Materials

Digging Into Materials

If there are shortages, bottlenecks, and commodity inflation everywhere, why is the rating for the Materials sector so uninspiring? Although valuations are compelling for Materials groups, the overall decline in the rankings can be traced to EPS revisions and macro influences, like the U.S. dollar and low rates.

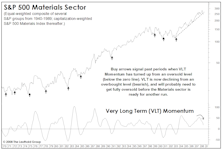

Momentum: “New Junk” In The “Old Trunk”

March 23rd marked the one-year anniversary of the COVID-19 bear-market bottom. We are all eager to turn the page on the pandemic ordeal and move forward to brighter days ahead. Looks like some big help is coming our way.

Commodity Stocks: More Of The Same

Someone forgot to tell commodity trades this is an era of diversity of inclusivity: This year’s leap in the S&P/Goldman Sachs Commodity Index has been entirely the result of its heavily-weighted energy inputs.

Time To Get Contrary With Commodities?

After a strong 2016 and a “Bridesmaid” (i.e., sector runner-up) performance in 2017, the Materials sector seemed primed to benefit from the “late cycle” character of the economy in 2018.

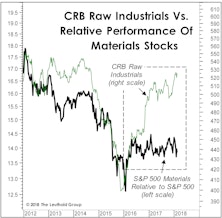

The Commodity Stock Disconnect

While watching a forecast go awry is painful, there’s an alternative that we consider to be even worse: the failure to be paid on an accurate forecast. The resulting feeling of helplessness must be similar to that of a corporate director who manages to lose money on inside information.

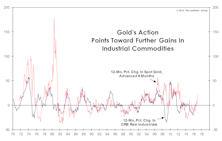

Commodities: More To Come?

Commodities have enjoyed a strong year thus far, and the GS Scores on the Materials sector have followed suit (albeit with a slight lag), as highlighted in June’s “Of Special Interest” section.

Time For Materials?

The Leuthold Materials sector jumped five spots to #3 in the June Group Selection (GS) rankings, its highest ranking in eight years and the first reading outside of the bottom four in almost four years.

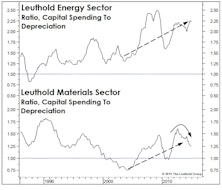

Capex, Capacity And The Dollar

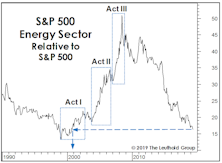

We’ve been highlighting the overinvestment (or malinvestment) risks in commodity-oriented equity sectors for the past three years, but we certainly did not foresee those risks exploding the way they have in the oil market over the last seven months.

Commodities: Not A New Bull

The year’s second biggest surprise (next to the relentless drop in bond yields) might be the YTD bounce in the major commodity indexes.

Select Industries Purchases Commodity Chemicals

Well-rounded factor strength, coupled with an intriguing fundamental backdrop, lead us to our first Materials group holding in a year.

Profit Margins At The Sector Level

All ten of the S&P 500 sectors recorded a sequential increase in four-quarter trailing net profit margins. But consider where sector margins stand today relative to their 25-year medians. Eight of ten S&P 500 sectors are recording profit margins well above their long-term medians.

Another Kind Of Decoupling?

We’ve discussed the interrelationships between industrial commodities, commodity-oriented equities and Emerging Market stocks. Getting one’s bet right on any of these three has generally led to profitable positions in all three. But that certainly hasn’t been true in recent months.

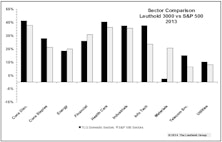

Sector Performance – Finding Discrepancies

Our Tech sector outpaced the S&P 500 Tech sector by 1400 bps and our Materials sector lagged the S&P 500 Materials by 2300 bps. Here’s why…

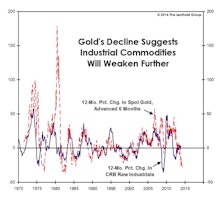

Commodities In 2014: Supply Remains A Concern

While gold garnered most of the headlines last year (down 27%), commodities performed badly across the board in 2013. We expect more of the same in 2014.

Stock Market Leadership In 2014: Large Caps, Tech, Health Care

Following a great year for trend-following, capitalizing on key reversals in sector performance will be important in winning the 2014 performance derby.

