Liquidity

Echoes Of 2021

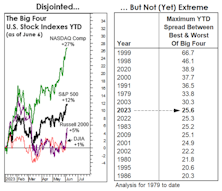

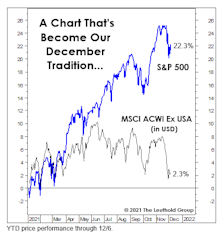

The NY FANG+® Index is up 68% YTD and +21% in the last month, with the Equal-Weighted S&P 500 up less than 2% YTD. Yet a measure of internal market disparity has 2023 barely cracking the top-ten of “incongruent” market years—meaning it can get worse before it gets better.

Liquidity & Lending—Headwinds Still Ahead

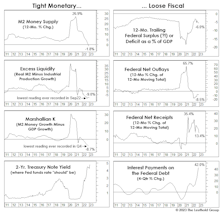

Liquidity and lending conditions have tightened significantly over the course of the current tightening cycle, but they are likely to get worse before they get better.

Was That A Pivot?

Stock market monetary- and liquidity conditions over the last year have been the harshest we’ve seen in a 33-year career, and consistently the largest drag on the Major Trend Index (even overshadowing valuations!).

Pause, Then “Paws?”

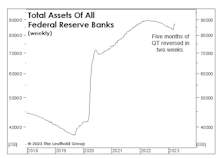

Despite the Fed’s tough-talk about getting the funds rate above 5%, monetary and liquidity measures are significantly less bearish. Thank SVB depositors, who required a bailout big enough to reverse five months of QT in just two weeks. The market reaction looks like that after September 2019’s Overnight Repo-market turmoil, which forced the Fed to end its first experiment with QT.

Inadvertent Easing?

Sometimes, a sharp upside reversal in the stock market will correctly anticipate future improvement in monetary and liquidity conditions. That was the case with the powerful up-leg that sprang from the market’s 2018 Christmas Eve bottom.

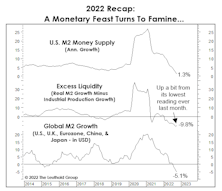

Illiquidity Rules The Day

Nearly everyone would cite high inflation as the dominant theme of 2022. But we think that the evaporation of a one-time ocean of liquidity better explains the horrendous backdrop for stocks and bonds. High inflation sped up the rate of evaporation, but it was going to occur anyway.

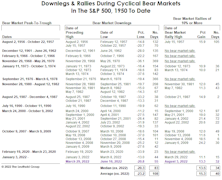

Bear Market Rallies In Context

The 2022 bear market is the 13th cyclical bear since 1950, and it’s already joined the mightiest half of its predecessors based on the fact that it’s actually contained a bear-market rally. Six of the prior 12 bear markets weren’t interrupted by even one rally of at least 10%.

No Time To Dance

No one wants to be this cycle’s Chuck Prince. In June 2007, the Citigroup CEO said, “As long as the music’s playing, you’ve got to get up and dance.” (Fifteen years later, when one Googles his name, “music playing” is what auto-fills.)

“Peak Insanity” Is Behind Us

We think 2021 has earned its place in the books as the wildest and most speculative year in U.S. stock-market history, eclipsing even 1929 and 1999. That doesn’t mean 2022 will bring a panic or a crash, maybe just a degree of sobriety.

The Stock Market IS A “Fundamental”

The impact of U.S. stock-market “hegemony” extends far beyond currency markets. We believe the mania has progressed to the point where the stock market itself will shape the intermediate-term and even long-term fortunes of the U.S. economy more than it ever has before.

Liquidity Letdown?

Stock market liquidity might seem plentiful, with the Fed still buying $120 billion in bonds per month under the all-too-predictable continuation of what was first billed as an emergency operation. However, the steadiness of QE masks a major second-quarter reversal in “excess liquidity.”

Flesh Wounds, Or Something Deeper?

At the August 5th, S&P 500 bull-market high, seven of our eight bellwethers had failed to make a “confirming” high during the prior month of trading—up from six non-confirmations a month ago. “The dog that didn’t bark” (yet) is the S&P 500 Equal Weighted Index.

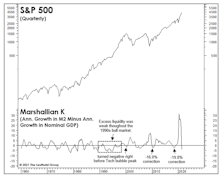

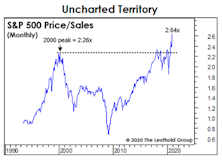

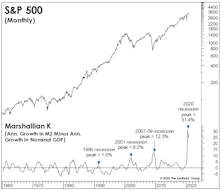

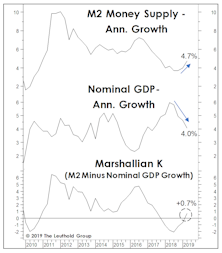

Sharing The Punch Bowl?

The gap between YOY growth rates in M2 and nominal GDP just flipped negative after four quarters of record-high readings. In other words, the recovering economy is now drinking from a punch bowl that the stock market once had all to itself. Similar drinking binges occurred in 2010 and 2018, both of which then experienced corrections north of 15%.

Music For The “Mania”

At some point during the June/July streak of seven-consecutive S&P 500 daily-closing highs, an album from 1980 popped into our heads: Nothin’ Matters And What If It Did—released when John Mellencamp was still known as John Cougar. It brought to mind some “nothin’s” that seem not to matter.

Stock Market Observations

The speculative peak for this market rally may have occurred in either January (when GameStop and other “left for dead” short candidates soared), or February (when indexes tracking the “newborns”—IPOs and SPACs—both peaked). But even if we knew that for certain, a major peak in stock prices could still be months away.

Has Liquidity Peaked?

