Labor

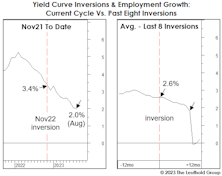

Labor Market Begins To Labor...

Most labor market measures continue to weaken, and for investors still heavily invested in stocks, we’d caution against waiting for all labor market figures to deteriorate before scaling back. Equities will likely take a big dive before such conclusive evidence arrives.

How Much Slack?

By now it’s consensus that the Fed missed the ideal window for the first rate hike (if one ever existed) by at least a year and a half. We don’t disagree…

U.S. 10-Year: 245-250 Area A Strong Barrier

We expect the 245-250 area, the upper bound of the previous lower range, to be a strong barrier.

A Taper & Hibernating Bears

The rise in interest rates after the taper was on the back of low liquidity around the holidays. 3% is a pretty strong upper bound for the 10-year, and a failure to stay above this level will probably see a re- test of the 275 level in the near term.

The Dual Mandate Presents A Clear Dilemma For The Fed

The “dual mandate,” which means the Fed is paying close attention to both inflation and employment, presents a clear dilemma for the Fed when it comes time to decide on a taper.

View from the North Country

The Ross Perot Factor...A New Hero Streaks Across The Political Heavens... Let’s Screw the Kids (Government Generosity for the Elderly)...U. S. Cheap Labor?