January

Putting Two Market Maxims To The Test

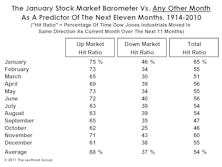

For decades, stock market observers have viewed January’s action as a harbinger for the rest of the year. Is there any merit to that belief?

How About That January?!

The market’s stumble in early February was so abrupt that there was no time for us market numerologists to bask in the limelight of the bullish January Barometer.

Most Likely Just A Correction

So, what happened to the January Barometer—the old analyst’s maxim that a market gain in January portends a gain for the full year?

Discrepancies Arise Between December & January

January could be a month that disrupts the current trend, but one month is not enough time to merit a changing of the guard.

January Anomalies Revisited

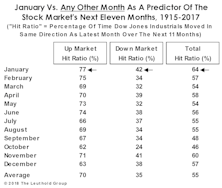

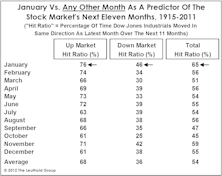

The January Small Cap bounce effect ain’t what it used to be, but extrapolating the month’s market action for the next eleven months is a “less bad” idea than any other time of the year.

Up Market In January = Up Year??

As January goes, so goes the year. 2012 looks like it could well be an up year for stocks based on the January barometer. Market cycle chart from 1958 also says 2012 will be the “time to buy.”

A “Textbook” Start To 2011

All time honored seasonal anomalies are indicating stocks can go higher in 2011. The good news is our Major Trend Index agrees, and has actually been getting stronger the last few weeks.

The January Effect: Return To The Good Old Days?

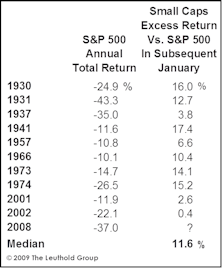

“January Effect” has lost some of its luster in recent years, but historically it has produced very strong returns following big down years.

February 1st: Investors' Groundhog Day

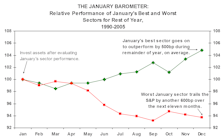

We wondered whether or not strong relative sector price action during January tended to persist for the remaining eleven months of the year. During the last 16 years, evidence proves that the strength does persist.

January Effect: Now Arrives In December

Buy now to play January effect. Every year, over the last ten years, small caps have beaten the large caps in December!

A Disappointing Start

The “seasonals” were with us, but have yet to produce positive results. “V” shaped economic recovery conviction stronger than a month ago.

Bullish...At Least for a While

The public is back as evidenced by strong mutual fund cash inflows. Seasonally strong Q1 mutual fund inflows should push the DJIA above 10,000. Traditional “January Effect” may be absent again in 1999, as it has previous four years.

It’s A Big Cap Market

No January effect this year. It was a large cap show, with the DJIA (+5.4%) outperforming 85%-90% of stock groups and sectors for the month and the S&P trouncing about 70%.

“Playing the Bounce”

For over 10 years, The Leuthold Group has been sending out a list of year end trading suggestions. In November and December we go “bottom fishing” for stocks that are overextended on the downside. When year-end selling pressures lift, these selected Issues typically rebound nicely Into January or even February.

“Playing the Bounce” …The January Effect

This year we have decided to “play the bounce” with 8% of our model’s equity assets. The market environment looks right and we have confidence in our quantitative and qualitative judgement disciplines.