VLT Momentum

Small Caps Missed The Memo

For the first time since 1946-47, the super-bullish, six-month window beginning with the mid-term elections through the following April, failed to see a material upswing in Small Caps.

VLT: You Read It Here Last

We anticipated it for months, and now that it has finally happened, we’re burying the news in the final page of this section. Yes, the last day of March saw the S&P 500 trigger a “low-risk” BUY signal on our Very Long Term (VLT) Momentum algorithm, known elsewhere as the Coppock Curve.

Small Cap Malaise

Imagine telling a Small Cap investor in mid-2018 that: (1) the U.S. economy would spend all but two months of the next 4-1/2 years in expansionary mode; and (2) M2 money supply would increase by 50% in that time, and yet the Russell 2000 would gain a grand total of just 9% over the same span.

Might VLT Be Out Of Step?

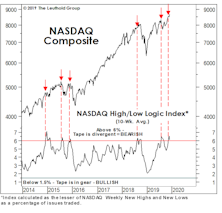

Unless the S&P 500 and NASDAQ correct more than 5% from their March 6th levels by the end of the month, both will trigger new VLT BUYs. Rather than celebrating that prospect, however, we find ourselves wondering what might go wrong.

VLT Update

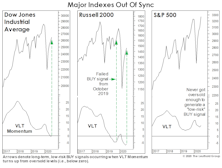

The progression of bullish technical evidence since October’s S&P 500 low is compelling, though not overwhelming. With that low now almost four months behind us, the VLT Momentum oscillator for the S&P 500 probably “should” have already triggered a new BUY signal. Yet, both the S&P 500 and NASDAQ Composite are still holding out.

1966-67: When The Yield Curve “Failed”

Given the tendency of economists and strategists to dismiss the message of an inverted yield curve, it’s surprising there’s been no scrutiny of the “dog that didn’t bark”—the inversion of 1966. That’s the last time an inverted curve did not lead to a recession.

Is This Year’s Strong Start “Signal Or Noise?”

This year is off to a much stronger start than suggested by the 3-4% gains in the blue-chip averages: Through January 12th, the Value Line Arithmetic Composite—an equally-weighted index of about 1,700 stocks, was up 7.0%.

VLT: “A Swing” And “A Miss”

We suspected November’s “low-risk” VLT Momentum BUY signal on the Dow Jones Industrials might turn out badly, and we were right: The Dow’s decline last month was enough to cause VLT to roll back over, which officially “rescinds” that signal.

Mixed Messages From VLT

While VLT for the S&P 500 continued to trend lower in November, the DJIA calculation edged higher and triggered a new BUY signal. The message could soon get more confusing: A BUY signal for the Russell 2000 would be triggered if that index closes December above 1,813, while the S&P 500 and NASDAQ would have to climb more than 11% and 15%, respectively, to trigger a VLT BUY.

Don’t Trust The Thrust…

Jay Powell’s speech on November 30th triggered a 1,000-point intraday reversal on the DJIA and left us wondering who might have slipped the Chairman a recent copy of the Green Book.

Jay Powell, The Chartist

When Jerome Powell took the reins of the Federal Reserve in early 2018, many commentators cheered the fact that he does not possess a Ph.D. in Economics. It will be many, many years before historians are able to conclude whether that’s a good or bad thing.

Yesterday’s action, though, left us wondering whether Powell might stealthily be in the process of earning a different designation—that of Chartered Market Technician (CMT).

VLT: A Double-Sworded Edge

“Oversold” usually has a positive connotation in financial jargon, yet history’s worst air-pockets have almost always occurred when the stock market was deeply oversold. More time is needed before a “low-risk” entry point for the S&P 500 will be triggered from the VLT’s currently “oversold” status.

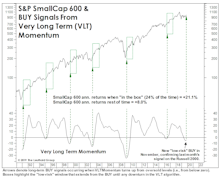

Supercharging VLT With Small Caps

Leuthold did not invent VLT. The credit goes to Sedge Coppock, a technical analyst who insisted on being called an “econometrician.” While the famed Coppock Curve was based on the Dow Jones Industrial Average, Leuthold found the algorithm useful at the industry group level—it is a component within our Group Selection (GS) Scoring system.

VLT Says Stocks Are Finally Oversold

The 2022 bear market has unfolded in a way that’s finally driven our Very Long Term Momentum algorithm for SPX into oversold territory for the first time since 2016. However, that only means a “low-risk BUY signal” is now mathematically possible—we could be writing about the “impending BUY” for many months to come.

Down—But Not Washed Out

Based on a short-term perspective, stocks may be ripe for a bounce. However, the S&P 500 has not reached “oversold” territory since early 2016, and it is still a long way from doing so. Of the major indexes, only the Russell 2000 is now positioning to soon claim a “low-risk buy” signal.

Down, But Hardly “Oversold”

Historically, a good measure of a fully oversold market has been a drop to negative by our VLT Momentum algorithm. YTD, it has been on the downswing, but is still in the vicinity of its highs reached during the Trump Bump. If the May bottom in the S&P 500 turns out to be the final low for the decline, VLT would be one of many suggesting the new rally is among the riskiest in market history.

