Share Growth

Valuing The Experiential Reopening

The onset of the COVID-19 pandemic in early 2020 brought a sudden halt to social gatherings, crowd events, and even personal contacts. Experiential business models were hardest hit by forced closures and lockdowns; cruise ships were forbidden to sail, restaurants and theme parks were closed, and air travel and hotel occupancy dwindled, all in an attempt to minimize personal interactions. The stocks of leisure services companies took a beating in March 2020, with Chart 1 documenting the virus’ impact on 34 large and midcap stocks representing this theme.

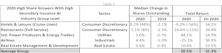

“Change In Equity Shares Outstanding Factor” Surprises In 2020

Historically, companies that have grown their equity share base over the previous year are apt to underperform the broad market in the ensuing months; those that had reduced shares outstanding tend to outperform. However, the opposite happened over the course of the last year. Here we explore the underlying details to see what contributed to this result.

Research Preview: The Experiential-Reopening Trade

A strong argument can be made that experiential consumer services was the economic sector hardest hit by the pandemic lockdown. Cruise ships were forbidden to sail, restaurants and theme parks were closed, and air travel and hotel occupancy dwindled—all in an attempt to minimize personal/public interaction. The stocks of experiential companies took a beating in March 2020.