Interest Rates

The Return Of Returns

A distinguishing feature of fixed income securities is that the expected return on a bond over its remaining lifetime is known with considerable certainty at the time of purchase. This characteristic can be a blessing or a curse, the negative aspect coming into play during an asset price bubble. Equity investors can justify almost any price as they dream of boundless riches arising from the bubble’s driving theme, limited only by their imagination. However, a bond’s yield to maturity is known at the time of purchase and this is the return investors in aggregate will earn. Even during the euphoria of an asset bubble, the expected outcome - the return of par value at maturity - is also the best-case outcome, and that is where our story begins.

Research Preview: Oh Bond Pain

Here we evaluate the returns of fixed-income ETFs since the Fed began its boosting campaign last March; for many mainstream offerings, the picture is not a pretty one. We recap the pain felt by investors in conventional fixed-rate bond funds.

George Bailey Goes To Silicon Valley

One of the most vivid memories of the Great Depression is the sight of nervous depositors lined up outside a bank hoping to withdraw their meager savings before the bank failed. Like a rare tropical disease that was thought to be eradicated by modern medicine, the classic bank run reappeared this month in the form of Silicon Valley Bank. At the beginning of March, the market had no particular concerns about the potential for systemic bank failures, but SVB’s sudden demise has cast a pall over the entire industry.

Past Pivots Prompted By Politics

We scrutinized the typical path of money growth during the four-year presidential election cycle, and found that it typically tends to bottom out in October of the midterm year! The cycle says a monetary pivot is imminent, and the average pattern traced out by M2 suggests an acceleration in the growth rate of about 2.5% leading up to the presidential election.

Time To Retire The Fed Model?

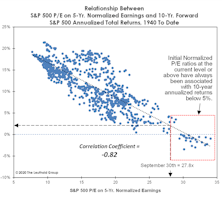

We’ve heard no references lately to the famous “Fed Model” for stock market valuation. We think we know why: The model’s usual proponents probably don’t like its current verdict—which is that stocks are far more expensive than at the early January market peak.

Fake-Out Or Break-Out?

“Don’t fight the Fed” was profitable advice dispensed almost daily by bulls in the 2nd half of 2020 and all of 2021. It’s been valuable advice in 2022, as well. However, when the Fed turned hostile earlier this year, the bulls deviated from their own sound advice and looked for new narratives.

LEI On The Precipice

The LEI’s 3.6% six-month annualized loss through September 2006 was the largest decline not followed almost immediately by a recession. This year, the LEI contracted by 3.7% over the six months through June—if a recession is avoided in the current experience, it would be the most misleading signal in the history of the LEI as currently constructed.

Zigs And “Zags”

Like Gonzaga in the NCAA basketball tournament, stock market bulls are set for their first real test in a very long time.

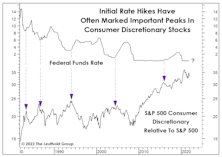

Danger For Discretionary?

It’s been so long since investors have faced a serious Fed tightening episode that they may have forgotten a helpful rule of thumb: An initial hike in the fed funds rate is usually a good excuse to dump some Consumer Discretionary stocks.

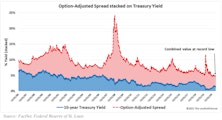

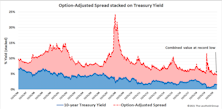

Tactical Junk

High yield bonds returned a robust 15.4% in the year ending June 30, extending a winning streak that produced a 56.4% cumulative return since the end of 2015. After a quick, severe drawdown at the height of the COVID-19 scare, junk bonds have experienced nearly ideal market conditions, heralding a return to trends that have been in place for several years. The post-pandemic move toward this record low has been a boon to high yield bond investors, but it has also created a significant risk of reversal. We believe most things in the financial markets are defined by cycles, with Treasury yields and credit spreads no exception. Tight readings for both rate series demand that we consider the possibility that a cyclical reversal could weigh on junk bond prices going forward.

Why The Fed Is Hog-Tied

We’ve long considered ourselves lucky to have escaped from our graduate-economics program after only a year. Among the few nuggets we managed to retain was the startling conclusion to a paper written by a famed department professor asking, “Do Large Deficits Produce High Interest Rates?”

