Sector Valuations

Technology Stocks: Dance Like Nobody’s Watching

In the middle of the last decade, we marveled at the Tech sector’s ability to flog the rest of the market quarter after quarter, with no meaningful breakout in valuations. Specifically, the median Price/Cash Flow ratio for S&P 500 Technology managed to “hug” the 15x level for about four years beginning in late 2013. Tech’s post-COVID boom is nothing of the sort.

Weight Watcher—Another Look At Sector Valuation

There are numerous ways to measure sector valuation, but we found the simplest one: sector weights. Overall, using simple sector weights, we arrive at the same conclusions about sector valuation as one would using conventional valuation metrics.

Sector Rotation: Momentum Versus Valuation Factor

For sector overweight/underweight decisions, applying a Momentum overweight with both EM and DM countries has been most successful.

A Contrarian “Late-Cycle” Play?

The Amazon Effect masks both the underperformance of the average Discretionary stock and the relative value that’s been reestablished across the sector. “Discretionary ex-Amazon” is a better contrarian pick than Energy.

No Sector On Sale...

While cap-weighted U.S. indexes remain far below their 2000 valuation highs, in some ways today’s market presents an even more difficult hurdle for value managers.

Paying Up For Stock Market “Leftovers”

It’s well known among market professionals that value investors are congenitally grumpy (for example, the retired keeper of our Undervalued & Unloved stock screen went by the internal nickname of “Eeyore.”) Worse yet, bad market conditions have lately combined with value managers’ bad genetics to make them an especially unhappy lot, even by their own dour standards.

The Bull Market Turns Six

The bull’s 72-month lifespan now rates as the fourth-longest among all 23 DJIA bull markets since 1900, and the cumulative price gain of +179% ranks sixth.

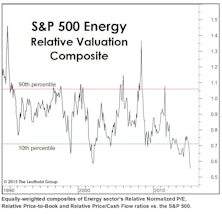

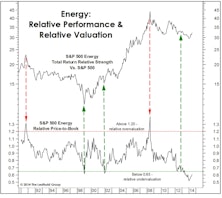

Thoughts On Energy

The recent Energy sector decline has accomplished the feat of wiping out all of the upside gains achieved during its “Third Act” played out in the 2006-2008 surge.

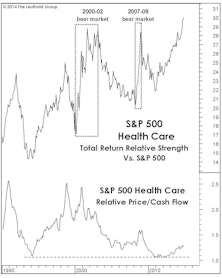

Gruber The Guru?

Last month’s tactless comments from MIT health care economist Jonathan Gruber contained an (accidental) investment nugget we’ve alluded to several times in the last three years (and, no, it does not relate to the “stupidity of the American voter” or investor).

Sector Valuations: A Top-Down Look At Risk & Opportunities – Predicting Relative Returns

Cheapest three sectors on a relative basis: Info Tech, Health Care, Energy

Energy Sector Heating Up

We’ve been negative on commodities and most commodity-oriented equities for the last three years, believing that the magnitude of the ramp-up in commodity production capacity over the last decade remains generally underappreciated by investors.