Secular Bull Market

Smarter Than The Bond Market?

The half-percentage-point drop in the 10-year Treasury yield, since mid-March, has investors worried about “what the bond market might know” that the stock market doesn’t. Maybe it’s time to stop lionizing the bond market’s prescience and give the stock market its due.

Another Eulogy For The Bond Bull

In the past year, big-name bond gurus have put forth various yield targets that, if exceeded, would provide definitive proof that the secular bull market in Treasury bonds begun in 1981 had finally ended.

Could It Be A “Two-Fer?”

The milestones achieved by the current cyclical bull market have been so numerous that we hope you’ll forgive us for missing one back in May.

What’s In Store For The Secular Bull?

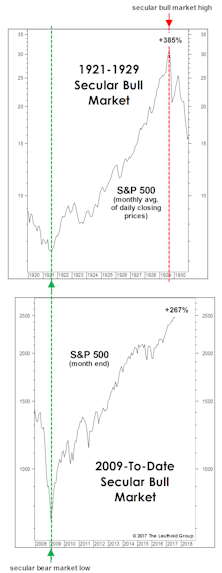

Last year seemed to cement the view that stocks have entered a new secular bull market, and today we’re not going to offer our dissent—what with the S&P 500 trading about a third above its 2000 and 2007 “Twin Peaks”.

The Ten-Year Stock Market View: Are Above-Average Returns Possible?

Unfortunately, the upswing since early 2009 can be considered immature only from the perspective of its age. The math just doesn’t support the secular case.

More Upside In Energy Stocks? Comparisons To 1974-1980 Bull Market Say Yes!

Relative valuations seem to support a continuation of energy stock strength.

The Secular Bull Market Lives (I Think)

Using history as a guide, the current secular bull market may run another 5 years or more. By historical standards, it is well past middle age, but is not yet ready to keel over.

Bond Market Summary

T-Bonds at their recent lows were down 30% from peak levels. Yes, it has been a bear market, but it may be about over. At minimum, a strong move to 11%-12% levels is expected before election day. Is the five-point move in recent days the 10 beginning of this? Maybe …