P/E

Peak EPS: Another Critique

It’s only been a few years since we added the Peak P/E ratio to our suite of market valuation measures. That situates us in the uncomfortable position of having to explain why a big decline in this newer metric might be misleading.

We’re The Government And We’re Here To Help

Our trusted civil servants must have found a list of our old Economic/Interest Rates/Inflation components and began to “discontinue” those once invaluable to us and other Fed watchers. It’s a hindrance, but we still have the one that is most correlated to stock prices and it’s free: The ever-expanding balance sheet.

“Peaking” Into The Future

Peak P/E has just moved into its top decile on a postwar basis. If the recent rally is indeed the first roar of a new bull, then this is a bull that’s a “baby” on a calendar basis, but quite elderly from a “character” perspective.

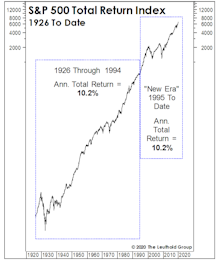

The Chart Everyone Missed

When we first met Steve Leuthold in the old company office in a renovated warehouse, he was updating a several-foot-long chart of either the DJIA or S&P 500, by hand, and we got a brief lecture on the importance of using logarithmic scale on price charts.

Small Cap Smack-Down

We were fooled on Small Caps, and it’s been a “multi-factor” catastrophe.

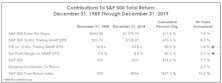

Superhuman Feats Got Us Here

The simultaneous “New Era” ascension in margins and P/E ratios hasn’t generated anything exceptional from a return perspective. To the contrary, annualized S&P 500 total returns over this 25-year period of margin magic and (mostly) escalating P/E ratios merely match “Old Era” returns.

A Spectacularly Average Thirty Years

In the spirit of good holiday cheer, we made a partial concession to the True Believers with a December “Chart of the Week” in which we narrowed our stock market valuation analysis to the historically elevated levels of last 30 years.

Valuations: An Updated “Modern” Take

An occasional critique of our valuation work is that we consider “too much” market history to form a judgment as to what constitutes “high” or “low.” This type of feedback declined during and after the financial crisis (when historic valuation thresholds were temporarily revisited), but it has become more pointed as the U.S. market has soared to new highs.

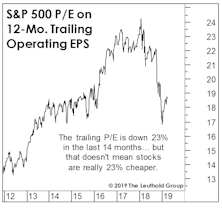

The P/E Decline Has Been Greatly Exaggerated

The S&P 500 has bounced back to levels seen at the January 2018 spike high, yet is valued more cheaply than it was 14 months ago.

Beware The Breakout

The S&P 500 finally erased the losses from its nine-day swoon in January and February.

Too Many Clocks

Whatever one’s philosophical leaning, the practice of adjusting earnings has left investors with too many watches to consult. We look deeper into the topic of adjusted earnings to gauge the slippage between commonly-referenced earnings clocks.

Staples Still Stomped Upon

Consumer Staples has historically been the sector most resistant to intermediate stock market corrections, exhibiting an average “downside capture” of less than 40% during all such declines dating back to 1989.

Will Rates Kill The Low Vol Mania?

While there are many parallels between recent action and that of 1999-2000, stock market leadership is not one of them.

Bridesmaid Strategy: Low P/E Sector: Annual Results

Table 5 shows annual performance results for the Cheapest Sector strategy under all four rebalancing frequencies, along with the lowest P/E sector for the annual version of the strategy.

Value: Scarcer Than In 2000

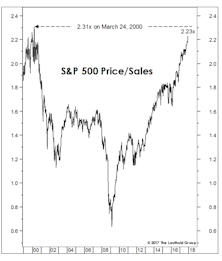

Comparing current valuations to March 2000 is unfair to March 2000. Any Value or Small Cap manager from that era can attest that values became more plentiful as the S&P ascended into its narrow peak.

Valuation-Based Country Selection/Rotation

Despite cyclicality, over the longer term, investing in lower valuation countries ekes out better performance in an EM portfolio, and Dividend Yield showed the most consistency in terms of value factor effectiveness.

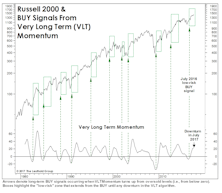

VLT Goes “Quiet”

Last year’s “low-risk” BUY signals from our Very Long Term (VLT) Momentum algorithm have proven very profitable, but enough time has elapsed that they should no longer be considered an important bullish factor.

Broad Participation = Broad Overvaluation

We’ve argued for many months that, across all of the U.S. stock market valuation work we monitor, there’s been only one chart that’s truly looked “bubbly”: the S&P Price/Sales ratio.

Where The Bear Lingers

While the next recession could be caused by a variety of factors, we suspect the recovery will eventually end like most post-war expansions, only after a significant rise in interest rates.

