Style Performance

Active/Passive Whiplash

The active/passive performance derby experienced a severe case of whiplash the last three months. Through the end of the first quarter, market conditions were advantageous for active managers, now the second quarter has revealed a massive shift in favor of passive styles.

Is Value Still A Value?

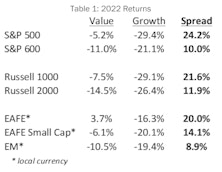

Deflating valuations in the Technology and Innovation space produced ghastly results for growth investors in 2022, with the S&P 500 Growth index experiencing an agonizing 29.4% loss. Meanwhile, last year’s bear market was no more than a mild irritation for value investors as the S&P 500 Value index lost just 5.2%. The collapse in exuberantly priced growth stocks produced a 24.2% return spread between the value and growth styles, which goes into the record books as the second biggest annual win for value since 1975.

Research Preview: An Epic Comeback

Style rotation powered S&P 500 Value to a 24.2% advantage vs. Growth, while DM large-cap Value earned a 20% return spread against Growth. Small-cap spreads favoring Value were also in the double-digits, but narrower because small-cap Growth wasn’t exposed to the collapse of mega-cap Tech.

The Mysterious Affair of Style Returns

Mystery writers are fond of creating misdirection by introducing multiple eyewitnesses that each describe the crime differently. This plot device confuses the storyline until a clever detective comes forward to unravel the conflicting evidence and solve the mystery.

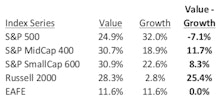

This scenario played out in style returns for 2021, as shown in Table. Our first witness is a large cap manager who tracks the S&P 500 and reports another banner year for Growth, its seventh win in the last ten years. Our second observer is a small cap manager who watches the broader market and tells of Value’s excellent year. Meanwhile, our third bystander is an international manager tracking EAFE, who reports seeing a whole lotta’ nothing in the style derby last year. In this study, we channel our inner Hercule Poirot to determine what, in fact, did happen across domestic style returns in 2021.

Research Preview: A Playground Scuffle Between Value And Growth

It is a scene easy to imagine: Two children on the playground arguing about who’s the top dog. This schoolyard scuffle played out in 2021 between the Value and Growth styles, with each claiming bragging rights from their own perspective.

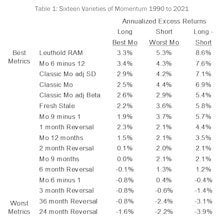

Can Mo Outrun A Bear?

Hiker #1: Can you run faster than that hungry bear looking at us?

Hiker #2: I don’t need to run faster than the bear, I just need to run faster than you.

The Momentum style of investing has a long history of generating excess returns, and ranks near the top of the list of essential smart beta factors. However, Momentum also has a dark side; it is prone to severe drawdowns whenever the market makes a significant reversal.

Factors: Ain’t Misbehavin’

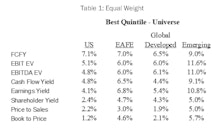

Investment styles and factors are generally interpreted as having an inherent preference for either bullish or bearish market environments. The theoretical tilt of each style is based on its design and its sensitivity to economic, profit, and valuation cycles. However, theory and practice do not always agree, and we must look to actual performance to confirm our impressions.

Research Preview: Factor Standings For 2020

As we review factor and style returns for 2020, it occurs to us that the “whole” is much less interesting than the sum of its parts. Many factors are considered to be either bullish or bearish in temperament, and last year’s round-trip offers an opportunity to test the reliability of those characterizations.

Style Performance Differs Based On Market Cap

Growth continues to lead within Large Caps while Value has the advantage among the Mid and Small Cap arena.

The Active Goose, The Passive Gander

Raise your hand if you’ve heard this one before:

(A) 80% of active funds underperformed their index over the past 10 years.

Now, keep your hand up if you have also heard this:

(C) Therefore, investors should buy passive index funds.

The King Is Dead: A Global Chartbook

Last year we published a report titled Price to Book: The King is Dead (available on the Leuthold Research website) with the objective to better understand the decade-long struggle of the value style. Our findings showed that indexes based on the Price to Book ratio have indeed lagged since 2007 but that other measures of value performed significantly better until just recently.