Stocks

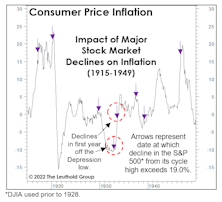

Stocks, Inflation, And Reverse Causality

Forget interest-rate hikes and quantitative tightening. There exists a very important weapon in the fight against inflation that the Fed did not have at its disposal in the 1970s: an overvalued stock market.

Higher Prices Shouldn’t “Surprise” Us

The Fed has communicated it’s inflation target in uncharacteristically-plain English. Maybe they need to dumb it down more, because it’s the investors in English-speaking countries who have been the most surprised by the recent pickup in the inflation numbers!

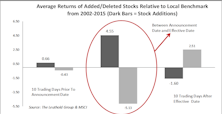

Index Rebalance Effect—A Disappearing Anomaly?

In the past we’ve made the observation that adding/deleting stocks to/from a popular index can have a profound impact on the target stocks’ short-term trading volume and performance.

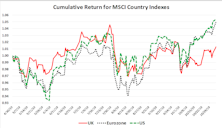

U.K. Stocks: Bottom Fishing… & Chips

A preview of the upcoming Of Special Interest that will examine if the tortured process of Brexit is creating an opportunity to bottom fish washed-out and unloved U.K. stocks. Time to buy?

Leverage Factor: A Boost For High Quality Stocks?

A review of Quality factors, as well as the lower valuations of High Quality stocks, supports the current High Quality cycle amid rising market volatility. The Leverage factor may provide particularly strong backing for High Quality stocks.

Intermediate Top?

In mid December an Interim Memo was sent advising clients of a negative change in our Early Warning Index, an indication that an intermediate top was forming. It has been about four weeks since that alert and the work has continued negative.

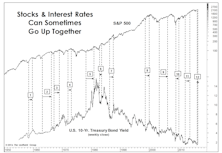

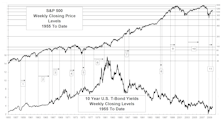

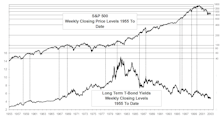

Rising Rates: Not Always A Death Knell

While the Dow Jones Bond Indicator has stood the test of time, history shows that rising bond yields are not always a bearish stock market phenomenon.

Too Early To Dethrone Dividend Stocks?

In the context of a low growth/low inflation environment, with the Fed taking its time to guide rates upward, fixed income type of investments may pale by comparison to dividend paying stocks.

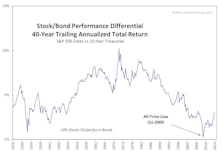

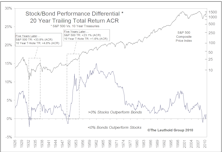

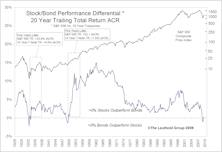

Exploring The Historical Relationship Between Stock And Bond Returns: An Update

We were surprised to see that all differentials ten years and longer are still below their respective 1926-to-date medians, indicating they still have the potential to keep moving towards historical median levels. We expect stocks to outperform bonds going forward.

Stock/Bond Correlation Upside Down—Stocks And Interest Rates Can Rise In Tandem

An examination of this historical relationship turns up some interesting findings that challenge the traditional disposition.

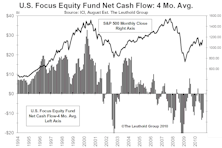

Nightmare On Main Street: Individuals Are About To Get It Wrong…Again

There were plenty of interesting facts to be discovered in reading the latest mutual fund flows report from the Investment Company Institute (ICI). The recently released report, which detailed the statistics for September, showed that there were nearly $15 billion of net redemptions from U.S. equity funds for the month. September, by the way, was a month where the S&P 500 rallied to an 8.8% gain. We have noted in the past that the public is generally a trend following herd that buys into market strength and sells on weakness.

Slowly Righting The Ship Of Risk And Reward

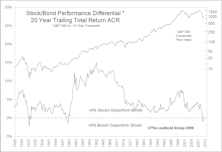

Stock/bond Risk-reward relationship beginning to return to normal. Back in Q1 2009, performance differential between S&P 500 and 10 year T-bonds was at generational lows. In prior periods of bond superiority, stocks ultimately came soaring back. Expect to see stocks do much better over next 5 years.

Interest Rate Moves And Stock Prices… Another Look

At times it is indeed possible to have interest rates rise and stocks also move higher, and it is also possible to have rates decline and stocks fall.

Rising Interest Rates Don’t Prohibit Rising Stock Prices

Expect stock prices and interest rates to move higher together for a while. There are plenty of examples of this historically...although some of them go waaayyyy back.

