Euro

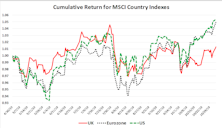

U.K. Stocks: Bottom Fishing… & Chips

A preview of the upcoming Of Special Interest that will examine if the tortured process of Brexit is creating an opportunity to bottom fish washed-out and unloved U.K. stocks. Time to buy?

The Dollar: Upside Limited In The Near Term

A closer look at the dollar’s two main counterparts, the euro and the yen, reveals a regime shift in both cases, but for different reasons.

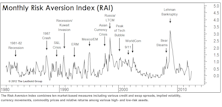

New Higher Risk Signal Generated But Optimistically Cautious

This new “Higher Risk” signal closed out the previous “Lower Risk” signal generated last December, and this measure is telling us it’s time to play a little defense.

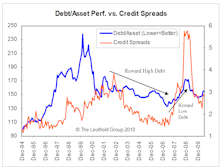

Risk Aversion and “Episodic” Factor Returns: Investors Favoring Conservative Characteristics

We expect risk appetites to remain low and investors to continue to reward conservative stock characteristics over the next 3-6 months.

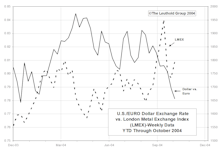

Long Term Bullish Case: Dollar Versus The Euro

Thanks to weak dollar, foreigners may be buying up Florida vacation homes. The U.S. is now on sale! Making the long term bullish case for a dollar rally against the euro.

View From The North Country

Steve presents the transcript of his April 3rd interview with Barron's Senior Editor, Sandra Ward.

Checking In On The Dollar

In Steve Leuthold’s 2005 ‘Outlook’, he called for a strengthening of the Dollar vs. the Euro in 2005, with the Dollar/Euro exchange rate hitting 1.16 before year end. So far, the dollar has made good progress towards achieving that target.

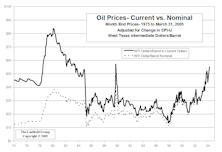

Energy Prices In Perspective

With oil and gas prices continuing to make new highs, we thought it would be helpful to put some perspective on rising energy prices.

View From The North Country

Steve Leuthold answers client questions in this month’s “View From The North Country”, including his thoughts on the slowing earnings growth, and his definition of secular bear markets. His dollar outlook is also updated.

Industrial Metals Stocks: October Brings A Wild Ride For Metals Investors

Physical metals experienced a deep sell-off on Wednesday Oct. 13th. It was one of the largest single day drops ever in the base metals markets, prompting London metals traders to dub the day “Black Wednesday.”

Different Pictures Of Gold Prices

Gauging how much impact the dollar’s decline has had on the rising gold price.

Inflationary Impact Of The Falling Dollar

Much of the upward price movement in commodity prices, as measured in U.S. dollars, is the result of the weak dollar. A weaker dollar has an inflationary impact on U.S. prices.

View From The North Country

The European view of the world, by guest “View” editor, Jim Bianco.