Unprofitable Companies

The 2021 Speculative Mania And Its Aftermath

One of the societal benefits of recessions and bear markets is that they serve to correct the unhealthy excesses that build up in overheated economic booms and overly enthusiastic bull markets. As market historians, we believe it is instructive to look back at cycles of excesses and their corrections to learn how such patterns evolve and, quite often, repeat themselves.

“PSsss”

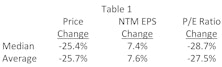

The most brutal bear markets occur when falling earnings are accompanied by shrinking valuations, producing a compound negative effect on stock prices. Investors in 2022 have (so far) avoided this double-whammy in that valuations have taken a hit, but EPS estimates are holding strong. We are intrigued by the notion that 2022’s bear market has, to date, been all about valuation compression rather than earnings weakness. Investors are coping with the problems of the day by letting the air out of bubbly valuations, and this report takes a closer look at the valuation squeeze underlying the current selloff.

Research Preview: P/E Multiple Compression In 2022

Stock market corrections are the result of falling valuations and/or falling earnings, and when both conditions appear together, investors are in for a rough ride. Thus far, the 2022 selloff has been confined to compressing P/E ratios, and we launched a research project to take a closer look at shrinking stock valuations in this market downdraft.

Speculating In “The Nebs”

One measure of a bubbly bull market is the degree of speculative fervor embedded in the prices of companies with nebulous, indeterminate, or even nonexistent intrinsic values. Since the bear market low in March 2020, speculative manias have evolved in a menagerie of asset classes including Innovators & Disruptors, SPACs, meme stocks, crypto currencies, and NFTs. Based on the breadth of valuation extremes across numerous and diverse assets, this bull market may rank second to none.

Research Preview: Style Swings In 2021

Despite elevated uncertainty over pandemic developments and expected policy tightening, and in the face of aggressive valuations, the S&P 500 still managed to gain a delightful +28.7% in 2021. Even more noteworthy, in our opinion, is that this advance came with nary a single correction of more than 10%.

Valuation Extremes: Here Be Dragons

Top decile valuations are often the result of unduly positive investor sentiment that leads to inflated multiples. Bullishness comes in varying strengths: optimism, enthusiasm, exuberance, and, at the extreme, the mania of crowds. Because bullishness manifests itself in aggressive valuations for speculative companies, we believe the prices being applied to such companies - for which intrinsic value is dependent on a future that looks significantly different than today - are an excellent measure of investor sentiment. In that spirit, we examined past cycles of extreme valuations with the goal of understanding how they relate to investor sentiment and what they might tell us about market conditions and relative returns.

Research Preview: A Tale Of Two Tails

Top decile valuations, such as those in place today, are usually the result of excessively positive investor sentiment that leads to inflated multiples. Bullishness comes in varying strengths: optimism, enthusiasm, exuberance, and, at the extreme, the mania of crowds. Leuthold research typically tracks valuation sentiment by examining median P/E ratios, but in this study, we are taking the opposite tack. Rather than looking at medians, we are focusing on the outliers in each tail of the valuation distribution.