Insiders

April Factor Performance: Talk About Boring

Very little to show for a month of solid market performance. Breaking the market down by capitalization yields some interesting results.

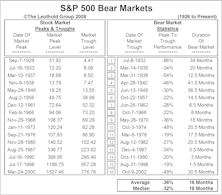

The Beginning Of The End.....Yes, We’re Talking About The Bear Market

September was a horrible month for the stock market, but now is not the time to be selling stocks. We believe a market bottom is close at hand, and this month’s “Inside The Stock Market” section presents several of our “big picture”, historical market studies to provide support for this belief.

Morose On Main Street… So Why Isn’t The Smart Money Worried?

Consumer confidence levels have sunk to five year lows. Could this be a bullish omen for the markets?

Attractive Groups Based On Insider Scores

We have been taking the opportunity each month to highlight a portion of our groups’ insider buying and selling scores. This month, we are presenting the groups with the best insider scores.

Unattractive Groups Based On Group Insider Scores

In prior issues, we have presented those equity groups that had been displaying the best readings in terms of insider selling/buying. Several clients have expressed an interest in seeing those groups with the most significant levels of insider selling. The following table presents the ten groups with the most pervasive insider selling.

Attractive Groups Based On Group Insider Scores

During the last few months, we have been looking at the Insider Selling and Buying among various broad sectors and have also recently been presenting those specific equity industry groups that currently have the best scores based on the insider patterns of selling and buying.

Attractive Groups Based On Insider Scores

During the last few months, we have been looking at the Insider Selling and Buying among various broad sectors and last month decided to present those specific equity industry groups that currently have the best scores based on the insider patterns of selling and buying.

Attractive Groups Based On Insider Scores

Best looking groups based on current Insider Buying Selling patterns include: Gas Utilities, Aluminum, Brewers and Auto Manufacturers.

Insider Buying/Selling In Technology Sector…..Some Isolated Buy Signals

At the market lows, the Tech insiders while not net buyers clearly slowed their aggressive selling.

Insider Selling/Buying In The Financial Sector…..Lots Of Selling At Present

An examination of Financial groups with respect to insider selling/buying. At the extremes, this tool (which is employed in our GS Scores) works pretty well.

Insider Selling/Buying In Health Care Sector…..Has Proven To Be A Useful Guide

A look at the Insider Selling patterns of several Health Care related groups. As with Energy groups, there is some evidence that Insiders’ transactions can be useful in identifying tops and bottoms in specific industry areas.

Client Questions

Answering client questions on the economic recovery, bull market upside, valuations, Main Street and what could go wrong?

Insider Selling: Not As Bad As Media Depicting

Recent selling by corporate Insiders is not as bad as you are being told!

Insider Block Measures....Recent Selling Binge Shows Signs Of Slowing

Despite the recent rise in net selling over the past 5 months, we still view recent buy signals in Q4-2002 and Q1-2003 as bullish for the stock market.

Insider Block Measures....Recent Increase In Selling But Reading Still Viewed As Normal

While the recent spike in insider selling has been well documented by the media as an ominous sign for stocks, the YTD level of net selling is down significantly from recent years.

Insider Block Measures....Selling By Corporate Insiders On The Rise As Market Rallies

We view recent buy signals in Q4-2002 and Q1-2003 as a bullish indicator for the stock market. In the past, these “buy” signals have provided a timely indication that stock market performance would improve going forward.

Insider Block Measures....Encouraged By New Confirming Bullish Signal

The decline in insider selling this year is a very encouraging sign for the stock market.

Insider Block Measures....Back Into “Normal” Net Selling Territory From Bullish Zone

The latest 10-week reading of 0.27% has risen back into the normal zone after spending six weeks in bullish territory.

Insider Block Measures....New Big Buy Signal Registered In February!

The latest reading is well into bullish territory and is the most positive reading on this indicator since the first quarter of 1995.

Insider Block Measures....Approaching Another Buy Signal

We would view a new buy signal as a bullish confirmation of the previous buy signal (registered October 30th).

Insider Block Measures....Still Bullish

Through the end of 2002, reported big block net sales totaled $24 billion, compared to net selling of $40 billion in 2001 and $72 billion in 2000.

Insider Block Measures....Bullish

You may notice we have raised the buy and sell zone going back to 1997. The reason for this adjustment becomes pretty clear when you look at how the dollar volume of big block net selling has been trending upward since 1997.

Insider Block Measures....Selling Pressure From Insiders Continues To Wane

Latest 10-week reading of 0.29% remains in the normal range of net selling territory.

Insider Block Measures....Less Selling By Insiders In August/September

The most recent sell signal (registered June 26th) proved to be very timely in retrospect, with the S&P 500 falling a big 14% in the four weeks that followed.

Insider Block Measures....The Late June Sell Signal Was Again Timely

The most recent sell signal (registered June 26th) proved to be very timely in retrospect.

Insider Block Measures....Another Sell Signal Registered In Late June

This is the second sell signal registered in the last six weeks.

Insider Block Measures....Brief Sell Signal Registered In Late May

The latest 10-week reading has moved back into the upper end of normal range, after registering a sell signal in previous week.

Insider Block Measures

Insider selling on the rise, but no sell signal yet.

Insider Block Measures

Remains in normal historical range.

Insider Block Measures

Remains in normal historical range.

Insider Block Measures....Remains In Normal Historical Range

Remains within the “normal” historical range for net selling.

Insider Block Measures & NASDAQ Short Interest Ratio

Insider block measures now moving down toward bullish territory…..but not there yet.

Insider Block Measures...Selling Volume Drying Up

The latest 10-week reading declined a big 48% from the previous month end, and has fallen to the lowest level of insider net selling since late-1998.

Insider Block Measures...Selling Volume Declines Some, But Remains Heavy

Early in June, it appeared that big block selling was on the decline. But in the three months since, heavy selling has resumed.

Insider Block Measures...Heavy Selling Volume Still Sending “Bearish” Message

Early in June, it appeared that big block selling was on the decline. But in July and August, selling has resumed at a furious pace.

Insider Block Measures

Selling volume steps up in July.

Insider Block Measures...Brief Selling Respite In Early June, But Then Heavy Selling Resumes

Early in June, it appeared that big block selling was on the decline. But in recent weeks it appears that heavy selling has resumed once again.

Insider Block Measures...Insiders Didn’t Buy This Dip

The latest 10-week reading fell 16% from the previous week, but the average remains above historical selling extremes.

Insider Block Measures...Insiders Not Buying This Dip

Despite stock price corrections in the last year, significant net selling continues among the “smart money”.