Yield Curve Inversion

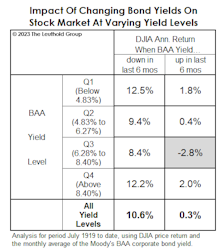

Yields Up, Economy Down?

Based on past experience, steepening in the curve from deeply inverted levels, as it has done recently, means a recession should be fairly close at hand. Worse, the fact that this move is of the “bear-steepening” variety should further depress economic prospects over the next 12-18 months.

Calibrating The Curve

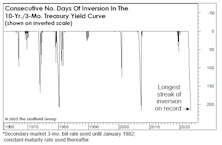

Bloomberg macro strategist, Cameron Crise, noted in early September that the 10-Yr./3-Mo. Treasury-yield spread was set to exceed the old record of consecutive days (217) in negative territory. That threshold, established in 2006-07, was indeed broken on September 7th, and—with the spread still more than 100 basis points—an end to the current inversion episode is hardly on the immediate horizon.

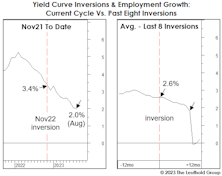

Labor Market Begins To Labor...

Most labor market measures continue to weaken, and for investors still heavily invested in stocks, we’d caution against waiting for all labor market figures to deteriorate before scaling back. Equities will likely take a big dive before such conclusive evidence arrives.

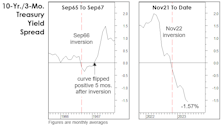

Revisiting The 1966 Forecast Failure

Developments over the last four months leave us even more skeptical that the November yield-curve inversion will join 1966 as a “false positive.” The number one reason being the subsequent shift in the yield curve itself.

Just A Typical Pre-Recessionary Rally?

Is the stock market disconnected from a souring economy? It might seem that way, and the topic dominated the discussion at the recent Market Technicians Association annual symposium.