Cyclical Bear Market

Herd Instinct

Growth and Tech have been the flagrant winners YTD, yet the SVB crisis triggered further bifurcation: Since SVB failed, it’s been important to own only “big” Growth and “big” Technology, amplifying the multiples of monster stocks, like MSFT and AAPL. Can a major market low occur when investors are herded in a handful of the most richly-priced public companies in history?

Bear Market Rallies In Context

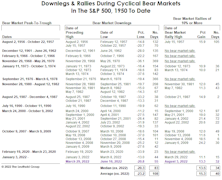

The 2022 bear market is the 13th cyclical bear since 1950, and it’s already joined the mightiest half of its predecessors based on the fact that it’s actually contained a bear-market rally. Six of the prior 12 bear markets weren’t interrupted by even one rally of at least 10%.

“Recessionary” Valuations?

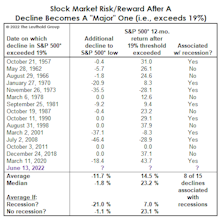

The bear was a mere cub back in March when we examined the historical record of buying S&P 500 dips in the -10% to -12% range. “Blindly” buying them turned out to have mediocre returns, but we illustrated that the positions of various business-cycle indicators could help one determine whether or not catching the proverbial “falling knife” was warranted.

A Stock Market Brain Teaser

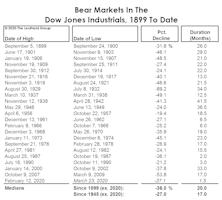

The bull and bear labels can be dangerous to stock market operators, so much so that famed speculator Jesse Livermore is said to have abandoned them in favor of softer terminology: “Lines of least resistance.” We aren’t about to ditch the old labels, or even our collection of bull and bear bookends.

Where Are The Leaders We Need?

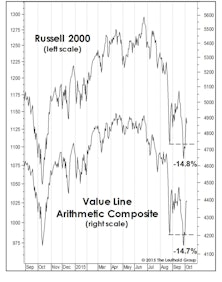

Small Caps lagged during the bounce off the March lows before a late-April spurt briefly pulled them ahead of the S&P 500. Still, considering that Russell 2000 losses were so much steeper than the S&P 500’s (-43% versus -33%), we would have expected something better.

Betting Against The Odds?

The optimists are betting that the longest bull market in history—one that carried valuations above levels seen at all but one of preceding cyclical peaks—has been followed by the shortest bear in history, at 27 days.

Did The 20% Bounce Kill The Bear?

We rolled our eyes when Barron’s and others proclaimed a “new bull market” after a three-day, 21% surge off the March low. That incredible bounce is much more likely to be the first of at least a few bear market rallies.

A “Best Case” Bear Scenario?

We intentionally curtailed our discussion of stock market valuations the last few months to allow the “dead horse” to recover from the thrashings administered in recent years. Now we’re rested, refreshed, and ready to deliver a few more lashes.

The Line Of Least Resistance Is Lower

At some point in his career, famed stock trader Jesse Livermore ceased using the terms bull and bear, opting instead to describe trends in terms of “lines of least resistance.”

Market Observations

It’s been one of the worst years on record for diversification, with our hypothetical All Asset No Authority (AANA) portfolio down 7.2% YTD through yesterday. That’s the second-worst year for AANA since 1972, and there’s probably not enough time left for performance to undercut 2008 (-24.9%) for the bottom spot.

Assessing The Damage

Our tactical accounts remain positioned very defensively, and we have yet to see the sort of capitulative market action that would lead us to lift any existing equity hedges.

Foreign Stocks “De-Coupling”

Market action has been broader and better than we expected given monetary conditions, and Small Cap strength seems to lend credence to contention that rates aren’t yet high enough to bite.

Bear Market Rally Or New Upswing?

Richard Russell—who wrote Dow Theory Letters for almost 60 years before his death last year—observed that “bear market rallies look better than the real thing.”

Labeling The New Up-Leg

The short-term market surge certainly possesses the hallmarks of many previous bear-killers (or correction-killers)…but it also sports the look of many historical bear market rallies.

Foreign Stocks Set For A New “Bear”-ing?

Based on comparative valuations alone, one could have made a case for investing in foreign stocks over domestic ones as early as 2010—when EAFE’s valuations sunk to an historical low, relative to the S&P 500. Today, that gap remains extreme.

