Near-Term Forward Spread

A Delayed Day Of Reckoning?

Today, the recession / no-recession call dominates daily market debate probably more than any time since the spring of 2008 (when the economy had been in recession for 4-5 months). We fully expect the U.S. economy to roll over in the next several months.

Don’t Let Economists Work From Home…

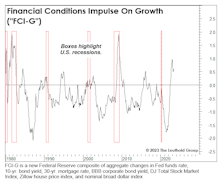

Last month, we noted that Jay Powell’s preferred measure of the yield curve—Near Term Forward Spread (NTFS)—was a winner, but a newly introduced index by the Fed, “Financial Conditions Impulse on Growth (FCI-G),” is a dud. Several simple forecasting gauges we’ve relied on for years are considerably more effective.

This Curve Threw Us A Curve...

Future economists learning of zero interest rates and Fed balance-sheet expansion during the 2021 inflation surge may wonder if policymakers were “on” something. Jay Powell is clearly “onto” something with his focus on a measure that few are familiar with: the Near-Term Forward Spread (NTFS).