2013 Factor Performance: What Worked? What Will Keep Working?

Momentum and Value worked in 2013. Materials and Financials were the easiest sectors to exploit; Discretionary and Tech the most difficult. Momentum works in December; Value and Small Caps at the start of the year.

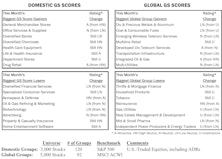

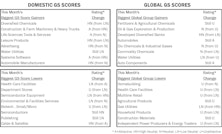

Group Models: Info Tech Tops Domestic, Financials Remain Atop Global

Both models have numerous Information Technology and Financials groups in Attractive territory. Neither model has any Unattractive Tech groups. Alternatively, neither model has any Attractive Utilities groups, while several Utilities rate Unattractive in each.

Group Models: Info Tech Tops Domestic, Financials Tops Global

Both models (particularly domestic) have a number of Attractive rated Information Technology groups and no Unattractive rated Tech groups. Financials’ domination of the Global Attractive range continues.

Sector Margins: Just Thank The Consumer

We’ve noted before that profit margin gains since the technology boom have been primarily a Large Cap phenomenon.

A Comprehensive Look At The Emerging Markets: Diagnosis And Prognosis

We examine Emerging Markets from both the top-down and bottom-up perspectives as we try to identify where to move and what to expect. We check in on two successful EM thematic group ideas as well.

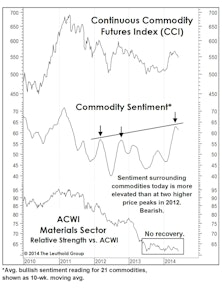

A New Leg In The Commodity Decline?

For more than two years we’ve discussed the supply-side risks to commodity producers stemming from capacity built during the manic “Third Act” of last decade’s Three Act Play in commodities. Commodity-oriented equities have indeed underperformed since 2011, but to date, most pundits have laid blame squarely on the demand side.

Key Observations On Q2 S&P 1500 Earnings

Year-over-year EPS growth rate for companies with Q2 reports (with about 65% in) currently stands at +4.2%, while revenue growth has come in at a better than expected +2.6%.

Group Models Agree On Energy & Materials

But Information Technology rises to the top of the Domestic model, while the trend of Financials domination in the Global model remains intact.

Sector Performance and Beta Comparisons

There are some substantial deviations in sector performance depending on your constituents and weighting scheme while, simultaneously, betas are converging toward one another.

Domestic and Global Group Models: Strong Agreement On Financials

Our Domestic Scores have five Financials groups rating Attractive; these same five industry groups are Attractive in our Global model. In total, seven Financials groups rank Attractive in the Global model, with insurance groups looking particularly Attractive.

A Contrarian Call For The Second Half

With the notable exception of the Consumer Discretionary sector, cyclical stocks topped out globally on a relative basis in early 2011 (Chart 3). Throughout the last two and one half years, there have been repeated calls for industrial cyclicals—which were, of course, the leaders of the last cyclical bull market—to reassume stock market leadership.

Commodities: Still Worried About Supply

Commodity producers seem to believe that last decade’s commodity boom is set to repeat. This belief itself probably ensures that it won’t.

The Outlook For Commodity Stocks

Energy looks cheaper and appears much more washed out from a sentiment perspective. Contrarians looking for commodity exposure should favor this sector over Materials.

Adding Aluminum: Initiating Exposure To Materials Sector

Select Industries portfolio has added new equity group holdings in Aluminum, initiating sector exposure in Materials.

A Dissenting View On Materials

Per our work, sectors like Consumer Discretionary and Technology provide a better way to capitalize on the global recovery now underway.

Materials: From First To Worst

Materials sector has fallen fast and hard in our GS Score rankings and is now the worst rated. Still see further downside based on valuations and technical factors. No, we do not think the underlying commodities can outperform while the stocks fall.

Commodity Curtain Call?

Inflation is peaking and the GS Scores did a great job signaling an exit from the Industrial Metals play. Commodities were hit hard in July.

Commodity Inflation = OWN MATERIALS STOCKS; Commodity Deflation = OWN MATERIALS STOCKS!!

There remains considerable macro support for industrial commodities.

More Life Left In Materials?

The Materials sector moved up to the top position in the latest Sector Power Rankings, based on the number of Attractive and Unattractive groups in each sector.

.png?fit=fillmax&w=222&bg=FFFFFF)