Leadership Cycles

The Cycle That Never Was

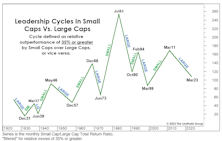

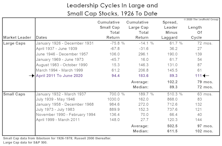

At 144 months, this is now the longest Large-Cap cycle on record, but its dominance will have to prolong to eclipse the second-longest leadership phase (1946-1957), in which Large Caps achieved a 190% performance spread above Small Caps.

Small Caps: We’ve Seen This Setup B-Four

In mid-2020, we wrote that a new multi-year leadership cycle had probably begun. Technically, that belief hasn’t been disproven, but the extent of outperformance has been disappointing in the nearly three years since.

Not Overthinking Small Caps

There are some positive cyclical influences for Small Caps, like higher inflation and deeply negative real interest rates. But in our minds, the valuation spread versus Large Caps is more important.

A Look At The Small-Cap Setback

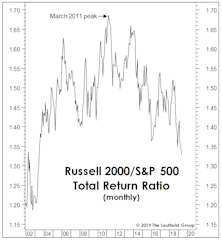

The Russell 2000 has blown the 14% lead it had built against the S&P 500 earlier this year, and now trails the index by almost 5%. Has that type of intra-year reversal happened before, and, if so, did it portend a major change in leadership?

A Small-Cap Theory Of Relativity?

Small Cap median valuations are among the highest in our 40-year database, but they are bottom quintile versus the nose-bleed level of the median Large Cap. If this Small Cap leadership cycle only matches the shortest one on record, it will last another three years. Based on the valuation gap, that guess seems conservative.

The “Next Big Thing” May Not Be Big

There’s one trend that’s lasted almost as long as the bull market and economic expansion and it hasn’t definitively come to an end. The current Large Cap Leadership Cycle hit the nine-year mark in April.

Leadership Rotation And Bear Markets

Bear markets are the financial system’s version of the changing seasons—a cycle we “enjoy” to extremes here in Minnesota.

Can New Reins Take Hold Of An Old Bull?

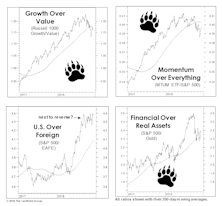

Three months ago, Large Cap Growth and Momentum were the winning ways to play the market; the long-time resiliency of these entrenched leaders was a cornerstone of the bullish case. Suddenly it’s Value and Deep Cyclicals leading, anything possessing Momentum, of late, has turned toxic. Ironically, this “new” leadership is now the foundation for the bullish reasoning.

Big Is Still Beautiful

The 10-year-old bull grabs most of the headlines, but its younger sibling has begun to command more respect.

It’s Not A Pause… It’s “Paws”

A bear market will almost always prove to be the catalyst of one or more shifts in long-term market leadership.

Monitoring Mo’s Mojo

Momentum is one of the most successful investment styles over the long run, and does particularly well in the later stages of a bull market during the run-up to an eventual peak.

Value Style’s 100-Year Flood

Value is the philosophical cornerstone of many legendary portfolio managers and is widely recognized as one of the most robust quantitative investment factors. Yet, despite its compelling conceptual merits and long-term record of superior returns, recent years’ underperformance of Value has lasted long enough to weigh on even 10-year performance records.

The Foreign Stock Conundrum

A good rule of thumb for thematic and sector investors is that stock market leadership rarely repeats itself in consecutive cycles.

Small Caps Out Of “Phase?”

If one manipulates the data correctly, one can make the size effect—whereby Small Caps earn excess returns over the long pull—look instead like a beta effect.

EM Leadership: Just The Beginning?

Our EM Allocation Model triggered a BUY at the end of August after 5 1/2-years in bear mode. This upgrade is consistent with a cyclical leadership run of one to four years relative to Developed Markets.

Rotation Away From Low Vol?

An encouraging break from a 15-month leadership pattern: Low Vol stocks have rolled over since mid-July, while the High Beta cohort has finally eclipsed its late-April highs.

Low Quality Dominance Since March

After two rough months moving into 2016, Low Quality stocks rallied and are now leading High Quality stocks YTD. Investors apparently brushed-off the slowdown scare from China, and later the Brexit headlines.

Small Caps: The P/E Premium Lives On…

Small Cap valuations may look better on a relative price-to-book basis, but we still believe their Normalized P/E ratios will suffer further compression before Small Caps reclaim the leadership baton.

