Mutual Funds

Research Preview: Is Buy-Write The Right Buy?

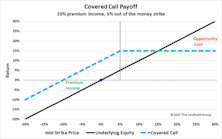

Many investors appreciate the benefit of covered-call strategies, but we wonder how many truly understand the opportunity costs of buy-write funds over time—or under differing conditions. On the surface, these approaches are simple, but they have complicated payoff patterns relative to stock and bond funds.

Active Managers Embrace The Bear

The fourth quarter of 2022 saw broadly positive equity-market performance with the S&P 500 returning +7.6%, the Russell 1000 Mid Cap Index at +7.2%, and the Russell 2000 Small Cap Index gaining 6.2%. Strong returns usually present a headwind for active managers, but the fourth quarter proved productive for actively managed funds.

Actively Bearish, Passively Bullish?

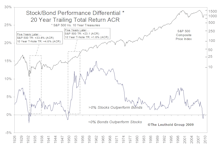

Relative performance of active and passive mutual funds is one of the leading story lines in our industry, with passive’s recent advantage leading some to argue that it will be the dominant style forevermore. We disagree, and believe that the active/passive relationship has been, and always will be, cyclical.

Expect A "Round Trip" In Sentiment

When the “most hated bull market on record” finally suffers a steep decline, it’s reasonable to expect that the hatred might evolve into true revulsion.

Cash Left The Sidelines Long Ago

The “cash on the sidelines” is a Supply/Demand argument that we’ve struggled with even in the most bullish of times; every purchase of a security is matched with a sale. But even taking the argument at face value, current holdings of retail investors and mutual fund managers suggest that the cash left the sidelines long ago.

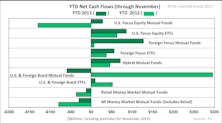

A Shift In Fund Flow Trends Holds Through Latter Half Of 2013

Both equity and bond categories set all-time nominal net cash flow records.

2013’s Fund Flow Trends Have Room To Run

Year-to-date, equity funds are cash on par with those of the 2000 tech bubble, while bond mutual funds are experiencing net cash outflows for the first time in a decade.

Target Date Funds Impacting Industry Fund Flows

Funds of funds, particularly target date funds, are growing rapidly and are now large enough to have a measurable impact on underlying fund flow trends.

Fund Flows Still Not Quite As They Appear

In this report we take an in-depth look at the evolution of the industry, particularly the U.S. mutual fund industry, to help understand how some fund flow trends are more of an indication of evolving investor preferences instead of an indication of retail investor sentiment toward a particular asset class.

Emerging Market Indicators Study—Premium/Discount Of Closed End Funds

Asset allocation portfolios continue to hold big positions in Emerging Markets. Jun Zhu presents an initial study exploring the use of Emerging Market Closed End Funds historical premium/discount levels as a predictor of future Emerging Market performance.

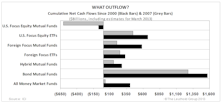

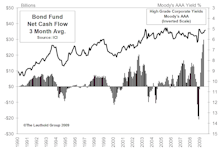

Lemmings Atop The Fixed Income Cliff....And How This Could Play Out Well For Equities

Get out in front of the lemmings. We expect to ultimately see bond funds reverse now that performance has been lagging the stock market. But where will the money go? Our best guess is that it flows to Emerging Country Equities….once again chasing strong performance.

Six Important Trends From The Supply/Demand Front

This month’s “Of Special Interest” section looks at six trends from the Supply/Demand front. Key to several of these trends is that investors chase performance: still seeing big inflows into bond funds, with big outflows from retail money market funds.

Mutual Fund Flow Trends...Some Encouraging, Some Troubling....

Starting to see some modest inflow into U.S. focus equity mutual funds, which is a stock market positive.

February Mutual Fund Flows...Big Inflows Continue

The numbers continue to be strong. At this point, we attribute the strong flow to a combination of seasonals, and pent up demand.

November Mutual Fund Flows...What Fund Scandals?

Public does not yet seem to phased by the mutual fund scandals as November marked the ninth consecutive month of net inflow to U.S. focus mutual funds, totaling $133 billion of net inflow.

View From The North Country

Thoughts and commentary regarding the groups in our Select Industries Portfolio, the Mutual Fund Timing scandal, NASD Margin Debt and deficit worries.