The last few weeks offer plenty of evidence that the mania has moved into a more feverish phase, yet the Fed insists that it is still “not-even-thinking-about ‘thinking about’” raising interest rates. That dismissive attitude could well whip up an even higher fever in the months ahead.

High Tide?

For almost nine months, an historic Fed liquidity flood has washed away any economic, valuation, technical, or “sentimental” stock market challenges. Nonetheless, each economic disappointment brings hope this flood will intensify. Those hopes aren’t irrational, because when it comes to any measure of liquidity, rate of change is more important than level.

A “Fed” Conundrum

“Don’t fight the Fed” has been great advice for stock market investors over the last nine months. For 2021, that won’t cut it. It should be: “Don’t believe the Fed.”

Liquidity: As Good As It Gets?

Stock market manias thrive on buzzwords, and if there’s a single one that captured the essence of the late 1990s’ boom it was “productivity.” In today’s version, our top candidate is “liquidity”—and we doubt anyone would argue.

Everyone Loves A Winner

The bullish consensus seems to be that unlimited Fed liquidity will lift all stock market and economic boats. However, past liquidity floods have tended to lift boats that were already the most buoyant. The “Y2K Liquidity Facility” and last fall’s emergency Fed intervention in the overnight repo market are two cases in which liquidity seemed to flow to where it was needed the least.

A Cross-Asset Dash For Cash

March’s mad dash for cash didn’t stop with rates/credit/FX markets. Among equities, there was also a strong preference for cash liquidity. The market rewarded companies that had strong cash positions and punished those without—which explains why traditionally defensive styles actually underperformed.

Liquidity Overflow!

Based largely on the bearish trends in our monetary and liquidity measures, we were correctly negative on stocks throughout most of 2018. It’s therefore especially painful for us that 2019’s market rebound has been credited almost entirely to the “pivot” in most of those measures.

Who Doesn’t Love “Excess” Money?

We’d concede the monetary backdrop for stocks is now mixed, an upgrade from the almost uniformly negative environment of last fall. On the negative side, the U.S. yield curve inversion has now persisted long enough that even the economic optimists are getting nervous.

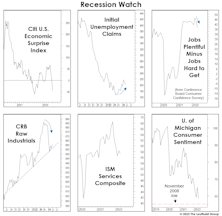

About That Great Jobs Report...

The December employment report temporarily eased fears of a severe U.S. slowdown. That’s a mystery to us.

It’s About Money, Not Profits

The consensus focus all year has been on the boom in U.S. corporate profits.

Thanksgiving Leftovers

Whatever one’s preferred leftovers from yesterday’s feast, the odds are good you’ll find them more appetizing than the slop served up by global asset markets this year. Stocks have obviously been turkeys, but all the surrounding trimmings that help diversify a portfolio have proven anything but complementary to the main course.

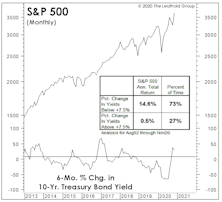

Stocks Not Yet Yielding To Yields

Regardless of how it’s measured, the liquidity available for global stocks continues to run off.

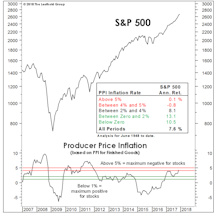

Earnings Soar While Liquidity Circles The Drain

Question: How can you be cautious on the stock market with recent earnings results so spectacular?

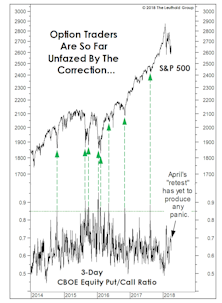

“What, Me Worry?”

Our shortest-term put/call measure has yet to reflect the level of fear usually triggered by a correction of this size. Meanwhile, the market setback has done almost nothing to stymy the optimism of either market newsletter writers or mutual fund timers.

Pressure Points?

The first few trading days of the new year have been a seamless extension of 2017—a low-volatility, “measured” market melt-up.

Market Thoughts In The "Season Of Excess"

While investors look high and low for signs of excess that might portend the next bear market, they should pause and consider the excesses that have recently gone away.

Stock Market Observations

The Major Trend Index stabilized in a moderately bullish range during the past several weeks, yet the Momentum/Breadth/Divergence category is almost the sole carrier of the bullish torch.

Fed Watching For The 21st Century

Deteriorating stock market breadth and worrisome leadership trends both suggest liquidity has already tightened; whether the Fed follows suit in September may now be just a formality.

Stuck In Neutral?

Extreme market viewpoints get the headlines, but it’s baked into our disciplines that we will (occasionally) be noncommittal.

Stocks Vs. The Dollar—More Complicated Than You Think

The recent strength in the dollar coincided with a spike in volatility and weakness in risky assets, but the relationship over the last couple years has been tenuous at best.

Emerging Markets: Dismal 2013, Hopeful 2014

What worked, what didn’t; what you need to consider for investing in Emerging Markets this year.

Liquidity Update: Trends Worth Watching

Helping propel the stock market recovery has been a build-up of excess liquidity. This has now generally been put to use, and can no longer be counted on as a market driver.

Liquidity Drying Up… Some Trends Worth Watching

Our broad read of the stock market is still bullish, but we can’t help noticing that the concerted effort to supercharge the economy via liquidity may be losing some steam.

Market Liquidity: Down But Not Out

What will be one of the key performance drivers for the second half of the bull market? The short answer is the same catalyst that brought the stock market down during the latter half of the last bear market: Liquidity.

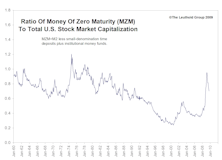

Think There's No Fuel For A Rally??.....Better Think Again

Using the ratio of MZM relative to total stock market capitalization as a gauge of market liquidity, shows there is a lot of fuel that can be put to work to drive a stock market rally.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.png?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)