Real GDP Growth

Yields Up, Economy Down?

Based on past experience, steepening in the curve from deeply inverted levels, as it has done recently, means a recession should be fairly close at hand. Worse, the fact that this move is of the “bear-steepening” variety should further depress economic prospects over the next 12-18 months.

Groupthink?

Question: While hopes for an economic soft landing have ticked up a bit, the consensus view among economists still seems to be for a recession in 2024. Does having so much company concern you?

Response: Of course!

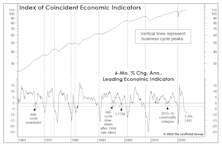

The LEI Clock Is Ticking

A contraction of 3% or more in the LEI’s six-month annualized rate-of-change has always been associated with a recession, with an average lead time of four months. Using that guideline, the most recent recession warning was triggered in June 2022, and the lead time is now approaching the longest ever recorded (16 months in 2006-07). If today’s lead time matches the 2006-07 experience, the business-cycle peak will occur in October.

A Delayed Day Of Reckoning?

Today, the recession / no-recession call dominates daily market debate probably more than any time since the spring of 2008 (when the economy had been in recession for 4-5 months). We fully expect the U.S. economy to roll over in the next several months.

Don’t Let Economists Work From Home…

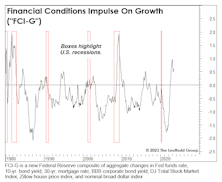

Last month, we noted that Jay Powell’s preferred measure of the yield curve—Near Term Forward Spread (NTFS)—was a winner, but a newly introduced index by the Fed, “Financial Conditions Impulse on Growth (FCI-G),” is a dud. Several simple forecasting gauges we’ve relied on for years are considerably more effective.

This Curve Threw Us A Curve...

Future economists learning of zero interest rates and Fed balance-sheet expansion during the 2021 inflation surge may wonder if policymakers were “on” something. Jay Powell is clearly “onto” something with his focus on a measure that few are familiar with: the Near-Term Forward Spread (NTFS).

ISM: Down, But Not Out

Early evidence shows the recent banking calamity knocked down already-fragile measures of confidence and activity, as exhibited by the ISM Manufacturing Composite posting a fifth-consecutive reading below 50.

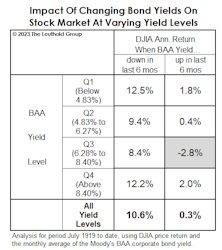

Something BAA-d Brewing?

Tightening peaked in Q4-2022, with the BAA yield at 266 bps above its year-earlier level—the most contractionary move since the early 1980s. If the standard lead-time applies, the full impact will be felt in Q4-2023.

The Yield Curve Meets Microsoft Excel

To our surprise, the measure that most closely correlated with real-GDP growth on a one-year time horizon is the rarely mentioned Treasury spread for the 5-Yr./3-Mo.