Large Cap

Thoughts On The Secular Outlook

Some have speculated that 2022 might have been the kick-off for a decade-long era in which the broad stock market indexes will make essentially no progress, like 1966-1982. However, that earlier experience provided opportunities within other market segments, which will also stand a much better chance in coming years.

Musings On A Manic Market

Officially, those quick to pronounce the move off March lows as a new bull market have been proven correct with new S&P 500 all-time highs. Fundamentally, though, there’s enormous risk in Large Cap valuations, regardless of where one believes we are in the economic cycle.

Big Is Still Beautiful

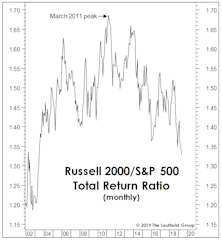

The 10-year-old bull grabs most of the headlines, but its younger sibling has begun to command more respect.

If Not Large Cap Growth, Then What?

With the valuation of several high-profile Large Growth names well over 100 times earnings, we consid-er alternatives by examining the relative valuations between LG and other equity categories.

The Kindness of Strangers

We have recently been struck by the tremendous valuations being awarded to companies that have never turned a profit. Tesla, Spotify, Workday, and Square all sport market caps above $25 billion based not on their recent earning power (which is zip), but on the hopes that they will one day move well into the black.

Active Vs. Passive Return Drivers

Our July special report “Active vs. Passive: A Three-Club Headwind” studied the recent dominance of passive indexes over actively managed funds.

Small Cap vs Mid Cap vs Large Cap

The Ratio of Ratios bounced off last month’s multi-year low (4% Small Cap discount) but still sits firmly below its Small Cap median, which is a premium of 4%.

Small / Mid / Large Cap

The August market action deflated P/E ratios across all market cap tiers, but our ratio of ratios was little changed.

Small Cap/Mid Cap/Large Cap

Nudged higher by Small Cap outperformance in May, our premium is little changed month-over-month and remains in its new 5-10% habitat.

Small Cap/Mid Cap/Large Cap

Small Cap Premium Plunges To 5%

Small Cap vs Large Cap

Small Cap Premium A Tick Higher To 16%

Small/Mid/Large Cap

Small Cap Premium Sinks To 15%

Small Cap vs Mid Cap vs Large Cap

Small Cap Premium Spikes Back To 20%

Small/Mid/Large Cap - Small Caps Experience Worst Monthly Return Since May 2012

In September, the Russell 2000 index lost 6% and is down 4.4% YTD. Large Caps widened their YTD performance lead (S&P 500 +8.3%). Small Cap Premium slides to 15%.

Small Cap/Mid Cap/Large Cap

Small Caps are selling at a 19% valuation premium relative to Large Caps.

Small/Mid/Large Cap

Small Cap Premium Slumps To 17%

A Milestone You Might Have Missed

The fifth anniversary of the bull market was met with fanfare, but the launch of the Large Cap leadership cycle in April 2011 is receiving no attention whatsoever.

Stock Market Leadership In 2014: Large Caps, Tech, Health Care

Following a great year for trend-following, capitalizing on key reversals in sector performance will be important in winning the 2014 performance derby.

Large Cap Vs. Small Cap: Performance Parity 1979 To Date

If we look only at the past eleven years, 2000-2010, the S&P 500 has decisively underperformed the Russell 2000.

Can Growth Stocks Outperform Value In A Bear Market? You ‘BETA’ Believe It!

Conventional wisdom and modern day historical evidence indicate that Value stocks do better in bear markets. But from the 1920s through the 1970s, it was Growth that held up best during bear market declines.

Cyclical Stock Dominance — How Long Can It Persist?

An in-depth examination of performance relative to Growth stocks; what has been typical in terms of leadership duration; and how the economy and inflation may affect the current trend.

Large Cap Growth Versus Large Cap Value

Large Cap Growth stocks are relatively cheap compared to Large Cap Value stocks. The next major trend should be in Large Cap Growth.

View From The North Country

Many consultants and their clients have tightened the style boxes and narrowed the definitions to such a degree that it hamstrings the manager….and it’s detrimental to the client’s long term results.

Big Cap Versus Small Cap: S&P 500 Versus Russell 2000

The following table compares the performance of the Russell 2000 Index (since its inception in 1979) with the S&P S00. Over this entire period, the Russell has outperformed the S&P in ten of the twenty years (S0% of the time), producing a slightly lower annual compound rate, 12.4%, versus 13.6% for the S&P 500.

Tracking the Big Cap and Secondary Stock Relationship...Some New Analytical Tools

Historically, small cap stocks have outperformed big cap stocks in about two out of three years. But this has not been the case since mid-1983. What is going on? Has the investment world changed? Will small stocks ever again lead the parade?