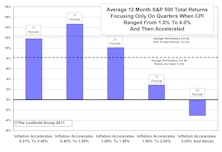

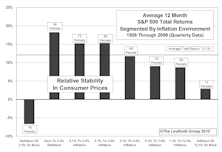

Rising Inflation: Not Always Bad For Stocks… Especially Small Caps

A look at stock performance in various inflation environments would seem to predict below average performance in 2009, but threat of monetary debasement inflation in 2011 and beyond could set the stage for poor performance.

Righting The Ship Of Risk/Reward

As of the end of Q1, the 20 year total return ACR differential between the S&P 500 and Ten Year Treasuries was negative, and at its lowest reading in 60 years.

Update On Our Stock/Bond Performance In Focus Special Study

Despite strong stock market returns relative to 10-year Treasuries, the “generational anomalies” still exist. Stocks should outperform bonds going forward.

Generational Perspectives On Stock Vs. Bond Returns

So, over the long run, stocks are supposed to provide better returns than bonds as compensation for taking greater risk. Well the last 20, 30, and 40 year periods show that bond and stock returns have been at the smallest performance spreads ever. In some cases, bonds actually produced better returns. It’s pretty depressing huh?

Reasons To Own More Stocks

Looking for reasons to own more stocks? Doug Ramsey has a whole bunch of them.

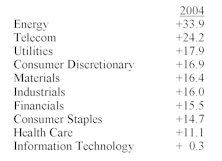

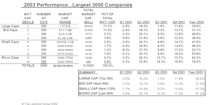

Did You Have The Right Mix In 2004?

Small Cap Stocks were hands down winners relative to large caps, while just edging out mid caps. This is the fifth consecutive year of small cap superiority.

Equity Performance By Market Cap Tiers

Weighted versus Unweighted S&P 500 comparison, Russell 2000 versus S&P 500 annual comparison and 2003 equity performance by market cap tiers.

Rising Interest Rates Don't Prohibit Rising Stock Prices

This month, we provide historical evidence that stocks can indeed move higher, even when interest rates rise. Six periods since 1955 are proof that it can happen and we expect it to happen again.

2002 Dreams And Nightmares….A Look At What Might Have Been

An examination is made of the previous year’s leaders and laggards to see if success could have been attained by buying last years big winners (or the big losers).

Why We Conclude Equities Are No Longer Overvalued

Explanation of how we use historical valuations to compare to today.

The Billion Share Club

In 1990, only two companies with more than a billion shares outstanding, guess how many now?

Looking At Stock Market Risk and Analyzing Past Bear Markets

A look back at 20 prior bear markets (1900 to date) to examine the question, “Just how long does it take to recover from a bear market?”

1997 Dreams And Nightmares...Minimal Metamorphosis

Each January, this publication has presented a look back at the prior year’s best and worst industry groups and institutional stocks.

Stock/Bond Relationship...It Is Changing

Increasingly, stock and bond markets moving in opposite directions. There may be some reasons why this is happening now.

Early 1997: The Stock Market Looks Higher

December's stock market was a mixed up affair, but this is not unusual for December.

Expecting Stocks Down and Bonds Up? Explain Please

“If you are expecting long bond rates to fall as low as 6% later in 1997, how come you are so afraid of the stock market?” This question, or some variation thereof, is frequently heard from clients these days.

A Message in the Bond Market Madness?

The equity crowd is now having some second thoughts: What is good for bonds may not be good for stocks.

View From the North Country

Should we just own stocks and forget about asset allocation? After all stocks have been the best performing asset class over the last 70 years.

Major Trend Index Still Negative….But July Market Action Improved

Major Trend remains in negative territory but market action (both stocks and bonds) improved in July. Short term, both stocks and bonds may continue to rally.

Stock Market Performance In Perspective

The histograms in the following pages are taken from the January 1993 edition on Benchmarks.

Bullish on Bonds and Bearish on Stocks?

Remember the basics: A slowing economy should bring lower interest rates but it also typically brings declining earnings, not usually a good environment for stocks.

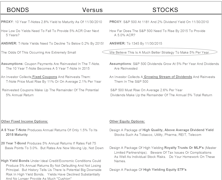

Comparing Common Stock Cash Flow Yields to Bond Yields: The Ratio

Comparing cash flow yields with bond yields we find that stocks are not significantly overvalued compared to bonds. Stocks are not yet comparatively cheap, but they come out much better in this stock/bond comparison than in the dividend yield/bond yield comparisons or in the earnings yield/bond yield comparisons.

Comparing Common Stock Cash Flow Yields to Bond Yields

We thought last month might be the end of this bond/stock comparative series. However, a recent note from a client has prompted us to undertake an additional study comparing common stock cash flow yields with bond yields.

The Historical Relationship of Earnings Yields to Bond Yields

This is the third in a series of studies presenting historical relationships between stock market valuations and bond yields. In this issue, we examine the historical relationship of the bond yield and common stock earnings yield in terms of a ratio.