Secular

Thoughts On The Secular Outlook

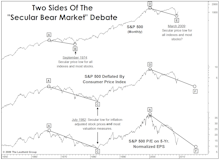

Some have speculated that 2022 might have been the kick-off for a decade-long era in which the broad stock market indexes will make essentially no progress, like 1966-1982. However, that earlier experience provided opportunities within other market segments, which will also stand a much better chance in coming years.

Secular Bull Or Bear?

Is a new secular bull market underway? New highs in essentially all U.S. undermine the argument from the shrinking pool of secular bears. But new converts to the bull thesis should be concerned about the valuation levels already reached.

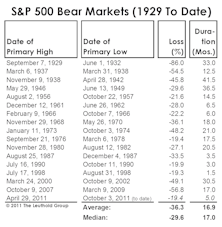

The Bull In Historical Context

The cyclical bull market is approaching its fifth birthday. Should you be nervous? Yes, but not so much because of its age.

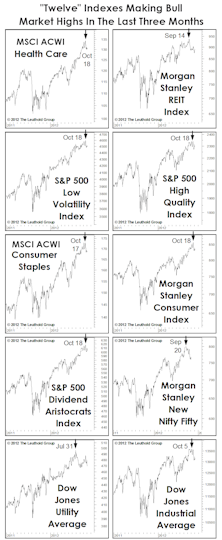

Is The Glass “Half Full”?

A “dozen” major market measures have moved to new bull market highs in the last three months. But many of these have been the groups that do best when “risk” is “off,” and may be a reason “Ain’t Nobody Happy,” even in an up year.

An “Old” Bull Market… That Should Get “Older”

The bull market is increasingly showing signs of advanced age, but that is only to be expected for a move that now measures 40 months off its March 2009 low.

Ain’t Nobody Happy

Despite the big October rebound, Doug Ramsey examines various market players and finds that dissatisfaction with recent market moves may proliferate among all but a select few.

Be A Buyer In An October Scare

Following a strong September, October may be a little weaker. However, readers should use any October scare to buy equities in anticipation of strong end to 2009.

“Secular” Is In The Eye Of The Beholder

Secular versus Cyclical markets. It shouldn’t really matter. Investors can lose a lot waiting to be right. The Key is to focus on the cyclical movements within a secular bull or bear market.

Is Another Major Low Lurking Beyond 2009?

Several independent methods are presented that seem to triangulate on the years 2012 and 2013 as candidates for another significant stock market low - - maybe the final low of a secular bear market which began in 2000?

Update On Japan...Holding Our Positions, But Watching Closely

Recent market action appears to be indicating that cyclical forces have, for the time being, put Japan’s stock market recovery on hold.

Inflation Update

Wage pressure is only cloud on inflation horizon.

Inflation Update

Wage inflation looked like it was finally taking off in October, but November's data showed a different picture, as four of the nine subsets (including Total Wage inflation) moved lower.