Volume

Keep Some Powder Dry

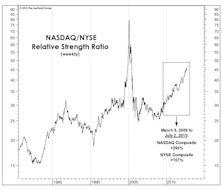

We’ve discussed market analogies with the year 1999 at length, and will give it a rest for awhile—in part because parallels to the year 2000 have cropped up! In the first five weeks of 2020, the NASDAQ 100 has already outperformed the NYSE Composite by about 7%, while in the first five weeks of 2000 the spread was 8%.

Will Rates Kill The Low Vol Mania?

While there are many parallels between recent action and that of 1999-2000, stock market leadership is not one of them.

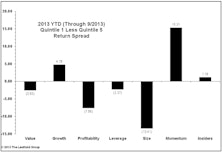

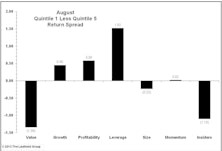

“Index Rebalance Effect” Once Again Proven

Validating results of a prior study, a look at the last four MSCI index rebalances shows that stocks soon to be added outperform from Announce Date to Effective Date, while deleted stocks underperform.

NASDAQ Apathy?

The NASDAQ has solidified its grip on 12-month leadership, rising 11% versus a 4% loss in the NYSE Composite. A surprising feature of NASDAQ’s relative strength dominance is that is has not been accompanied by a rise in relative volume.

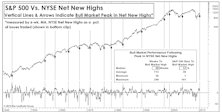

A Milestone You Might Have Missed

The fifth anniversary of the bull market was met with fanfare, but the launch of the Large Cap leadership cycle in April 2011 is receiving no attention whatsoever.

Trading Volume Nothing To Worry About

We take a detailed look at the decline in trading volume and conclude the trend might be a positive going forward.

Using A Few Bear Arguments To Make A Bullish Case

Doug Ramsey utilizes several bear market arguments to build a bullish case. Rising Interest Rates, Overbought Market, Low Volatility, and Low Trading Volumes, can all be looked upon in a BULLISH light.

No Time To Nit-Pick

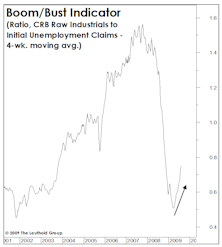

Lots of people spinning economic and market statistics to cast doubt on the recovery and stock market rally. Doug Ramsey goes point by point to make an honest assessment about the current conditions. Things do actually look pretty good right now!

Inside the Stock Market

The Major Trend Index is positive, but not as robust as a few weeks ago. The Early Warning work is okay, giving no indication of an impending major or intermediate market top.