Small Cap P/E Ratios: Not Yet Low Enough

When the Fed surreptitiously began to tighten as we believe (via tapering), in January 2014, history suggested that Consumer Discretionary and Small Caps would be the most likely initial market victims (at least from a relative perspective).

Value, Momentum, And The Stock Market Cycle

Conventional measures of market action, like breadth and industry leadership, point to the formation of a bull market top. Divergences abound.

Small Cap Premium Finally Shrinks—But Remains Historically Extreme

July’s Russell 2000 -6% rout finally deflated some of the Small Cap valuation premium we’ve been grousing about in recent years.

Quality Stock Rankings: Low Quality Momentum Persists

Low Quality Momentum persists, and a look at how Valuation factors affect the Quality model output.

How Long Can Small Caps Lead?

The Russell 2000 is about five points ahead of Large Caps YTD, and is approaching its April 2011 long-term relative peak. We view this outperformance as their leadership’s last gasp and not a new cycle.

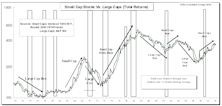

Small Cap Stocks: Hard To Make The Numbers Work…

Leuthold’s Doug Ramsey takes an in depth look at historical Small and Large Cap cycles and offers insight as to where we stand now and what can be expected going forward.

U.S. Small Caps: Carving Out A Very Long Top

The current period of small cap leadership is the longest ever. And while small caps have been selling at a premium, the premium has persisted for a long time.

Small Cap Appeal Is Fading

After already rallying substantially from the March lows, it will be tougher for small caps to continue their outperformance.

The Stampede That Wasn't

A month ago we suspected June might see a big institutional rush into the stock market. The stampede never came, though, and the market finished essentially flat for the month.

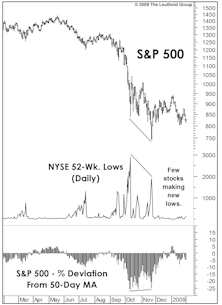

Positive Technical Trends

While there is plenty to worry about, some important technical trends still suggest that November 20, 2008 stands a good chance of being the final low of this bear market.

December Market Action

2008 is over. We expect 2009 to be better since worst-case scenarios now seem less likely to play out.

Bull Markets: The Best Comes First

New bull markets are front end loaded, with the strongest performance usually coming within the first few months. Study also shows that Small Cap Growth stocks tend to outperform their Large Cap and Value counterparts.

Small Cap Stocks: An Extension In Leadership?

Small Cap leadership trend maybe re-emerging. Doug Ramsey examines Small Cap performance coming out of bear markets. Historically, they have been able to do well as higher beta plays.

What Early Cycle Leadership Looks Like… An Historical Perspective

In the spirit of historical market research, we thought it would be a good time to revisit which industry groups perform best from bear market lows.

Consumer Goods Stocks Versus Commodity Stocks: Identifying Long-Term Leadership

Are we asking the wrong question about Consumer Stocks versus Staples? This month’s “Of Special Interest” looks at the relationship between all Consumer groups (both Discretionary and Staples) compared to Commodity related groups.

Cautious On Small Caps

Small Cap outlook continues to deteriorate. Despite recent underperformance, valuation premium is not shrinking.

Large-Cap Growth: Could A Long Wait Get Even Longer??

Valuations set the stage for better performance out of growth. But it is important to note that there’s precedent for the value cycle—seemingly already overextended in time and price—to get much more extended.

Is Performance Rotation Here To Stay?

Group rotation has made it tough for managers to outperform. There has been a lack of sustainable leadership.

Characteristics Of A Bear Market

Assuming a bear market has already begun, what can be expected?

Cyclical Stock Dominance — How Long Can It Persist?

An in-depth examination of performance relative to Growth stocks; what has been typical in terms of leadership duration; and how the economy and inflation may affect the current trend.

Leuthold Ten Factor Small Cap Leadership Model Update: Still Neutral

Market seems to be moving toward a possible leadership transition from small/mid caps to large caps. Small caps significantly lagged large caps in July, and also now lag YTD.

View From The North Country

Terrorist threats, rising oil prices, the war in Iraq, and upcoming presidential election seem to have taken center stage against a backdrop of impressive corporate earnings momentum.

.jpg?fit=fillmax&w=222&bg=FFFFFF)