Leadership Rotation

Beware Of The Changing Of The Guard

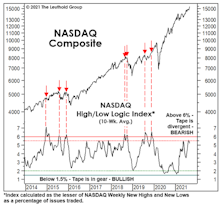

A rotation from Growth to Value resumed in grand fashion in October. Qualitatively, new leadership sounds like a good thing. Statistically, bulls ought to hope that the tape gets back into gear.

Unfinished Business

Our tongue-in-cheek celebration of the bull market’s second birthday in late March looks premature. But the “Terrible Twos” we warned about have erupted in full force.

Reading The Short-Term Tea Leaves

The market’s August push was enough to lift four of the seven lagging bellwethers to new cycle highs. Among the three remaining laggards, only the Dow Jones Transports is still significantly below its high.

Flesh Wounds, Or Something Deeper?

At the August 5th, S&P 500 bull-market high, seven of our eight bellwethers had failed to make a “confirming” high during the prior month of trading—up from six non-confirmations a month ago. “The dog that didn’t bark” (yet) is the S&P 500 Equal Weighted Index.

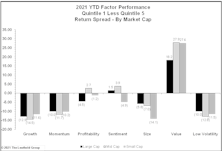

Rotation Into Value Continues

While Value outperformance continued throughout the first quarter, March saw higher-quality Value names take the lead. Prior to March, it was mostly the unprofitable companies that had driven the rotation.

Leadership Rotation And Bear Markets

Bear markets are the financial system’s version of the changing seasons—a cycle we “enjoy” to extremes here in Minnesota.