M2 Growth

Yet Another Thing The Fed Has Screwed Up...

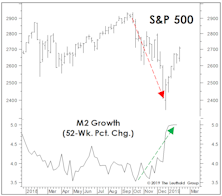

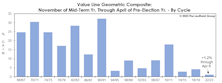

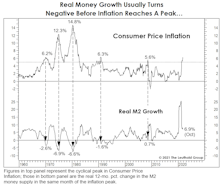

In today’s cycle, we’ve not yet observed the usual pre-election “ramp” in M2 growth. That might help explain why the traditionally hyper-bullish, six-month window beginning at the time of mid-term elections has so far been underwhelming.

Goodbye Inflation, Hello Recession?

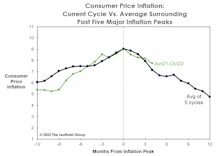

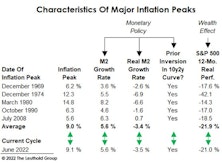

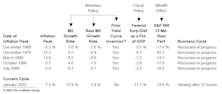

Unlike the five prior cycle peaks, this year’s inflation peak materialized during an ongoing economic expansion. That implies the “post-peak” monetary policy has never been tighter than today—making a soft landing even more improbable.

How This Year’s Inflation Peak Differs From Its Predecessors

Our studies of economic and stock market history are meant to provide perspective, not an investment roadmap. But occasionally a current trend will resemble the past so closely it’s eerie.

Take the current inflation cycle. If (as we believe) June’s CPI inflation rate of 9.1% represents the peak for this business cycle, then many of its characteristics have lined up almost perfectly with the “average” of past inflationary episodes.

Economy Soaking Up Scarce Money Supply

There might be “too much money chasing too few goods,” but some monetary measures imply there’s “no longer enough money” to finance production of those goods and still support a stock market that’s far from cheap.

Past Pivots Prompted By Politics

We scrutinized the typical path of money growth during the four-year presidential election cycle, and found that it typically tends to bottom out in October of the midterm year! The cycle says a monetary pivot is imminent, and the average pattern traced out by M2 suggests an acceleration in the growth rate of about 2.5% leading up to the presidential election.

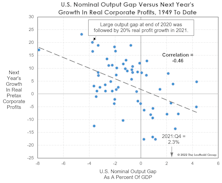

“Gapping” Lower?

NIPA’s “all-economy” profit margin declined a bit in Q4—which typically peaks before SPX profits—and that falloff coincided with the economy officially reaching full employment, based on the CBO’s Nominal GDP Output Gap. When the Output Gap has flipped positive (like in Q4), corporate profit margins usually come under immediate pressure.

What “Causes” Inflation To Decline?

Last year’s consensus view that inflation would prove “transitory” missed the mark. There’s no reason for shame; inflation forecasting hadn’t been a required investment skill for the previous 30 years.

A 2023 Inflation Peak?

We don’t profess to be professional inflation forecasters, but are struck by a sort of “temporal” mismatch in the arguments used by those who believed the inflation pick up would be temporary. Specifically, the most commonly-cited bullish inflation arguments have been secular in nature, based on long-term trends in technological innovation, demographics, and free trade.

“Memes” Need Money Growth...

The extra months of QE “auto-pilot” failed to support some of the themes we’d have thought were the most likely to benefit from it—including IPOs, SPACs, Bitcoin, and the sky-high growers favored by the ARK Innovation ETF. Instead, the smart play with each of these assets was to ignore the ever-expanding Fed balance sheet and sell in February.

Timing Is Troubling For “Team Transitory”

From the start of the inflation upswing this spring, pundits cited well-known disinflationary factors they believe will soon halt the current inflationary upswing—like free trade, the speed of technological advance, and aging populations globally.

Can Money Growth Trump All Else?

In 2019 and 2020, our regard for time-tested valuation tools resulted in tactical portfolios being underexposed to stocks during a pair of tremendous rallies. Now, the critique is that we don’t appreciate the brilliance of today’s policymakers and their miraculous ability to pivot just when the stocks (and, in the latest case, the economy) need it most.

Questioning The Monetary Rebound

This year’s upswing in money-supply growth has been one of many factors that’s prevented our economic work from triggering a recession warning. Following a two-year decline, year-over-year growth in M2 bottomed near 3% late in 2018 and has trended upward all year, reaching 6.7% in the latest week (Chart 1).

Monetary Musings

Among six major monetary gauges, five are now graded bullish, compared with just three a few months ago, and zero at the end of 2018.

Monetary Madness

We always do our own work and draw our own conclusions. Lately, though, we’ve wondered what the late “Monetary Marty” Zweig might say about the stock market’s current liquidity backdrop.

Odds & Ends

Here are some brief follow-up notes on topics covered in recent months’ Green Books.

Watch What They Do, Not What They Say

While the celebration over Jerome Powell’s “Christmas Capitulation” lingered throughout February, we’re still awaiting signs the capitulation consisted of anything more than words.

It Wasn’t Powell Who Panicked

The Fed’s “Christmas capitulation” seems to get most of the credit for the stock market rebound, but we’re not exactly sure how, or even if, the Fed capitulated at all.

.jpg?fit=fillmax&w=222&bg=FFFFFF)