Monetary Policy

Waking From A Slumber?

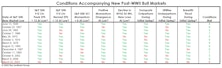

We’re very skeptical that the rally from last October’s low represents the first leg of new bull market. But if it is—as many believe—then it has unquestionably inherited the worst set of genes we’ve ever observed in the species.

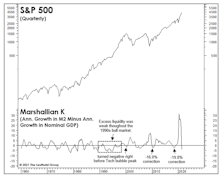

Liquidity Letdown?

Stock market liquidity might seem plentiful, with the Fed still buying $120 billion in bonds per month under the all-too-predictable continuation of what was first billed as an emergency operation. However, the steadiness of QE masks a major second-quarter reversal in “excess liquidity.”

Musings On A Manic Market

Officially, those quick to pronounce the move off March lows as a new bull market have been proven correct with new S&P 500 all-time highs. Fundamentally, though, there’s enormous risk in Large Cap valuations, regardless of where one believes we are in the economic cycle.

Can The Rally Recover From Its 0-For-8 Start?

The current rally is either the first upleg of a new bull market, or the second-largest bear market rally in the last 125 years. The lone development that can settle the issue is for the S&P 500 to move above its February 19th closing high of 3,386.15.

Over-Stimulated?

We can’t count the number of times in the last week we’ve heard analysts worry about “what the Fed might know that we don’t.” In the words of John McEnroe, “You cannot be serious!”

The Easy Fed and the “Other” Inequality

Super-easy monetary policy has been blamed for the rise in income and wealth inequality in recent years, and more recently we’d fault the Fed for performance inequality within the stock market.

Beware The Policy “Narrative”

It’s been amusing to watch the narrative surrounding Fed policy evolve as the market has rallied.

An Old Chart Whose Time Has Come?

No, it’s not a 1990s-like love affair with the stock market. But it’s surely a sign of the times when TV pundits seem to have dropped even passing references to valuation when spinning their mostly bullish market yarns.

Enjoying It While It Lasts

We don’t think the current stock market upleg is over.

Party Like It's 1998? One Big Caveat

Based on the four key features of the current macro environment: global disinflation, monetary conditions divergence, an extended bull market, and sub-par economic performance, 1998 ticks all the boxes.

Inflation & Monetary Policy—A Feedback Loop

Inflation and inflation expectations are key inputs to central banks’ policy decision process. Divergent policies have very different impacts on inflation.

Debt Monetization: Is The Printing Press Working Overtime?

Debt monetization evaluated by three separate measures. All three measures suggest monetization is increasing, however the severity of this trend is debatable. Judge for yourself.

Bond Market Summary

The bond market is looking increasingly vulnerable. The economy appears to be deteriorating, inflation is nowhere in sight and short rates are declining. With all this going for it, why is the bond market stagnating?

.jpg?fit=fillmax&w=222&bg=FFFFFF)