Housing

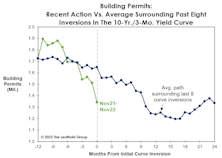

The Yield Curve And The Problem Of Timing

Frequently, there’s money to be made in the stock market in the months following the initial curve inversion. After the inversions of August 2006 and June 2019, the S&P 500 rallied another 23% and 19%, respectively, into its final bull market high. If this cycle plays out in textbook fashion, the business-cycle peak would arrive in September.

What’s Your “Number?”

Those in their peak earning years (40s and 50s) who’ve also enjoyed the stock market’s windfall gains are very likely to have seen their annual expenses climb much higher than the Consumer Price Index over the last several years.

Housing: Saner Than You Think

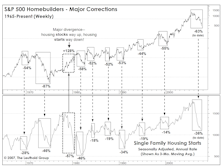

On a technical basis, Homebuilding stocks have only just emerged from their decade-long post-bubble bust. With P/B 24% below the mid-2005 peak and 15% below the “overvalued” threshold, they look reasonably priced in a world that’s almost entirely devoid of value.

Housing Groups Heat Up

A major driver of the division in recent performance among retail groups has been the burgeoning “nesting” theme. Stuck at home, consumers are directing their dollars toward indoor and outdoor home upgrades. A related theme has now established itself in the upper rankings of our group work—Housing.

Slowdown Or Recession? Confidence Is Key

The pattern of sharp sell-offs followed by equally sharp rallies continued in June. Most risky assets recouped nearly all the losses suffered in May, and then some.

Rental Rates Rocket Alongside Slowing Home Prices

Headlines surrounding the U.S. housing market have recently fixated on sputtering home sales; declining affordability, thanks to the combination of rising mortgage rates and sky-high home prices, is to blame.

Housing: Curb Your Enthusiasm

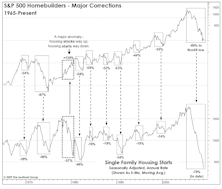

Despite record low mortgage rates and pressure to re-loosen down payment and lending requirements, single family housing starts have yet to recover to levels consistent with even the average recession trough.

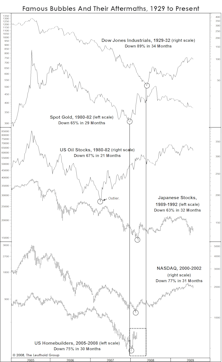

Housing: Just Like The Bubbles Before It

Sectors that become the object of obsession during one economic cycle tend to remain cyclically depressed in the following one.

Handicapping The High In Housing

Today it seems taken for granted that the great housing meltdown of 2006-2010 was sufficient to purge the last decade’s excesses, and that housing can now be relied upon as one of the drivers of a slow but elongated U.S. economic expansion.

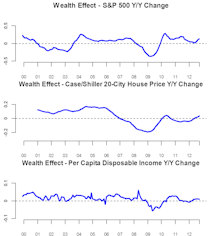

Wealth Effects: Housing Likely To Be The Bright Spot

The stock market wealth effect has been direct and pronounced. But it’s been wearing off, with the subsequent rally after each Fed stimulus weaker than the previous one.

U.S. Home Price Indexes Dissected

With a number of Housing-related stock groups remaining in the Attractive range, various Home Price Index (HPI) methodologies are dissected to better understand the data included.

Housing-Related Groups Flock To The Top

The Homefurnishing Retail group was purchased in the Select Industries Portfolio in late May.

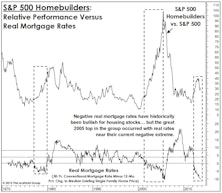

Rates Too High For A Housing Rebound?

Are mortgage rates still too high for a rebound when looking at real mortgage rates?

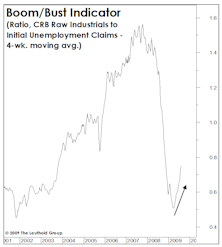

“Just Another” Soft Patch

MTI studies of market values, investor psychology and price action have (so far) overwhelmed the economic “elephants in the room.” A few thoughts on those elephants.

