Total Return Ratio

A Look At Where Rate Hikes Are “Working”

Speculative spirits are back, and the index that’s suddenly close to its 2021 high is the one we viewed as the epicenter of the mania—the NY FANG+® Index!

Stocks Versus “Safe Havens”

While we aren’t clamoring to add long-term Treasuries in tactical accounts, we believe that the past 18-months’ action has left them more attractive versus stocks than during most of the last 15 years. However, compared to gold, the S&P 500 still trails on a total return basis measured back to Y2K.

Small Caps Getting Cheaper By The Day

It was September 2020 when we suggested that a new multi-year phase of Small-Cap-stock leadership had begun. Almost immediately, the Russell 2000 reversed a big chunk of the prior decade’s underperformance. Unfortunately, that was the extent of the run.

Small Caps: We’ve Seen This Setup B-Four

In mid-2020, we wrote that a new multi-year leadership cycle had probably begun. Technically, that belief hasn’t been disproven, but the extent of outperformance has been disappointing in the nearly three years since.

Meanwhile, In “Relative World”...

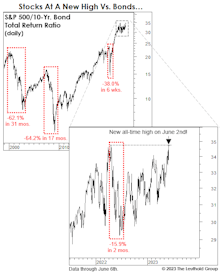

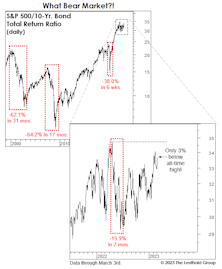

A large swath of the institutional asset-allocation world is engaged in the sometimes dangerous, binary game of “stocks versus bonds.” Although the 2022 bond debacle caused relatively mild damage to a massively overweight equity position, the bear markets of 2000-2002 and 2007-2009 produced losses for stocks versus bonds that exceeded 60%.

Emerging Markets: Watching Closely

Foreign stocks have been leaders off last fall’s lows, but not by a big enough margin to flip our Emerging Market Allocation Model to a bullish stance. The model factored into our general avoidance of EM equities the last several years; now January’s action has us on alert that the outlook may soon shift.

Jury Is Still Out On EM

Emerging Market stocks have been swept up in the last month’s rally in all things cyclical and high beta. Nonetheless, the MSCI Emerging Markets Index is still down marginally from its level coinciding with its April 30th VLT BUY signal.

Back To Y2K?

The bull market took out another old record last month when the S&P 500 topped the cumulative total return of the 1949-56 upswing. The total return since March 9, 2009, is now 468%. Since the highs of March 2000, the S&P 500 cumulative total return is actually a few basis points behind U.S. 10-year Treasury bonds.

Lessons From The Old Masters: John Neff

A recent trip to the Netherlands included visits to The Rijksmuseum and The Mauritshuis to view paintings including The Night Watch, widely acclaimed as Rembrandt’s greatest work, and Vermeer’s equally celebrated Girl with a Pearl Earring.

Lessons From The Old Masters: John Neff

We believe the results of every investment operation depend, more than anything else, on the quality of the investment philosophy and process that drives the portfolio.

America’s Already First...

Thanks to the U.S. dollar’s recent spike, foreign equities in dollar terms declined during November while the U.S. markets were celebrating a Trump victory. Thirty-nine of the 49 MSCI country indexes are in bear market territory from the perspective of a dollar-based investor.