REITs

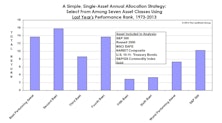

Bridesmaid Track Record

Overall, five of the seven assets available for the Bridesmaid strategy have underperformed the S&P 500 over the long-term, and three (Treasury Bonds, Gold, and Commodities) lagged by 390 basis points or more per year.

Momentum: Not Just For Stock Pickers

For those not blessed with clairvoyance, we’ve developed an asset selection strategy that’s done very well, historically, compared to the “naïve” AANA Portfolio and even against the almighty S&P 500. We’re not implying that investors dump their valuation models, economic forecasts, or their intuition. But they should recognize that price momentum tends to persist—not just among stocks and industry groups—but at the asset-class level as well.

Momentum Across Asset Classes

For those not blessed with clairvoyant asset selection ability, we’ve developed a simple single-asset portfolio strategy that’s handily beaten the AANA Portfolio and the S&P 500 over the long-term.

What's Ailing The REITs?

This year’s cooperative bond market hasn’t helped rekindle much enthusiasm for bond-like stocks like the REITs and the Dividend Aristocrats, which are up 3% and 6% YTD, respectively, compared with a 9% gain in the S&P 500.

REITs: “We Are #11” - A Fresh Look At The Newest GICS Sector

On August 31st, Real Estate will become the newest GICS sector and the first Level 1 addition since the framework was unveiled in 1999—REITs had been classified as an industry under the Financials sector.

A Top Down View Of REITs

Although Valuations are a headwind for the asset class, at the stock level our disciplined multi-factor model indicates best opportunities are Small/Mid Caps, and Hotel & Resort-oriented names.

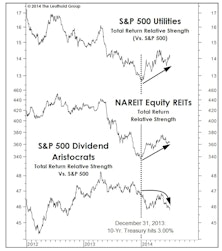

Beware Bond-Like Stocks

We certainly have nothing against dividends, but for more than a year we’ve believed that high-yielding themes like the Utilities, REITs, and the S&P Dividend Aristocrats have become so popular they’re likely to disappoint their new owners for a while.

Industry Groups To Avoid

Currently, the Unattractive range of our GS Scores is characterized by two themes, commodity-oriented groups and high dividend groups.

Buy The Bridesmaid, Not The One Looking To Rebound

The investment leadership of a given year has historically had better-than-even odds of outperforming in the following year at both the asset class and equity sector levels.

Is The Dividend Mania Ending?

The list of new lows is dominated by yesterday’s darlings, “bond-like” stocks. In particular, Utilities and REITs have been hammered. However, not all of the stock market’s high yielders have been trashed.

Are Alternative Assets Effective In Hedging Portfolios?

Alternative assets have attractive return rates since 1994. But their portfolio diversification benefits have diminished as they become more equity like, though their correlations to bonds have fallen.

REITs Beginning To Look Interesting

REITs were at one time a market darling, and for the first three quarters of 2008 they were holding up much better than the stock market.

Buying REITs In Core And Asset Allocation Portfolios

Returning to REITs as an alternative to fixed income. Adding new 4% holding in both the Core and Asset Allocation Portfolios, with the focus exclusively on Residential and Health Care REITs. Weighted average yield of the new holding is about 5.7%.

Everybody Seems To Be Asking About REITs

Andy Engel’s current take on the REIT sector. Discussed from both a quantitative and qualitative perspective. Should you be buying or selling REITs?

Financials Retreat In April

REITs and Financials still unattractive despite retreating in April. Financial sector weight in S&P 500 still too high given the interest rate climate.

View From The North Country

There is a clear lack of attractive options in fixed income and we are increasingly skeptical about the REIT markets, as premiums and new offerings are at or near peak levels. Industrial Metals still offer outstanding opportunity.

Better Than Bonds?…..Stocks That Yield More Than Ten Year Treasury Notes

Tax disadvantaged REITs might now compete with tax advantaged high yielding non-REITs. We provide a list from a screen identifying high yielding non-REIT stocks.

The Rationale For Adding REITs To Core Portfolio

Adding new 5.0% REIT holding in Core Portfolio. Viewing it as an alternative to the low fixed income yields.

Tactically Increasing REIT Exposure in Conventional Portfolio

REITs continually ranked this year among Most Attractive. After tactical additions, 15% now invested in REITs. Interest in these real estate proxies is definitely increasing, by both institutional and individual investors.

REITs: Building Upon Our Foundation

Conventional Portfolio boosting REIT holdings above the 8-10% core position. New purchases increase REITs to 12% of total assets. Increase viewed as tactical move, NOT an upward revision in core position.

Real Estate Segmented As Separate Asset Class

REITs removed from equity portfolio and now occupy separate real estate asset class. High equity valuations and moderate upside bond potential make real estate an appealing long term play.

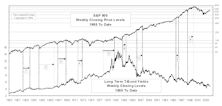

View from the North Country

Thermal pollution time…Steve Leuthold’s 1996 views (and 1995 reviews) on stocks, interest rates, economy, dollar, deficit, earnings, alternative investment areas and, yes, the Super Bowl.

Something To Buy Now

Observations and opinions on REITs as well as highlights from a recent institutional investor REIT forum.

Building a Position in REITs

REITs being added to Conventional and Unconventional Portfolios. Expect total returns here to be in excess of 10% annually. REITs are also expected to act as a defensive holding in a down market.