Real Interest Rates

Gold: Not As Shiny

In mid-July, we sold our tactical portfolios’ small (2%-ish) position in physical gold ETFs. That holding had been built up from 2018 to 2020 to around 5.5% of the portfolio, then pared in early 2022 when Russia invaded Ukraine. That doesn’t mean we’re gold bears.

Fiscal “Juice?”

Not to pick a fight with Keynesians (or other economists), but we’re reluctant to label the explosion in the federal deficit as unequivocally “stimulative.” Some factors behind the increase probably do boost the economy, but others simply rob Peter to pay Paul.

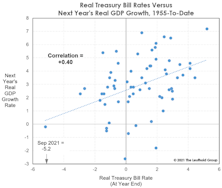

Rethinking Real Rates

Consumer Price Inflation has stabilized in the 5.2–5.4% range in the last two months, giving the Fed hope that it’s reached a near-term peak. Still, the presence of 5%-plus inflation in the face of ZIRP leaves the real short-term Treasury-bill rate about as deeply negative as it has ever been.

VLT Complicates The Market Puzzle

At October’s close, a long-term BUY signal was triggered on the Russell 2000. The fact that some market segments are triggering “oversold BUYS” when blue chips are at record highs speaks volumes about the internal disparities that have developed during the last few years. The Russell BUY signal is not inconsistent with our belief that the action since the January 2018 peak remains part of a lengthy cyclical topping process.

Small Caps And The Recent “Rate Hike”

The 1999 leadership parallels we discussed in the latest Green Book remain intact—U.S. over foreign, Growth over Value, and Large over Small. Small Caps have given up most of the “beta bounce” enjoyed in the first two months off the December low, with one Small Cap measure—the Russell Microcap Index (the bottom 1000 of the Russell 2000)—undercutting last year’s relative strength low and those of 2011 and 2016.

Did The Doves Swoop In And Save The Day?

Just a few months ago, Fed Chairman Jerome Powell boasted a reputation as a straight-talking, sound-money banker.

About That Great Jobs Report...

The December employment report temporarily eased fears of a severe U.S. slowdown. That’s a mystery to us.

They Can’t Tax What’s Not Earned

With three quarters of a sharply lower corporate tax rate on the books, the median four-quarter trailing profit margin for both the S&P 500 and S&P MidCap 400 jumped to all-time records in the third quarter.

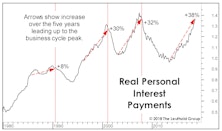

Rates Hurting Households

Doubling of yields since 2016 has slammed households. Percentage increase in rates is more important than the absolute level.

Real Rates and the Federal Deficit

The real short-term interest rate shows how inappropriately-loose monetary policy has remained in the face of a steady economic expansion.

Real Rates And The Federal Deficit

We previously mentioned the increasing focus on the real short-term interest rate as an important measure of the Fed’s policy stance. In truth, we wish the Fed had paid more attention to this measure during this cycle.

Rates Are Up, But Are They High Enough To Punish?

While momentum has been the best-performing stock selection factor in 2018, there’s a less well-known and purely fundamental factor that rates almost as well: A company’s ability to lose money!

Real Rates Are Perking Up

With negative nominal yields throughout Europe dominating the fixed income headlines, a very different development in the United States has failed to attract any attention: the emergence of positive real short-term interest rates in the past two months.

How Long Can Small Caps Lead?

The Russell 2000 is about five points ahead of Large Caps YTD, and is approaching its April 2011 long-term relative peak. We view this outperformance as their leadership’s last gasp and not a new cycle.

Gold, After The Deluge

Gold broke sharply lower in April, possibly sounding the death knell for the 12-year bull market in gold (and silver). We sold one-third of our holdings in the Core and Global funds in late February at around $1595/oz., cutting each fund’s position to 4% of total assets from 6% previously. Following the big bounce in late April, we sold another chunk at $1470/oz., leaving both Core and Global funds each with a small position of 2.5% of total assets that we’ll likely continue to hold, simply in the interest of diversification.

.jpg?fit=fillmax&w=222&bg=FFFFFF)