Mid Caps

Y2K 2.0?

Cap-weighted valuations for the S&P 500 and S&P Industrials are homing in on the all-time records seen in the first quarter of 2000. We’ll confess that after those valuations collapsed in the years that followed, we thought we’d never see them again in our lifetime—let alone a mere generation later.

The Valuation Case For “SMIDs”

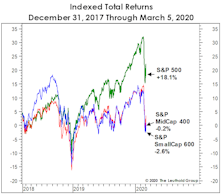

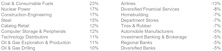

Mid and Small Cap stocks underperformed in 2018 and 2019. However, after the collapse of February and March, these “SMID” Caps have largely kept pace with the torrid rebound in the blue chips. Today’s valuations are priming the SMIDs for a similar “decoupling” in the years ahead, like that following Y2K.

Are SMIDs Cheap Enough?

A composite measure of Mid Caps and Small Caps are at bottom-decile valuations relative to their 26-year histories. From a shorter-term viewpoint, though, we find it scary that valuations are so low just a single month into the recession.

Valuations: A “Progress” Report

As deep as the losses in the DJIA and S&P 500 have been, most professional investors recognize that those averages have masked the extent of the damage suffered by most stocks.

A Developing Opportunity In The “SMIDs?”

The underperformance of Mid and Small Caps in the last few years has taken valuations from top-decile readings (and, indeed, a few all-time records) just 25 months ago, down to the middle—and even lower reaches—of their 30-year valuation boundaries.

Small Cap vs Mid Cap vs Large Cap

After spending two months in discount territory, in March the Ratio of Ratios headed closer to its historical median premium of 4%.

Small/Mid/Large Caps

Small Cap Premium Bounces Back To 23%

Small/Mid/Large Caps

Small Caps are selling at a 20% valuation premium relative to Large Caps (23% last month), using non-normalized trailing operating earnings.

Small/Mid/Large Caps

Small Cap Premium Continues Upward To 23%. Large Caps Lead On The Downside In January

Small/Mid/Large Caps

Small Cap Premium Continues Upward To 21%. The red-hot equity market of 2013 was especially good for Small Caps with a +38.8% total return.

Small/Mid/Large Cap Internals

Small Caps are selling at a 20% valuation premium relative to Large Caps, using non-normalized trailing operating earnings.

Small Cap Premium Ticks Up To 16%

Small Caps are selling at a 16% valuation premium relative to Large Caps, using non-normalized trailing operating earnings. Using estimated operating earnings, Small Caps are selling at a higher valuation premium of 23% (25% last month).

Small/Mid/Large Caps - Small Cap Premium Slips To 14%

Small Caps are selling at a 14% valuation premium relative to Large Caps, using non-normalized trailing operating earnings. This is down slightly from last month, and ranks in the 91st percentile of the 1983-to-date history of this measurement.

Small Caps Lead Year-To-Date

Large Caps lost 2.9% (total return) in August, just ahead of Small Caps (-3.2%) and Mid Caps (-3.8%). YTD, Small Caps continue to perform ahead of the other two subsets.

Small Cap Premium Remains 15%

Small Caps are selling at a 15% valuation premium relative to Large Caps, using non-normalized trailing operating earnings. This is the same as the past two months’ readings. Using estimated 2013 operating earnings, Small Caps are selling at a higher valuation premium of 23% (24% last month).

Small Caps Lead Year-To-Date

Large Caps gained 5.1% (total return) in July, lagging Small Caps (+7.0%) and Mid Caps (+6.2%). YTD, Small Caps are now ahead of the other two subsets, and Large Caps are the laggards.

Small Cap Premium Remains 15%

Small Caps are selling at a 15% valuation premium relative to Large Caps, using non-normalized trailing operating earnings. This is the same as last month’s reading. Using estimated 2013 operating earnings, Small Caps are selling at a higher valuation premium of 24% (25% last month).

Quality As An Investable Stock Selection Concept

In this note, we discuss our market-level measure of quality, and highlight an expanded methodology for determining the “quality” of a stock and the performance implications associated with such a concept.

May Market Action

The stock market continued to move higher in May, with small and mid cap stocks outperforming the majority of large cap indices.

S&P 400 Mid Cap: An Easy Benchmark To Beat In 2006

The S&P 400 Mid Cap index had a tough year in 2006. On the other hand, The Leuthold Group’s Mid Cap Index did very well, up 21% in 2006.

S&P 500 Not Overvalued

The index is not currently “overvalued”…..Nor is it undervalued. Small/mid cap stocks cheap, but large caps also getting attractive.

Growth Versus Value—Transition To Growth Leadership?

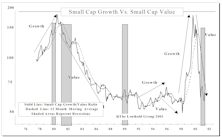

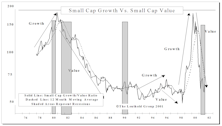

The weight of the evidence points toward a transition from value leadership to growth, with small caps leading the way. But, getting the timing right is no easy matter.

Growth Vs. Value—Transition to Growth Leadership?

It appears that a transition to growth leadership is already underway in the small caps segment of the market.

Growth Versus Value Update: The Tech Effect

Have we really had a big correction in growth stocks, or is the growth index just being pulled down by the tech bust?

"Value" Performance Superiority May Diminish Or Even End Soon

Our work indicates Small and Mid Cap growth stock action is heating up. It is entirely possible that a transition to Small and Mid Cap growth leadership is already in the works.

Stock Market Sweet Spot

Stock Market Sweet Spot between now and election. Fewer impediments with inflation pressures easing and economy showing signs of a slowdown. Also, making a case for Mid Caps and is the Paid To Play performance for real?

Tracking Shifts In Market Capitalization Leadership

Small caps and Mid caps now outperforming Big caps. A change in leadership appears to be in progress.

Tracking Shifts In Market Capitalization Leadership

If small caps can move back above the October 1999 level in the coming months, this would certainly be encouraging for small cap fans and may even signal a change in the trend to confirm that leadership is indeed moving to the small cap arena.

Tracking Shifts In Market Capitalization Leadership

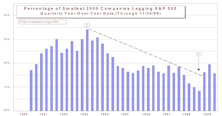

A unique way to monitor and react to changing stock market capitalization leadership trends. This new study examines the percent of stocks lagging the S&P 500, segmented by capitalization tiers.

Time To Shift Into Mid Caps?

Advise clients mandated to be fully invested to move assets away from Large Cap institutional favorites and into Mid/Small cap names.

Making The Case For Mid Caps

For managers who are mandated to stay fully invested, Mid Caps make pretty good sense as a replacement for extremely overvalued Nifty Fifty stocks.

View from the North Country

Where Do We Go For Good Investment Returns Now?... Polling The Pro's For Our Client's Current Stock Market Attitudes...Taking Another Look At The New S&P Midcap Index

.jpg?fit=fillmax&w=222&bg=FFFFFF)