US Bonds

U.S. Investment Grade Corporate Bonds: Maintain Neutral

Our overall view toward credit has turned decidedly cautious over the last couple months and that includes our long-term favorite.

US Bonds

“Lower Risk” signal closed out the “Higher Risk” signal generated five months ago. We’re encouraged by the resilience in risky assets during the oil sell-off and the late surge in global bond yields. We’ve been favorable toward high-grade credit and maintain this view within the fixed income space.

U.S. High Yield Corporate Bonds: Maintain Neutral

Although the fundamental picture remains healthy for most U.S. High Yield issuers and defaults are expected to be low, the reversal of a crowded trade could lead to further substantial losses on these bonds.

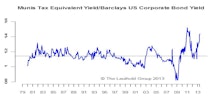

U.S. Municipal Bonds: Maintain Neutral

We believe the sell-off in Munis is overdone in the short-term and these bonds look attractive relative to Treasuries. But in the medium-term the tapering risk will linger; this is a big negative for long maturity credits like Munis.