Municipal Bonds

U.S. Municipal Bonds: Maintain Unfavorable

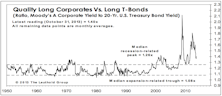

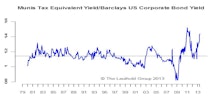

There is still a lot more room for Munis to underperform Corporate bonds.

US Bonds

Net outflows continued as the cushion from credit spreads is still inadequate...So far risk contagion from the Puerto Rican bond default has not been an issue. Munis still look attractive relative to Treasuries, and investment grade Corporates...The improvement in credit markets and inflation expectations looks more shaky as oil prices broke below the recent tight range and uncertainty around Greece adds to the overall risk aversion. We reduced these bonds to Unfavorable.

US Bond Market

Although the overall picture remains favorable for high grade credits, the increased exposure to interest rates with an ever thinner spread cushion does concern us. We will monitor closely for potential downgrades.

US Bond Grades

The renewed participation of credits in the risk asset rally is a welcome sign.

US Bond Market - October 2013

We are encouraged by the narrower spreads in October as the feared divergence between credits and equity markets did not continue.

Our Position on U.S. Bonds

U.S. Investment Grade Corporate Bonds: Favorable, U.S. High Yield Corporate Bonds: Neutral, U.S. Municipal Bonds: Neutral

U.S. Municipal Bonds: Maintain Neutral

Their relative cheapness, combined with the prospect of higher tax rates, certainly makes Munis more attractive now. But we’ll wait for interest rate volatility and outflows to subside before turning bullish on Munis.

U.S. Municipal Bonds: Maintain Neutral

The relative cheapness combined with the prospect of higher tax rates certainly makes us much more interested in Munis now. But we’ll exercise patience, waiting for the negative headlines to fade and interest rate volatility to subside before turning bullish on Munis.

U.S. Municipal Bonds: Maintain Neutral

We believe the sell-off in Munis is overdone in the short-term and these bonds look attractive relative to Treasuries. But in the medium-term the tapering risk will linger; this is a big negative for long maturity credits like Munis.

U.S. Municipal Bonds: Maintain Neutral

Inflows into Muni bond funds turned negative; higher interest rates currently the biggest risk.

Inside The Bond Market

The fixed income markets ended the year on a strong note.

Bond Market Summary

Overall, July was one heck of a month for the fixed income markets. Most of the move in short term paper came early in the month but longer term fixed income securities continued their steady rise until the last three days of July.