI and PPI to both edge higher in second half of year...could be negative surprise, but not the start of something big.

Bond Market Summary

U.S economy weakening faster than expected: Global economy also slowing. Increasing odds of a hard landing in 2001.

Bond Market Summary

Overall inflationary pressures subsiding, but expect some energy related flair-ups.

View From The North Country

“What? You’re buying Junk Bonds?!” Although some may view this as a high-risk, contrarian bet, the logic behind the strategy is explained.

Bond Market Summary

U.S. economy losing momentum, global economy slowing more…..Increasing odds of recession in 2001, as banks tighten credit, energy costs remain high, and technology falters.

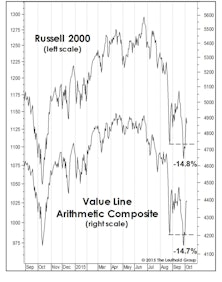

January Mutual Fund Flows

Net inflows into U.S. focus equity funds were somewhat ahead of last year’s pace by the end of January. Estimated net inflows of $18 billion compares to last January’s $16.1 billion.

Bond Market Summary

1998 Inflation Projections: CPI expected to end 1999 about unchanged from year end 1998 levels (year over year change of 0.0%).

Bond Market Summary

At current levels U.S. T-bonds are no longer viewed as attractive. U.S. T-bond potential downside now about matches upside potential. Our 17 year old 5% T-bond target was achieved last month.

January Mutual Fund Flows

Net inflows into equity funds lagged somewhat behind last January. We estimate U.S. focus equity funds experienced still strong net inflows of $17 billion, but foreign focus net inflows may have been less than $1 billion (net redemptions in the first few weeks).

A Potential Tactical Move Into Junk Bonds

It still appears to be premature, but we are giving serious consideration to adding a package of selected high yield corporate bonds to the fixed income component of the two asset allocation models.