Pensions

AANA: The Good And The Bad

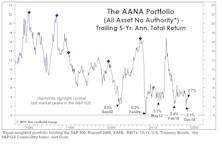

Large Cap U.S. Technology has been the place to be this year, but even an “unmanaged” portfolio with a variety of assets has fared well so far in 2019.

Public Pensions—Changes Beginning

Last issue, we presented an introduction to our thoughts on the problems being faced by public pensions. The following is a look at some initial action by states.

Are Public Pensions The Next Bubble?

Matt Paschke discusses how public pension funds are approaching huge hurdles as state and municipal governments have promised more than they are able to provide.

View from the North Country

What About China?...The 7% Solution...Plan Sponsor's Future Investment Earnings Assumptions Are Too High...Some Facts About Gold

View from the North Country

A month ago, this section featured the commentary "Bad News For The PBGC (And The Taxpayer)". This proved to be quite timely.

View from the North Country

Asset Allocation Today: The Age of Specialized Money Managers…Northwest Airlines: Smoke Free and Toilet Free Flights?

Bond Market Summary

In many ways the bond market is more impressive than the stock market. In some ways I think it is a brand-new ball game with a growing number of new players. Throw out your old rule books. We have raised our maximum pre-election expectation for T-Bonds to 10%, up from 11%.