Monetary Measures

Was That A Pivot?

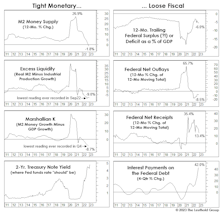

Stock market monetary- and liquidity conditions over the last year have been the harshest we’ve seen in a 33-year career, and consistently the largest drag on the Major Trend Index (even overshadowing valuations!).

Pause, Then “Paws?”

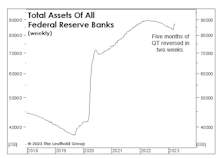

Despite the Fed’s tough-talk about getting the funds rate above 5%, monetary and liquidity measures are significantly less bearish. Thank SVB depositors, who required a bailout big enough to reverse five months of QT in just two weeks. The market reaction looks like that after September 2019’s Overnight Repo-market turmoil, which forced the Fed to end its first experiment with QT.

Inadvertent Easing?

Sometimes, a sharp upside reversal in the stock market will correctly anticipate future improvement in monetary and liquidity conditions. That was the case with the powerful up-leg that sprang from the market’s 2018 Christmas Eve bottom.

Let Us Add To The Bullish Cacophony

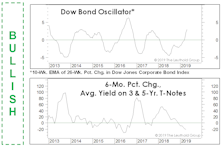

It’s been a heck of a stock market year, and there are still four months left. What else could go right? Monetary conditions, for one thing—at least as proxied by our Dow Bond Oscillator (DBO).

Can Money Growth Trump All Else?

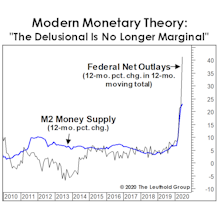

In 2019 and 2020, our regard for time-tested valuation tools resulted in tactical portfolios being underexposed to stocks during a pair of tremendous rallies. Now, the critique is that we don’t appreciate the brilliance of today’s policymakers and their miraculous ability to pivot just when the stocks (and, in the latest case, the economy) need it most.

Measuring The Cost Of “Free”

The S&P 500 and NASDAQ have lately traded as if the hybrid “Fed/Treasury put” entails no cost at all. But dollar alternatives—like forex, precious metals, and crypto-currencies—are saying, “Not so fast!”

Stimulus Gone Wild!

Market perma-bulls deserve high marks for their persistence, yet, despite all that’s transpired in 2020, their case is exactly the same as six months ago: Extreme stimulus won’t “allow” a significant stock market drop, nor any further economic deterioration.

Liquidity Overflow!

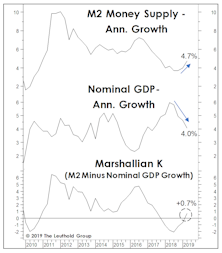

Based largely on the bearish trends in our monetary and liquidity measures, we were correctly negative on stocks throughout most of 2018. It’s therefore especially painful for us that 2019’s market rebound has been credited almost entirely to the “pivot” in most of those measures.

Monetary Madness

We always do our own work and draw our own conclusions. Lately, though, we’ve wondered what the late “Monetary Marty” Zweig might say about the stock market’s current liquidity backdrop.

Who Doesn’t Love “Excess” Money?

We’d concede the monetary backdrop for stocks is now mixed, an upgrade from the almost uniformly negative environment of last fall. On the negative side, the U.S. yield curve inversion has now persisted long enough that even the economic optimists are getting nervous.

Mixed Monetary Messages

Confidence in the U.S. economy’s health reached a new peak with the April employment report, with a blowout number for nonfarm payroll coinciding with a soft wage print.

Watch What They Do, Not What They Say

While the celebration over Jerome Powell’s “Christmas Capitulation” lingered throughout February, we’re still awaiting signs the capitulation consisted of anything more than words.

It’s About Money, Not Profits

The consensus focus all year has been on the boom in U.S. corporate profits.

.png?fit=fillmax&w=222&bg=FFFFFF)