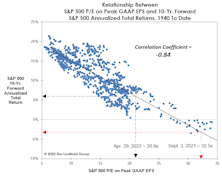

P/E Ratios and Forward Returns: An Update

While it’s not currently the most inflated measure among our Intrinsic Value readings, the S&P 500 P/E on 5-Year Normalized EPS has nonetheless just moved into its tenth historical decile. The latest reading of 23.6x ranks in the 93rd percentile of all observations dating back to 1926.

Eye Examination

It’s a throwaway line to say the current bull market is the “most hated in history,” but consider that this hatred in and of itself has led to probably the most dangerous extremity in the stock market today.

Tech: Prices (And P/E Ratios) Breaking Out

Technology has proven a bright spot in an otherwise disappointing year for our Group Selection (GS) Scores, and it sits atop the sector rankings for the third consecutive month as of October.

EM Leadership: Just The Beginning?

Our EM Allocation Model triggered a BUY at the end of August after 5 1/2-years in bear mode. This upgrade is consistent with a cyclical leadership run of one to four years relative to Developed Markets.

Cheapest Sector Strategy

We recognize that—regardless of their empirical appeal—momentum-oriented approaches aren’t suitable for every investor. For those investors, we’ve identified an alternative sector allocation strategy that’s delivered long-term results almost identical to those of the Bridesmaid approach, but which is based on a single, simple selection criterion that should appeal to the most hard-wired contrarian: The Low P/E.

Market Valuation Check

Stocks have long looked expensive on the basis of dividend yield, but now they look increasingly stretched on Forward EPS.

Royal Blues: High P/E Tier Beats S&P 500

The High P/E Tier is now slightly overvalued, the Middle P/E Tier is overvalued, and the Low P/E Tier continues being quite overvalued.

Dissecting The Capital Tier Indices

Sector weight changes during November were minimal.

Finding Value In “Forward Earnings”

Forward earnings might be the greatest Wall Street innovation in history: a tool that makes the stock market look cheap all the time.

Valuing The “Typical” Stock

Current median valuations are almost identical to those seen at the bull market highs of March 2000 and October 2007.

S&P 500: Equal Weighted Outperforms In Q3; Maintains Lead YTD

On a YTD basis, the spread between these two indices continues to expand, with the Equal Weighted index now outperforming by more than 4%. Consumer Staples is the most expensive sector among Large and Mid Caps, while Health Care is most expensive in Small Caps.

Global Valuations Rising, But U.S. Still At A Premium

The large valuation discount on foreign shares has narrowed a bit, reflecting better relative action in foreign shares over the past 14 months and relatively weaker foreign fundamentals.

Dissecting The Capital Tier Indices

Consumer Discretionary’s weight increased the most in the S&P 500, rising 0.5%. Health Care rose the most in Mid Caps (+0.3%), while Information Technology rose the most in Small Caps (+0.7%).

Time To Bet On China?

Is it time to reverse the “long U.S. consumer/short China” trade?

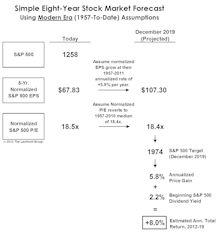

Worrying About 2019 - A Longer Term Forecast

Forecast for 2019 (yes that’s 8 years away) is for S&P 500 to reach 1974 (an +8.0% ACR). Projection based simply on earnings growth and normalized P/E ratios.

China Investing: Segment Valuation May Converge

Interesting development coming out of China recently that is getting little attention. The Chinese government is planning to allow ETFs with Hong Kong listed companies as underlying securities to be traded on the Shanghai and Shenzhen Exchanges.

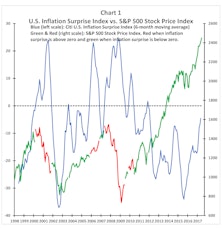

Market Interrelationships: “Unlearning” What We Thought We Knew

Doug Ramsey examines several once very reliable relationships between stocks, bonds, inflation, and commodities.

Global Valuations: Reverting To The Trough

From our perspective as disciples of Normalized EPS, the entire bull market to date has come from P/E expansion. However, that stands to change as global Normalized EPS are again on the rise.

Estimating The Upside

Given the very long-term ebb and flow of market valuations, it is hard to believe that—with old valuation norms finally and decisively violated to the downside—the market will spring back to anything like the valuations seen in the middle of this decade.

Disecting The Capital Indices

Identifying and comparing important characteristics of the broad sectors of the S&P 500.

Small Cap Outperformance: More Questions Than Answers

Small cap out performance so far in 2008 is baffling. Earnings growth has been weak relative to large caps and valuations are still excessive. Interestingly, EAFE Small Cap Index is underperforming, while its U.S. counterparts are doing well.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)