Not A “Stealth” Decline Any Longer...

The most compelling evidence that a bear market is underway may not be what’s been punished (Transports, Small Caps), but what hasn’t. We believe the final bull market highs of any composite or sector index were recorded on December 29th.

Deciphering The Transports’ Message

The Dow Jones Transports was the first U.S. index to top in this cycle (December 31, 2014), and it closed January 7, 2016 down 24.1% from that historic high. That development, in and of itself, sharply increases the odds that a new cyclical bear market is underway.

TIME: The Hidden Market Risk?

Is there a statistical relationship between the height scaled by a given bull market and its subsequent decline? That correlation is in fact pretty tenuous, we’ve found.

Stock Market Observations

The August market break did not emerge from out of the blue. The foundation for the bear case was put in place many months before those four ugly days in late August.

More Trouble Ahead

"Oversold" Doesn't Mean BUY

Beware The New ‘Wall Of Worry’

The Volume Oscillator discussed in this section is one of several encouraging developments within our Attitudinal work that has sent that category to its least negative reading (-57, Chart 1) since July 2013.

Mythbusters: Style Performance During Bear Markets

Will Rogers said, “It isn’t what we don’t know that gives us trouble, but what we know that ain’t so.”

Bullish, But Still Worried

Our longer-term bear market forecast and a temporarily positive stock market stance aren’t mutually exclusive.

Early Thoughts On The Next Bear

We expect a “garden variety” cyclical bear market to break out this year or early next year and present a chart demonstrating the potential path of decline. In the context of the last two decades’ market action, a decline of this variety does not “look” all that significant.

Two For The Price Of One?

Think the bull market is long in the tooth at almost six years of age? Maybe not.

Cycles: Bearish Window Closing, Another Opening...

We wrote in May the mid-year months of a mid-term election year are historically the weakest for the stock market from a calendar perspective. Large Caps, however, have mostly bucked that pattern.

Correction Or Bear Market? Looks To Us Like New Cyclical Bear

An update of our study on past bear markets, showing typical peak to trough declines in the popular market averages and the duration of these declines. Also look at past bear market rallies.

Bulls May Have Christmas...

Bulls may indeed have Christmas, but fundamentals for bearish case in 2008 are extensive.

Major Trend Index Even More Negative

Major Trend Index turned "negative" March 8 and has continued to deteriorate.

Does It Make Sense to Defense?

I know it may be difficult for readers to envision much of a market decline in the current environment. However, keep in mind that all bear markets are not “cyclical”. That is, some past bear markets were not related to the business cycle.

Remain Cautious For Now

In terms of amplitude, the bear market could be about half over. Typical cyclical bear markets decline 25%-30%. This is not a prediction, only the profile of a typical bear market decline. The current version may decline more or it may decline less.

Defensive Posture Maintained

It continues to appear that the stock market is forming a major cyclical bull market top. The Major Trend Index continued to deteriorate in November and indicates the market is in poor health and a cyclical bear market is likely.

Stock Market: Major Trend Index Now Negative

With the October 30th calculation, The Leuthold Group’s Major Trend Index has shifted into negative territory. Thus, our disciplined weight of the evidence approach dictates a very cautious policy.

1987 Compared With 1962

For quite some time this publication has been maintaining that “the next cyclical bear market could be very similar to 1962”. At least up to now, the 1987 decline does indeed closely resemble 1962.

“A Lot of 13-Year-Old Portfolio Managers”…… Some Market History

This last month, a client and I were discussing what the stock market was like back in the 1960’s and early 1970’s. We saw a number of parallels with the current market.

Client Questions

Recently, the majority of questions have, not surprisingly, concerned the liquidity driven market thesis. In second place are questions relating to today’s market and 1929.

Bond Market Summary

T-Bonds at their recent lows were down 30% from peak levels. Yes, it has been a bear market, but it may be about over. At minimum, a strong move to 11%-12% levels is expected before election day. Is the five-point move in recent days the 10 beginning of this? Maybe …

The End Is in Sight. That Is Good.

The stock market is in the process of making a cyclical bear market low. The Early Warning Index for market bottoms has turned Positive. The Major Trend Index is Neutral. It is time to start buying stocks again with cash reserves but hold long bond positions for now.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)