NIPA

Full Employment Brings Margin Risks

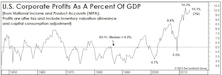

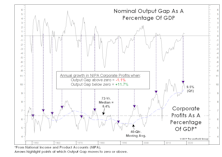

How high can corporate profit margins go? The third quarter saw a new record of 11.0% in NIPA “all economy” after-tax margins, and figures for the S&P 500, due out in a few weeks, will also set a record.

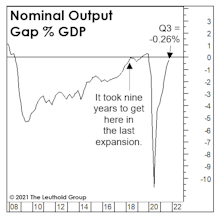

Are Earnings Set To “Gap” Higher?

We are troubled that the bullish optimism has spilled over into the 2020 estimates for S&P 500 earnings. Zero growth in 2020 is probably not a bad guess for NIPA figures, but S&P numbers don’t always follow suit.

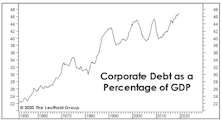

It’s Not What They Borrowed, But How They Used It

Following the deflationary bust of 2007-2009, the last decade was expected to be one of deleveraging. Only U.S. consumers appeared to get that memo, however.

Profits Have Peaked

With the S&P 500 EPS count steadily shrinking and managers getting ever more creative with “adjusted EPS,” corporate profits measured with standardized accounting rules merit a closer look.

What Can Margins Do For An Encore?

A massive drop in corporate tax payments lifted the third quarter NIPA profit margin back to the 10% level for the first time four years. But while we try not to always view the glass as half empty, we find it troubling that margins remain well-below their 2012 highs (10.6%) in spite of this one-time windfall.

Margins: Mean-Reversion Works

A late March issue of The Economist proclaimed “profits are too high” and “America needs a giant dose of competition.” Funny. NIPA Corporate Profits figures released that week show The Economist’s plea for lower profits had already been fulfilled—and not just in the latest quarter.

Earnings: What Is Normal?

Corporate profits are notoriously cyclical, and for decades we’ve sought to temper their swings by using a five-year smoothing of S&P 500 EPS in our valuation work.

Margins: Two Interpretations

Government accounting on everything ranging from the CPI, to the budget deficit, to even the unemployment rate is constantly assailed as being too rosy. So when a government report occasionally paints a less optimistic picture than the consensus one, we’re inclined to sit up and take notice (especially when we agree with it).

Profit Margins At The Sector Level

All ten of the S&P 500 sectors recorded a sequential increase in four-quarter trailing net profit margins. But consider where sector margins stand today relative to their 25-year medians. Eight of ten S&P 500 sectors are recording profit margins well above their long-term medians.

The Mundane Truth Behind Margins

The margin expansion story of the last 20 years is a financial one, not an operating one.

Decomposing Today’s Record Profit Margins

The celebrated gains in corporate profitability over the past decade and a half are attributable primarily to proportional declines in “below the line” items like interest expense and corporate taxes.

Two Valuation Metrics Still Bucking The Norm

With many (but not all) of our valuation metrics in overvalued territory, we present two histograms from our forthcoming quarterly BenchMarks publication that make the case that stocks are cheap (well, almost).

Stock Market Cheap! ...According To NIPA Profits

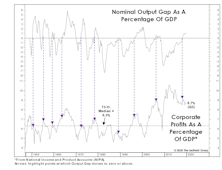

Based on NIPA Corporate Profits, the S&P 500 is now relatively cheap based on the prior 1956 to date history.

U.S. Market Overvalued, Not Undervalued, Relative To NIPA Profits

Contrary to some strategists’ studies the U.S. stock market is not cheap relative to NIPA (National Income and Product Accounts) corporate profits. In fact, like the majority of Leuthold studies, this metric indicates the market is overvalued.

A Closer Look At Seemingly Cheap Valuations Based On Corporate Profits

S&P 500 valuations using corporate profits (National Income Accounts), not as cheap as suggested and are likely faulty, in our opinion.

.jpg?fit=fillmax&w=222&bg=FFFFFF)