Research Preview: High Yield’s Heyday

High yield corporate bonds returned over +15% for the twelve months ended June 30th, building on a strong five-year run that was interrupted by a short, but painful, drop at the onset of COVID-19. Chart 1 indicates that high yield bonds compound at a remarkably steady rate, with infrequent but severe drawdowns during times of financial stress.

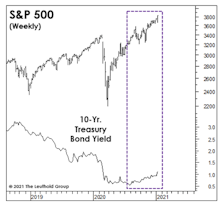

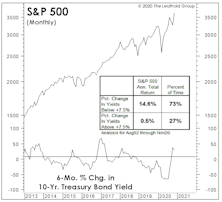

More On The “Rate-of-Change” In Rates…

The liquidity and interest-rate backdrop for stocks has been favorable to such an extreme that we’ve cautioned any minor diminution in this condition could trip up the stock market. On that score, the monetary aggregates and the Fed’s balance sheet don’t pose much concern. On the other hand...

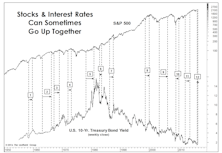

Rising Rates And Rising Stock Prices?

Often, what market pundits like to pass off as bold, contrarian forecasts are merely rationalizations and extrapolations of trends that have already been in place for some time.

High Tide?

For almost nine months, an historic Fed liquidity flood has washed away any economic, valuation, technical, or “sentimental” stock market challenges. Nonetheless, each economic disappointment brings hope this flood will intensify. Those hopes aren’t irrational, because when it comes to any measure of liquidity, rate of change is more important than level.

A Fast Start Comes At A Big Price

The first up-leg of the bull market has catapulted many Large Cap valuations to levels seen only in 1999, 2000, 2019, and pre-pandemic 2020. At the six-month point on September 23rd, the S&P 500 P/E on 5-Yr. Normalized EPS had already reached 26.9x—a reading that is 30% higher than at the same point of any other bull market.

Utilities Sector: What’s Driving YTD Performance?

We review the somewhat out-of-character performance of the Utilities sector to try to pinpoint what is influencing results. This article touches on several potential drivers for the sector’s relative strength.

Confidence Is The Key

The bull case for a “brief” pandemic-related recession and powerful recovery is the same as the bull case from two months ago for “no recession or bear market” at all: stimulus (as if that’s exactly what the U.S. economy has lacked for the last 11 years).

Low Rates Don’t Justify Higher P/E Ratios (And U.S. Investors Should Be Glad)

The fear (or hope) that U.S. bond yields would fall to zero or below subsided over the last month. However, the belief that low yields merit significantly above-average P/E ratios remains stronger than ever.

Monetary Madness

We always do our own work and draw our own conclusions. Lately, though, we’ve wondered what the late “Monetary Marty” Zweig might say about the stock market’s current liquidity backdrop.

The Fed Subsidy Is Wearing Off

Earnings results for the second quarter have so far "beaten" expectations (as they always seem to), but that hasn’t changed the calculus for Small Cap companies. About one-third of them have negative earnings over the last twelve months.

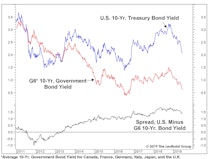

Limbo Rock!

As global rates have taken a precipitous dive the last few months, it’s been hard not to hum “Limbo Rock.” And just like Chubby Checker, we’ve been asking our screens “How low can you go?” on a daily basis.

Time For Dividend Stocks, But Stick With Quality

With multiple indicators flashing signs of an economic slowdown amid trade war uncertainty, investors are betting that an interest rate cut is on the horizon.

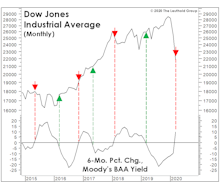

Signs Of Spring For Financials

Signs of spring are popping up everywhere in the Financials sector. S&P Financials was easily the top- performing sector in April and several sub-industries have been bubbling higher in our Group Selection discipline.