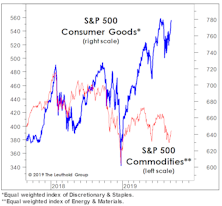

Energy: A Curse And A Blessing

The Energy sector emerged as the top performer for January, a nice respite after a terrible 2020—but not exactly a good omen. Unlike in horse racing—where the concept of “early speed” has significant predictive power—the early leader in the sector-performance sweepstakes hasn’t reliably followed through in the last 30 years.

VLT’s Struggles Are Telling Us Something

Our Very Long Term (VLT) Momentum algorithm has been a very good “confirmatory” market tool over the years, especially at the onset of a new cyclical bull market. But VLT has proven to be of little to no value in navigating this year’s gyrations. VLT’s latest flip-flops reinforce our view that the market leaderboard is set to be rearranged.

Five Reasons To Expect Higher Yields

Much of what we think “we know” about the bond market says yields should be headed higher.

A “Low-Risk” BUY?!?

So what do we make of July’s “low-risk” VLT BUY signal on the DJIA—the index on which the indicator’s creator (Sedge Coppock) did his original work? Sadly, not much.

A Bear That Left VLT Unscathed?

Our VLT Momentum algorithm was driven into oversold territory for at least a few months in all prior postwar bears. It didn’t happen yet this spring, which implies that the “grieving process” was neither deep enough nor long-lasting enough to set the stage for anything like a repeat of last decade’s bull. Most of our valuation work says exactly the same thing.

A Bear Market In Price, But Not Time?

Valuations aside, the absence of any sustained market pain over the last ten years argues for challenging times for stocks in the new decade.

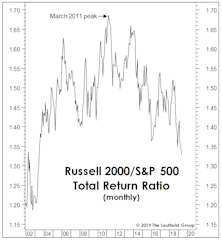

Small Cap Smack-Down

We were fooled on Small Caps, and it’s been a “multi-factor” catastrophe.

A Small Cap Strategy Session

Leuthold’s research team has recently flagged a number of items that suggest it may be time to consider small cap stocks. This asset class has been showing signs of life and the decision to overweight small caps is starting to seem relevant – and perhaps nicely profitable - again.

More Good News For Small Caps

Our call for improved relative performance in Small Caps received another boost in November, when VLT Momentum for the S&P SmallCap 600 confirmed the prior month’s “low-risk” BUY signal on the Russell 2000.

A Tough Tape To Read

Over the nearly two years since the stock market’s “momentum” peak in January 2018, the S&P 500 has gained less than 9%, while the Value Line Arithmetic Composite is unchanged. Mid Caps and Small Caps have made no upside progress during this period and most foreign markets are down.

Jury Is Still Out On EM

Emerging Market stocks have been swept up in the last month’s rally in all things cyclical and high beta. Nonetheless, the MSCI Emerging Markets Index is still down marginally from its level coinciding with its April 30th VLT BUY signal.

VLT Complicates The Market Puzzle

At October’s close, a long-term BUY signal was triggered on the Russell 2000. The fact that some market segments are triggering “oversold BUYS” when blue chips are at record highs speaks volumes about the internal disparities that have developed during the last few years. The Russell BUY signal is not inconsistent with our belief that the action since the January 2018 peak remains part of a lengthy cyclical topping process.

The Market Puzzle Gets Even More Complicated

At last night’s close, the Russell 2000 generated a “low-risk” BUY signal on our Very Long Term (VLT) Momentum algorithm, a possibility we’d alluded to in the September and October Green Books.

Small Cap VLT BUY: Not Quite...

Small Caps came tantalizingly close to activating a major VLT BUY signal in September, with the Russell 2000 closing less than a half percent below the trigger level. A new bull signal from this indicator wouldn’t “fit” into our market and economic narrative, but we won’t sweep it under the rug if it occurs.

Commodity Stocks: “Low” But Not Cheap

A general rule of thumb for thematic equity investors is that the dominant leadership sectors and groups in a given bull market normally don’t repeat as leaders in the subsequent bull.

Small Caps: “What If?”

The Russell 2000 is the most important major index on the cusp of a new BUY signal. Our best guess is that Small Caps will still trend lower for now, creating a buying opportunity in the months ahead.

“Too Smooth” Of A Ride?

While investors in Value, Small Caps, and especially foreign stocks might beg to disagree, a key MTI technical measure suggests this decade’s stock-market ride has been almost entirely “pain free.”

Big Is Still Beautiful

The 10-year-old bull grabs most of the headlines, but its younger sibling has begun to command more respect.

Portraits Of An Out-Of-Sync Market

We suggested many years ago that the final top to this historic bull market would be a long and complicated process rather than a clean and singular event.

Adding EM On A Rent-To-Own Basis

The Major Trend Index has remained in neutral territory during the last several weeks of upside action, suggesting there remain significant fundamental and technical shortcomings beneath it all. But this precarious MTI stance didn’t preclude us from acting on a new bullish reading for Emerging Market equities at the end of April.

Adding Some Emerging Markets On A “Rent-to-Own” Basis

Emerging Market equities have been modest underperformers during the current rally, but they’ve marshaled enough strength to trigger a new low-risk BUY signal on our VLT Momentum algorithm at the end of April.

VLT & Implications For Small Caps

For much of this decade, we had an allocation preference for Large Caps over Small Caps because of the considerable P/E premium commanded by the latter.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)