Labor Market

Groupthink?

Question: While hopes for an economic soft landing have ticked up a bit, the consensus view among economists still seems to be for a recession in 2024. Does having so much company concern you?

Response: Of course!

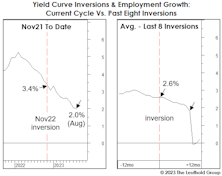

Labor Market Begins To Labor...

Most labor market measures continue to weaken, and for investors still heavily invested in stocks, we’d caution against waiting for all labor market figures to deteriorate before scaling back. Equities will likely take a big dive before such conclusive evidence arrives.

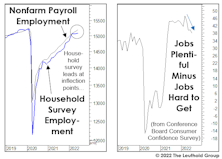

The Late-2022 Recession That Wasn’t

Our Treasury Secretary (and former Fed Chair) has described the JOLT survey (Job Openings and Labor Turnover) as her favorite labor market indicator. We don’t know why: It’s a good survey, but similar figures become available about two months in advance of JOLT.

The Economy Rallied In January, Too

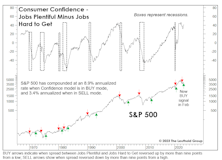

The narrative for January’s strong stock market bounce is that not all key economic releases looked to be forecasting a recession. However, one must consider that this was only true for coincident and lagging data series.

The World As Powell Sees It

When the economy falls into recession, labor market measures will be among the last to tell us. We can’t resist watching them anyway, for two reasons. First, we know that the Fed’s self-proclaimed data dependency is unduly reliant on lagging data points, like the monthly employment report. We want to see what the policymakers are seeing, even if that sometimes means using the same, fogged-up rearview mirror.

Job Market Suddenly “Laboring”

We cringe when we hear the Treasury Secretary or a regional Fed bank president dismiss the possibility of recession on the basis of “low unemployment and strong job gains.” Those measures are as “laggy” as any economic statistics the government publishes.

Ulterior Fed Motives?

In an echo of last decade, the Fed has come under fire for keeping crisis-based monetary policies in place well after a crisis has subsided. Predictably, the Fed rationalizes its uber-accommodation by citing the slowest-to-recover data series from a set of figures that already suffer from an inherent lag (labor market indicators).