Nikkei

Research Preview: What’s Up? Japan!

After being ignored for a generation, Japanese stocks are roaring in 2023. The Nikkei puts the S&P 500’s 16.9% YTD gain to shame with its +28.7% return. With developed international equities (ex-Japan) up a paltry 9.5%, diversification from expensive U.S. stocks cannot fully explain Japan’s surge.

A Storied Bubble’s Pearl Anniversary

The decade of the teens has given way to the decade of the twenties and “year in review” retrospectives are in the books, but as the calendar’s last digit rolls from 9 to 0 we consider one more anniversary worth remembering.

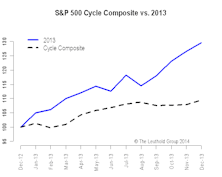

2014 Time Cycle—Lower Your Expectations & Be Patient

It’s time to update our time cycle composites, and what they say for equities in the U.S., U.K., Germany and Japan and long-term interest rates and credit spreads in the U.S.

Deflation… What If? (Part II)

Once again, this month’s “Of Special Interest” examines deflation but employs a longer time horizon. We also contrast the deflationary environment in Japan versus current U.S. conditions.

Update On Japan...Holding Our Positions, But Watching Closely

Recent market action appears to be indicating that cyclical forces have, for the time being, put Japan’s stock market recovery on hold.

Saving Face...Is Japan Finally A Turnaround Play?

Japan appears to be getting its fiscal house in order. Opportunity may be developing here. We constructed a list of potential Japanese ADRs, and built an index to monitor the situation.

View From The North Country

Full Disclosure (Reg FD), Investment Banking conflicts (hardly a recent development) and the Nikkei and DJIA: Will they cross this year?

Unconventional Asset Allocation Model Buys Nikkei Put Warrants

As readers know, we have been bears on Tokyo stocks for several years. But we were early in the past. Recent action leads us to believe the bubble may finally have burst, with the remarkable levitation act about over.