The Market Impact Of Today's Net Redemptions

The important role of cash levels in today’s mutual funds.

June Mutual Fund Flows

Estimate outflow of $20 billion in June, largest redemption month since Sept 01…..Not yet panic mode as this only represents 0.7% of total U.S. equity fund assets.

View From The North Country

DALBAR study shows average investor missed out on 17-year bull market performance of 1984-2000.

October Mutual Fund Flows & September’s “Record” Net Redemptions In Perspective

“Record” outflow only 10th highest as a percent of Equity Fund assets. But, as a percent of stock market capitalization, September net outflow was about on par with October 1987.

View From The North Country

Increased disclosure of mutual fund holdings detrimental to investment performance.

April Is The "Opportunity" Month

Bear market broadened out in late March to include other than technology sectors. Never before have so many lost so much.…There is plenty of blame to go around. Academia, The Street, the Media, the “Experts” to name a few.

In The Rear View Mirror

Year 2000 is half over...Leuthold Paid To Play equity portfolio concentrated in Energy and Health Care up 7% in June, +33% YTD. Also, today’s huge valuation dichotomy.

U.S. Equity Ownership Trends

A look at the short and long term trends among the major categories of U.S. stock market shareholders.

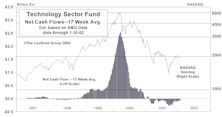

Main Street Stampede To Tech Funds

Cash inflows to Technology specific mutual funds has exploded.

Active Managers Beat Index Funds!

Just as many plan sponsors throw in the towel, active managers pull a great quarter out of their collective hat. What's in store for the second half of 1999?

View From The North Country

Chasing the tale of past performance…The large cap indexing stampede. It’s not too late to get invested in emerging market funds. Also “Richer than your wildest dreams”…The advertising pitch of online trading firms. Who is protecting the public from this?

View From The North Country

Transcript from late February conference call with Steve Leuthold and Byron Wien covering a wide spectrum of timely investment topics.

View From The North Country

Contrary to Wall Street wisdom, rising MZM is not necessarily indicative of Fed easing. Nor does contracting MZM mean a tightening Fed. Also, unlocking the mystery of the low U.S. savings rate.

The Expected Flood Never Arrived

In December 1998, nearly everybody seemed bullish about early 1999 (including me). A seasonal flood of new money was expected to run the market on the upside in the first quarter…..But, the flood never came.

October Mutual Fund Flows

Public confidence measures have taken some sharp declines in recent weeks but mutual fund investors have cautiously returned as net buyers. Meanwhile the mountain of cash in U.S. focus equity mutual funds has climbed to $125 billion.

September Mutual Fund Flows

Based on our estimates of mutual fund inflows at various market levels, it looks like more fund owners are now under water. About $116 billion was invested in the market above current levels. Nervous but not panicked mutual fund investors.

August Mutual Fund Flows

Weekly inflows for the month of August were positive in the early part of the month, but quickly turned to net redemptions as the market fell. The data demonstrates that investors continue to buy on strength. They don’t buy the dips!

July Mutual Fund Flows

According to the latest ICI report, fund managers investing in U.S equities were hoarding cash during the month of June. Percentage of assets rises to 4.1%, but still near all-time lows.

June Mutual Fund Flows

Estimated net inflows into U.S. equity funds increased significantly in June compared to May and nearly doubled year ago flows.

May Mutual Fund Flows

Mutual fund investors’ enthusiasm cooled during May’s volatile stock market, leaving monthly total equity fund inflows at the lowest level since March 1997.

View From the North Country

Remembering Mister Johnson, the founding spirit of Fidelity. A “Balanced” mutual fund up 8% in a single day? Also, a reader response to last month’s comments on a new NYSE rule and how good were the good old days?

April Mutual Fund Flows

Net inflows into U.S. equity funds for April are estimated to be down slightly from March but still running almost 40% ahead of a year ago.

March Mutual Fund Flows

Net inflows into U.S. equity funds extremely strong and now nearly 30% ahead of impressive 1997 levels. Fund flow controversy revisited. Still no consensus regarding December’s huge discrepancies between the top two data providers on the mutual fund cash flows.

February Mutual Fund Flows

Domestic equity inflows for 1998 lag last year’s levels, but still very strong...However, bond and money market fund flows YTD are significantly ahead of1997’s pace.