Industrials

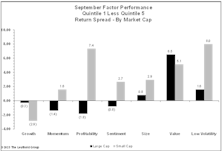

Factor Behavior Differs By Market Cap

Growth has performed much better among large caps than small caps, resulting in higher relative valuations for large caps. Based on factor valuations, we think value provides a more attractive large-cap entry point, while growth looks more attractive within small caps.

Weight Watcher Update—Still Like Value Sectors

While the valuation gap between Growth and Value sectors was compelling just a couple of years ago, it has closed drastically the last twelve months. Our analysis shows that Value sectors (Energy, Industrials) are still more favorable than Growth sectors (IT, Health Care).

Discretionary And Industrials Decline Rapidly In Rankings

Not much has changed at the top of our sector rankings in recent months, with Financials, Energy, and Info Tech in the top three positions. But, we have seen a very rapid decline with two sectors, Consumer Discretionary and Industrials. Over the past several months, these cyclical sectors have sunk to the bottom of our ratings. Here we take a look at what has caused this dramatic drop.

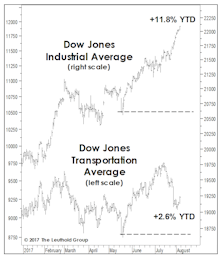

Troubling Transports?

Does the last few weeks’ stumble in the Dow Jones Transportation Average foretell anything sinister? Not on the face of it.

Has The Hook Been Set?

Two months ago, we suggested a short-term bounce in oil might prove to be the fundamental “hook” that would rationalize a bear market rally. We thought a bounce to $45 might do the trick—and oil futures essentially cooperated, reaching $41.90 on March 22nd.

The Bullish Case: A Mental Exercise

We’ve been correctly positioned near our tactical portfolios’ equity minimums, yet we’re oddly compelled to use this month’s “Of Special Interest” section as a very public second-guessing of that move.

Construction & Engineering: “Unloved” Opportunity?

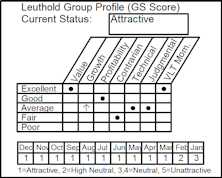

After nearly six years, the Industrials sector has reclaimed a top three spot among the GS Score’s Broad Sector Composite rankings—six of the sector’s 18 groups rank Attractive and two are in High Neutral. Construction & Engineering, an Industrials sector group, offers diversity in several ways—from the nature of its underlying businesses, and through areas of strength supporting the GS Score factor categories.

Profit Margins At The Sector Level

All ten of the S&P 500 sectors recorded a sequential increase in four-quarter trailing net profit margins. But consider where sector margins stand today relative to their 25-year medians. Eight of ten S&P 500 sectors are recording profit margins well above their long-term medians.

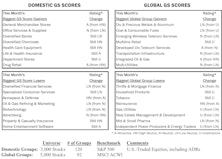

Group Models: Info Tech Tops Domestic, Financials Remain Atop Global

Both models have numerous Information Technology and Financials groups in Attractive territory. Neither model has any Unattractive Tech groups. Alternatively, neither model has any Attractive Utilities groups, while several Utilities rate Unattractive in each.

Aerospace & Defense Purchased

With a wide range of market cap choices, an excellent technical profile, and less dependence on federal spending than you might think, this group has compelling stories of future profitability and growth.

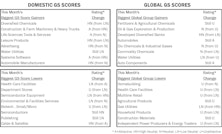

Group Models: Info Tech Tops Domestic, Financials Tops Global

Both models (particularly domestic) have a number of Attractive rated Information Technology groups and no Unattractive rated Tech groups. Financials’ domination of the Global Attractive range continues.

Select Industries: Adding Aerospace & Defense Group

Aerospace & Defense was added to the portfolio this month.

Sector Margins: Just Thank The Consumer

We’ve noted before that profit margin gains since the technology boom have been primarily a Large Cap phenomenon.

Group Models Agree On Energy & Materials

But Information Technology rises to the top of the Domestic model, while the trend of Financials domination in the Global model remains intact.

Domestic and Global Group Models: Strong Agreement On Financials

Our Domestic Scores have five Financials groups rating Attractive; these same five industry groups are Attractive in our Global model. In total, seven Financials groups rank Attractive in the Global model, with insurance groups looking particularly Attractive.

A Contrarian Call For The Second Half

With the notable exception of the Consumer Discretionary sector, cyclical stocks topped out globally on a relative basis in early 2011 (Chart 3). Throughout the last two and one half years, there have been repeated calls for industrial cyclicals—which were, of course, the leaders of the last cyclical bull market—to reassume stock market leadership.

Domestic and Global Group Models: Agreement On Financials, Industrials

DOMESTIC GS SCORES: Among the sector rankings, Consumer Discretionary leapt from fourth to first this month. Information Technology climbed to second from third, while Consumer Staples was bumped from first to third place.

GLOBAL GS SCORES: Financials’ domination of the Attractive groups continues, and no groups rate Unattractive. Consumer Staples, Energy, and Health Care have no Attractive groups.

Select Industries Takes Flight With The Airlines

This group has been Attractive since March, and currently ranks fourth in our Group Scoring model. We think an improving fundamental story, coupled with a strong GS Score, is emerging from this ravaged industry.

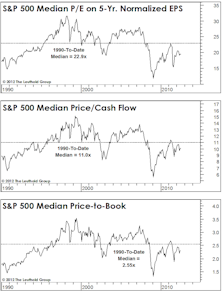

A Look At Thematic And Sector Valuations

Health Care and Consumer Staples valuations don’t look as dangerous as widely assumed. Utilities look expensive; conversely, the big corrections in the Industrials and Materials sectors have yet to create truly compelling valuations. The best sector for contrarians is Energy.

Beware The Economic Ticker Tape

It has become more and more difficult to filter out the short term economic noise. By focusing on this minutia, investors can easily lose sight of the big picture.

The High-Tech Thirty (Continued) and “Let’s Get Competitive”

The High-Tech Thirty index was introduced last month and fostered considerable interest. We have done additional work, providing more back history, and drawn a new chart. “Let’s Get Competitive” was introduced in a special feature last month however, because of timing considerations, we have not yet started building a major portfolio holding in this area. But maybe we should stop trying to get so cute and get on with it.

“Let’s Get Competitive”: A Conceptual Investment Theme

Capital spending to improve manufacturing and industrial productivity may be much higher than anticipated over the next three years. Management confidence is growing, and attitudes are changing: “Yes, we can compete with our overseas rivals.” Here are the stocks and industries that should be the major beneficiaries of this projected development.