Risk

The MOVE Is Now A Better Risk Gauge

The MOVE index, a volatility gauge for the bond market, has become a far better risk barometer—and it surged to a new cycle high in March.

Risk Barbell Or Middle Of The Road?

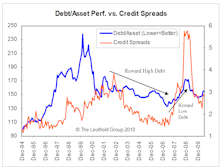

The underperformance of investment grade credit this year prompted the question of whether a risk-barbell portfolio of safe Treasuries and risky high-yield bonds may offer better performance than a middle-of-the-road portfolio of 100% investment grade corporate bonds in a highly-uncertain environment.

The Fog Of Uncertainty

Investing is, by its very nature, a forward-looking endeavor. The returns that are earned and the risks that are incurred by investments made today will only be determined tomorrow.

From Turkey To Thailand, EM Political Risks Hard To Dodge

A military coup was staged in Turkey on Friday, July 15th, but it was quickly suppressed. The damage, however, was done.

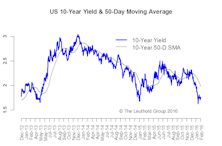

New Bond Market Record: G5 10-Year Average Hit All-Time Low

Despite the improvement in market sentiment, U.S. bond yields were dragged lower by their international counterparts.

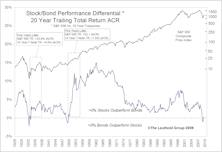

The Current State Of Stock-Bond Relationship: Risk-Off

The transition we saw last year from a mostly Risk-On (or Easing) environment to a more challenging Tightening (or Risk-Off) environment has made the relationship especially volatile.

Chinese Stocks: Accounting Red Flag Screen

We examine several models or screens to detect accounting or governance risks.

Risk Aversion Index Turns Higher, New “Higher Risk” Signal

We are turning defensive within fixed income and recommend moving up the quality scale.

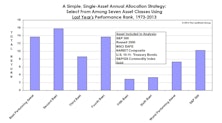

Buy The Bridesmaid, Not The One Looking To Rebound

The investment leadership of a given year has historically had better-than-even odds of outperforming in the following year at both the asset class and equity sector levels.

Risk Aversion Index Edges Lower, Stays On Its “Lower Risk” Signal

We are in the seasonally favorable part of the year and we continue favoring high-grade credits within fixed income.

RAI Falls, But Stays On “Higher Risk” Signal—Remain Cautious

The RAI fell in August and stayed on a “High Risk” signal. We remain cautious and recommend higher quality within fixed income.

RAI Fell, But Stayed On “Higher Risk” Signal—Remain Cautious

The RAI fell in July and stayed on a “High Risk” signal. We remain cautious and recommend higher quality within fixed income.

Leuthold Stock Quality Rankings—Tracking Quality And Risk Cycles

High Quality Stocks outperformed their Low Quality comparators in the second quarter, and we find signs that a new High Quality Cycle is starting to take off.

Commodities vs. Style Factors: A Risk Perspective

Chun Wang uses the CRB Index as a risk proxy to test the effectiveness of a range of quantitative factors in various environments. Commodity prices have become an increasingly important measure of risk, since higher commodity prices indicate a greater risk appetite and vice versa.

Risk Aversion and “Episodic” Factor Returns: Investors Favoring Conservative Characteristics

We expect risk appetites to remain low and investors to continue to reward conservative stock characteristics over the next 3-6 months.

Righting The Ship Of Risk/Reward

As of the end of Q1, the 20 year total return ACR differential between the S&P 500 and Ten Year Treasuries was negative, and at its lowest reading in 60 years.

Eight Weeks Up....Now What?

Assessing Market Risk. We see minor or minimal risk from the economy, inflation, and earnings. But, terrorist attacks and valuations could be more significant risk. Iraq is a moderate short term risk.

View From The North Country

Managing Your Mother Lode…Your Serious Money. Ten rules written for a soon to be published book, The Book Of Investing Rules, which contains an anthology of rules from well-known investors and financial professionals.

Looking At Stock Market Risk and Analyzing Past Bear Markets

A look back at 20 prior bear markets (1900 to date) to examine the question, “Just how long does it take to recover from a bear market?”

The Great Two-Way Market

Cribbing from Charles Dickens, February was the best of times and the worst of times.

View From the North Country

Recent “hedge” fund trauma marks the end of hedge fund mania. The risk in quantitative models: Never bet the entire farm on any statistical model when the unpredictability of the human factor is involved.

Risk/Reward Stock Substitutes

Bonds as attractive Risk/Reward substitutes...disguise them with fictional names such as Bondo Ltd., etc.

View From the North Country

Economic expansion now 40 months old...Yes, it has been somewhat anemic, but nevertheless it may be well past middle age. Getting real about risk: risk is not the same as volatility.

View From the North Country

Is sophisticated the same as smart? Market neutral operations are supposed to involve little or no market risk, so how could the entire asset base go down the drain?