Small Caps And The Recent “Rate Hike”

The 1999 leadership parallels we discussed in the latest Green Book remain intact—U.S. over foreign, Growth over Value, and Large over Small. Small Caps have given up most of the “beta bounce” enjoyed in the first two months off the December low, with one Small Cap measure—the Russell Microcap Index (the bottom 1000 of the Russell 2000)—undercutting last year’s relative strength low and those of 2011 and 2016.

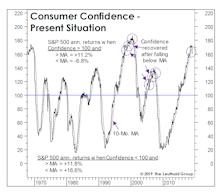

A Confidence Game

Several consumer confidence gauges plunged in the wake of the Q4 market decline (as expected), and then rebounded in a lagged response to the stock market recovery (again, as expected). But March saw the largest one-month drop in consumers’ assessment of their “Present Situation” since 2008.

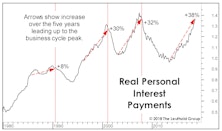

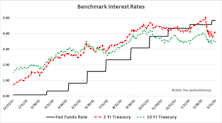

Rates Hurting Households

Doubling of yields since 2016 has slammed households. Percentage increase in rates is more important than the absolute level.

Measuring The Backup In Bond Yields

A couple of months ago, we (belatedly) observed that, in February the 10-year Treasury yield had bro-ken above its 10-year moving average. That simplistic tool has been a pretty good descriptor of yields’ long-term trend for more than a century, with few “whipsaw” signals along the way.

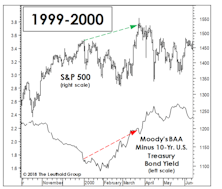

BAA Acting Baaaadly!

Whether or not they’ve risen for the “right” reasons remains up for debate, but the upward move in interest rates has hit the usual suspects very hard in 2018, like early-cycle industries and Emerging Markets.

The Rate Hike Carnage Is All Around Us

Taking a cue from the White House, today’s market pundits seem more prone to declarative, unsubstantiated statements than we can ever remember.

Company Leverage And The Impact Of Rising Interest Rates

Higher corporate leverage and rising short-term interest rates have not yet led to problems in the credit markets, but investors should be mindful of potential risks.

The Yin And Yang Of Utilities

Are Utilities defensives, or are they interest rate plays, or both? We believe the driving influence fluctuates based on market conditions, specifically fear, and the desire for protection in down markets.

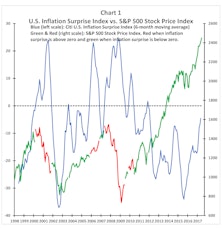

U.S. Rates: Range Intact, Bias Higher

The mini bond market sell-off in September was fueled by a string of positive developments, which should support the case for further upside in the Economic Surprise Index in the fourth quarter.

Rates & Inflation—In The Doldrums

The U.S. 10-year yield has been stuck in a tight range. Without new major catalysts, we expect the 10-year rate to be collared in two ranges, first 215-240 and, if this is broken, the wider range of 200-260, which is more significant and much harder to break.

Where The Bear Lingers

While the next recession could be caused by a variety of factors, we suspect the recovery will eventually end like most post-war expansions, only after a significant rise in interest rates.

U.S. Rates—Not A Bear Market Yet

There are certainly better catalysts this time that make a bear market a distinct possibility, but until a decisive break occurs (most likely when the 10-year gets above 3%), the bull market is still intact.

Rising Rates: Not Always A Death Knell

While the Dow Jones Bond Indicator has stood the test of time, history shows that rising bond yields are not always a bearish stock market phenomenon.

Goodbye ZIRP, Hello WIRP

Allow us to put forth yet another theory for this season’s plummet in NFL television ratings: Fed watching is back!

Implications Of Low Growth, Low Inflation, Low Rates

The current environment will likely persist longer than most expect which will put further downward pressure on profit margins. As margins come under pressure, companies increase leverage to prop up ROE. However, the market wants higher duration, not higher leverage.

Big U.S. Banks: We Have A Motion, Is There A Second?

YTD the S&P 500 has fallen 2% while the S&P 500 Banking industry group is down over 12%—a shortfall that has the attention of value investors and contrarians seeking a chance to buy high-quality banking franchises at fire-sale prices.

.jpg?fit=fillmax&w=222&bg=FFFFFF)