Profitability

S&P 500 Earnings Waterfall 2Q 2023

This month’s Refresh continues our practice of summarizing the latest earnings season by evaluating the composite results of the S&P 500 member companies. Many analysts address sales and net income, but rarely speak to the middle lines of the income statement.

The Calm After The Storm

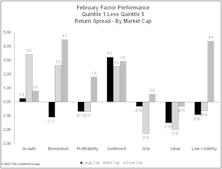

Factor performance stabilized in February, recovering from a brutal start to the year. While those dynamics bled into the first two days of February, the trend quickly reversed as interest rates bounced off recent lows and stayed on an upward trajectory for the rest of the month.

The Mysterious Affair of Style Returns

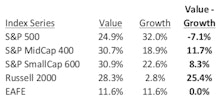

Mystery writers are fond of creating misdirection by introducing multiple eyewitnesses that each describe the crime differently. This plot device confuses the storyline until a clever detective comes forward to unravel the conflicting evidence and solve the mystery.

This scenario played out in style returns for 2021, as shown in Table. Our first witness is a large cap manager who tracks the S&P 500 and reports another banner year for Growth, its seventh win in the last ten years. Our second observer is a small cap manager who watches the broader market and tells of Value’s excellent year. Meanwhile, our third bystander is an international manager tracking EAFE, who reports seeing a whole lotta’ nothing in the style derby last year. In this study, we channel our inner Hercule Poirot to determine what, in fact, did happen across domestic style returns in 2021.

Digging Out Of The Red

An unprecedented number of companies are still deep in the red, even while the economy is shrugging off the impact of the pandemic. Small-cap growth companies are showing no sign of a quick recovery.

November’s Giant “Low Quality Stock” Rally

While quant managers watched their factors failing one by one, and market bears stared at the tape in disbelief, the number of retail investors continued to multiply and we witnessed a dramatic performance advantage for low quality stocks. Are we entering a prolonged “junk-rally” cycle?

Worrisome Profitability Trend Among Small Cap Companies

Despite a historic economic expansion during the past decade, there is an ever-increasing number of companies that are finding profitability has become harder to achieve.

The Kindness of Strangers

We have recently been struck by the tremendous valuations being awarded to companies that have never turned a profit. Tesla, Spotify, Workday, and Square all sport market caps above $25 billion based not on their recent earning power (which is zip), but on the hopes that they will one day move well into the black.

Quantitative Strategies: Factor Performance Reverses

Momentum suffered across almost every sector, but it was particularly bad for Health Care and Info Tech. Value factors finally rebounded after losing over the past year.

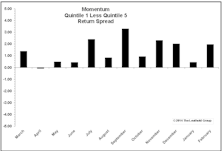

The State Of Momentum

Momentum has easily been the best quantitative factor over the last year. The only other factor with notable positive performance is Sentiment. Can this continue?

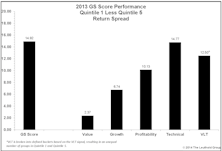

Group Scores Worked Well In 2013, What We Like For 2014

All five factor categories did well, and the best performing Attractive industries came from six different sectors and ranged from traditionally defensive to more cyclical groups.

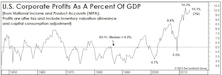

Decomposing Today’s Record Profit Margins

The celebrated gains in corporate profitability over the past decade and a half are attributable primarily to proportional declines in “below the line” items like interest expense and corporate taxes.

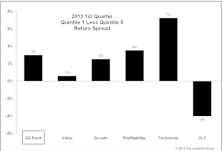

Q1 Review of Group Selection (GS) Scores

After a recent rough patch due to a multitude of factors (macro driven markets, high correlations, etc.), our domestic Group Selection (GS) Scores started seeing more consistent performance during the fall of 2012. This continued through the first quarter of this year, with the Attractive to Unattractive return spread at +3.0% year-to-date.

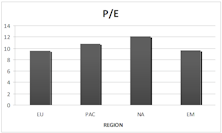

Where To Invest? A Graphical View of Global Equity Markets

Taking into account the variety of total return contributors, we conclude that no one regional equity market stands out as a slam dunk investment idea.

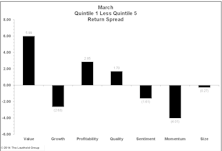

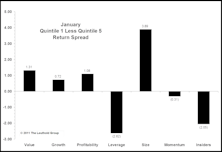

January Performance: Quality and Size Take The Lead...Finally

Quantitative Factor review for January shows Large Caps, Quality, and Profitability factors finally performing well. It’s been over a year since stocks with better Profitability outperformed in an up S&P month.

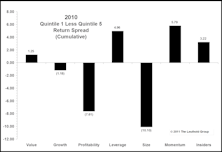

Year In Review: Inconsistency Among Traditional Factors

Factor performance during 2010: A review of traditional quantitative factors and their performance for the year.

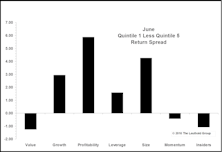

Factor Performance Shows Flight To Quality

Momentum cannot sustain itself, as multiple trends reversed over last two months. Profitability focus has returned to the marketplace as risk aversion grows.