Still Paying The Price For (Illusory) Prosperity

Housing data is so far following the picture-perfect path of a bubble aftermath. Based on other bubbles, the next cyclical top in housing will likely occur at astonishingly low levels.

Housing Hangover: May Linger Longer Than You Think

Housing stocks, and the enablers that helped create the bubble (Financials), are following the usual pattern of busted bubbles. After the bust, these past bubbles typically see a beta bounce establishing post crash highs. After that, it can take many years before these highs are again broken.

What Keeps Us Up At Night

We consider it incredible that most of the leading economic indicators have staged such traditional V-shaped rebounds with virtually no boost from the housing sector.

No Time To Nit-Pick

Lots of people spinning economic and market statistics to cast doubt on the recovery and stock market rally. Doug Ramsey goes point by point to make an honest assessment about the current conditions. Things do actually look pretty good right now!

A Ray Of Hope For Housing

If the November lows in the Homebuilders holds, based on the leading relationship between stocks and starts, an upturn in housing starts (not the broader economy) should be imminent.

Homebuilders.....Watching The “Window”

Not all gloom and doom this month...Homebuilders approaching window where past busted bubbles have bounced.

Housing: Still Too Early To Invest (Or To Build)

It’s still too early, but at some point in the next 6 to 18 months, going long the homebuilders will probably become the single most contrarian—and potentially highly profitable—thing to do. But before that happens, we expect to see more blood in the streets.

View From The North Country

Doug Ramsey steps in as guest commentator in this month’s “View From The North Country” to highlight what we currently see as the bullish arguments for the stock market and contrast those with the bearish arguments.

View From The North Country

Everybody sure hates the Homebuilders. However, contrarians should take note of this month’s analysis of earnings prospects, insider selling/buying, and the outlook for future housing starts. Now is not the time to be bottom fishing here. Nor is it time to be buying oil stocks.

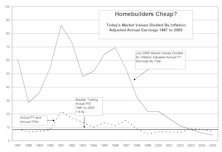

The Homebuilding Group – Value Play Or Value Trap?

Everybody sure hates the Homebuilders. However, contrarians should take note of this month’s analysis of earnings prospects, insider selling/buying, and the outlook for future housing starts. Now is not the time to be bottom fishing here.

View From The North Country

The perils of speculation in Housing…..lessons people are now learning. Also, client questions....and Leuthold's answers.

View From The North Country

Steve Leuthold lays out both the bullish and bearish stock market cases.

View From The North Country

Carnage and suffering in wake of Hurricane Katrina is tragic and almost unbelievable. However, investment implications may not be as negative as many are portraying.

View From The North Country

In my opinion, the U.S. stock market is entering the terminal phase of the current cyclical bull market, based on our historical studies of typical cyclical bull market duration and magnitude. To a lesser degree the same can be said for the economic expansion.

View From The North Country

A recap of the year so far, and our outlook for the second half of 2005.

View From The North Country

Leuthold outlines three conditions for “fixing” Social Security: Increased Retirement Age, Index Benefits To Price Index, and Means Testing.

View From The North Country

Weighing in on the current stock market positives and negatives currently being discussed by clients and Wall Street strategists.

Building a New Position: Housing

Buying 10% position in Housing. Moved up to Attractive last month, and currently the fourth highest ranked per our SS Scores. Expect current economic environment to be favorable for Housing.

Farm and Home

A historic look at farmland prices and home prices helps put today in proper perspective. Farmland price levels look especially vulnerable. Considering the high level of leverage now employed by some land owners, the high interest rates and the low cash flow, auction hammers may soon echo through rural America. Home prices are not as vulnerable but declines of 20% in nominal and real dollar values would not be surprising.

.jpg?fit=fillmax&w=222&bg=FFFFFF)