Market Action

Powell’s Dovish Accomplice

Last week we argued that U.S. money growth remains way too high to reasonably expect a peak in consumer price inflation during the next few months. At the peaks of the last five bouts of inflation of 5% or more, real growth in the M2 money supply had turned negative in four cases and had slipped to less than 1% in the other one. Today, real M2 is growing at nearly a 7% rate.

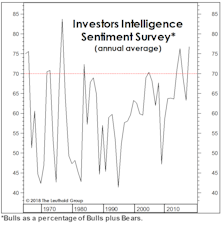

A Long-Term Take On Sentiment

We impatiently published this study two months ago instead of properly waiting for full-year numbers.

A Longer-Term Take On Sentiment

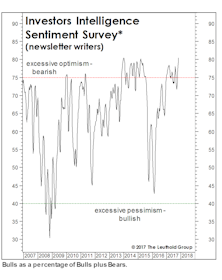

Stock market bears had a field day when the latest Investors Intelligence sentiment survey (Chart 1) saw the percentage of bullish newsletter writers spike to its “highest level since 1987.”

Lack Of Confidence Has Been Greatly Exaggerated

While this 7 1/2-year bull market has failed to give rise to anything resembling the equity culture of the late 1990s, we think it’s a stretch to claim—as dozens of commentators over the past five years have—that this bull is “the most hated” in history.

Fed Watching For The 21st Century

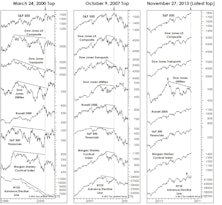

Deteriorating stock market breadth and worrisome leadership trends both suggest liquidity has already tightened; whether the Fed follows suit in September may now be just a formality.

Minding The Gaps

We think stock market action in the next few months will provide the Fed with an excuse to skip any rate increase in 2015. But our view is a minority one, and futures’ market odds on a September increase shot up in early August. Either way, the obsession over the timing of a Fed rate hike ignores the fact that world P/E ratios are already contracting—at least on the basis of our 5-Year Normalized EPS.

A Page For The Bulls

One could conceivably argue the market is still “cohesive” enough to hold together for awhile longer. June 23rd saw closing bull market highs in the NASDAQ, Mid Caps, Small Caps (both the S&P 600 and Russell 2000), and the critical KBW Bank and NYSE Arca Broker/Dealer Indexes.

Another Upleg?

The stock market generated enough positive evidence by the second week of February to knock us from our comfortable perch on the fence. We covered a portion of our equity hedges on February 12th, bringing net equity exposure in the Core and Global Funds up to 58% from the 50% level that had prevailed since November.

Stuck In Neutral?

Extreme market viewpoints get the headlines, but it’s baked into our disciplines that we will (occasionally) be noncommittal.

Stock Market Observations

Market gains have been less broad than in 2012 and 2013; market direction and leadership have been mismatched; and quantitative factors have been choppy.

A Quick Technical Take

If a bear market is imminent, it will unfold with less “internal” forewarning than any cyclical decline since the late 1930s.

Stay Bullish

It’s April once again… Are we due for yet another market top? Some perspectives on the possibility of attaining a new all-time market high in the current cyclical bull, and what may drive the upside.

Stock Market Observations

Under the “principle of alternation”—in which price patterns vary from cycle to cycle for the sole purpose of fooling market participants—the bull market is (in my view) unlikely to top out in the spring or winter of 2012.

Markets (Mostly) In Gear

Market in gear, with almost all market indices hitting new highs in tandem. Would be unusual for a market correction with this type of uniformity.

A Mid-Term Exam: What The Upcoming Elections Could Mean For The Stock Market

Prompted by a client request, Eric Bjorgen examines the impact of mid-term elections on the stock market.

Stocks And Economy Joined At The Hip… For Now

Economic indicators are hypersensitive to even small changes in the data, and investors are hypersensitive to the indicators themselves.

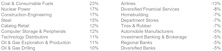

2009: Not Monotony, But Close

The 2008 worst performers shot to the head of the class in 2009. History however shows it doesn’t usually pay to buy the prior year’s laggards in hopes of hitting it big the next year.

January Market Action

Uncertainties are running high, and the stock market continues its struggle with a complex array of cross currents.

December Market Action

2008 is over. We expect 2009 to be better since worst-case scenarios now seem less likely to play out.

August Market Action

The broad market continued to trace out a labored recovery from the July lows, yet the day to day performance volatility continued to keep many market participants from getting too comfortable with the trend.

Yearning For Those Summer Doldrums...

In the past, Wall Street activity slowed in August as professionals headed for the beach. However, the “Hyper-connected Era” has changed all that, as evidenced by higher market volatility in recent years during July and August.

Major Trend Fades To Neutral During June Massacre

Well, now it’s officially a bear market. But readers should realize that since bear markets typically decline 28%, the bear is likely at least two-thirds over.

May Market Action

The stock market continued to move higher in May, with small and mid cap stocks outperforming the majority of large cap indices.

April Market Action

Relief finally came to Wall Street, not in the form of rebate checks or rate cuts, but from the strongest monthly returns since December 2003.

March Market Action

The moderate index level price moves from February month-end to March month-end didn’t give any indication of the wild swings that occurred during the days in between.

February Market Action

The stock market continued to trend lower in February, with most broad indexes posting losses in the 2%-3% range by month end.

January 2008 Market Action

To the extent that the January Barometer can still be trusted—and in judging its recent track record, it certainly can’t—the losses in January provide a foreboding message for the bulls in early 2008.

December Market Action

December’s bi-polar price swings had screens flashing brilliant with traditional holiday colors of red and green.

November Market Action

The venerable Wall Of Worry finally got to the stock market during November, with the major indexes losing their grip virtually right out of the gates.

October Market Action

October marked new all-time highs for the S&P 500 and Dow Jones Industrials, while mid and small cap indexes like the Russell 2000, S&P 600 and S&P Mid Cap indexes, tested, but failed to take out their July-2007 highs.

September Market Action

Although the general tone of the markets improved in September, we continue to see signs that recent strength may not have a lot of foundation or staying power.

View From The North Country

August was comparable to flying through a category five hurricane, a violent storm with gut wrenching updrafts and downdrafts. The relatively low volume recovery from the August lows has the characteristics of a bear market rally, not the beginning of another major move to the upside.

August Market Action

Not even the stock market gymnastics of late-February and March of this year could rival the kind of volatility we saw in August.

July Market Action

The Major Trend Index’s bearish reading put us on the right side of the market during the second half of July.

June Market Action

At a time when the public remains largely sidelined, corporations, private equity, and professional investors continue to take the U.S. stock market averages higher.

May Market Action

It is getting increasingly clear that current stock market gains are being built upon the backs of corporate and private equity investors.

April Market Action

The bulls remain in command as evidenced by the fact that the broad market averages continue their ascent toward new cyclical highs (or in some cases like the DJIA and Russell 2000—new all-time highs).

March Market Action

The stock market spent much of March trying to climb out of the hole dug back on February 27th. But to date, the primary indexes are still below late-February’s cyclical highs.

February Market Action...What Was That?

Although the markets continued to trend higher for much of the month, the steep losses on February 27th reminded us all again what a good dose of market volatility felt like. Feel better now?

.zip.jpg?fit=fillmax&w=222&bg=FFFFFF)