Price-to-Book

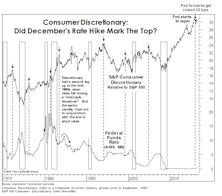

Discretionary: Is The Top Finally In?

Sector swings have been wild enough thus far in 2016 that Consumer Discretionary’s relative weakness has drawn little commentary.

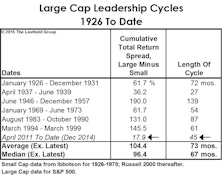

Small Caps: A New Ratio!

Small Caps lagged the S&P 500 by almost ten percentage points in 2014, but their underperformance streak technically dates back to April 2011. Nonetheless, their cumulative, 45-month underperformance in relation to the S&P 500 (now about –18%) is still modest enough that any mention of the current “Large Cap Leadership Cycle” is bound to draw a few head scratches.

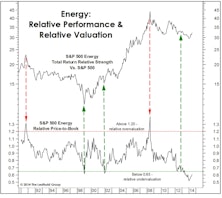

Energy Sector Heating Up

We’ve been negative on commodities and most commodity-oriented equities for the last three years, believing that the magnitude of the ramp-up in commodity production capacity over the last decade remains generally underappreciated by investors.

Estimating The Downside - March 2014

BACK TO THE MEDIANS (1957 To Date): S&P 500 13% Downside

The S&P 500 gained 4.3% (price only) in February. Based on the 1957-to-date valuation metrics presented below, the S&P 500 has 13% downside to its historical average. The S&P Industrials (which excludes Utilities and Financials) now has 26% downside to reach mean valuation.

2013 Factor Performance Review

2013 ended up being a good year for quantitative strategies, particularly those that focus on using Momentum

Valuing The “Typical” Stock

Current median valuations are almost identical to those seen at the bull market highs of March 2000 and October 2007.

Buy Energy Stocks

Why is right now a great time to buy Energy stocks?

More Life Left In Materials?

The Materials sector moved up to the top position in the latest Sector Power Rankings, based on the number of Attractive and Unattractive groups in each sector.

An Explanation For The Confusing S&P 500 Book Value Revision?

We still have been unable to get a satisfactory explanation from Standard & Poor’s of why and how they revised their Book Value calculation. The revisions were huge and had a significant impact on our valuation metrics.

S&P Announces Huge Upward Revision In Book Value Calculations…..Without Explanation

We remain confused by the huge revisions without a valid explanation.

Worth Noting

Steve’s notes on revising the GDP calculation, market implications of discount rate cut, stock market capitalization as a percentage of the GDP and more.