Premium

A Study On Closed End Funds

In March 1991, an article titled “Investor Sentiment and the Closed-End Fund Puzzle” was published in The Journal of Finance.

EM Closed-End Fund Discount/Premium: No Longer A Sentiment Factor

Closed-end funds (CEFs) rarely trade at net asset value (NAV). They either trade at a premium or a discount to share price. When demand for underlying assets is high, the price of a CEF will move above its NAV, trading at a premium. On the contrary, when investors are pessimistic about the underlying assets of a CEF, the price is driven below NAV, trading at a discount. Many studies have looked at CEF discounts and premiums as a means to gauge investor sentiment toward the assets they represent.

Long-Term Equity Performance Coming Up Short

The bull market has pushed short-term annualized performance readings well above median levels, while the longer-term readings remain subdued. But there is a silver lining…

Small/Mid/Large Caps

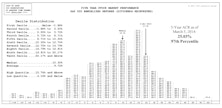

Small Cap Premium Continues Upward To 23%. Large Caps Lead On The Downside In January

Small/Mid/Large Caps

Small Cap Premium Continues Upward To 21%. The red-hot equity market of 2013 was especially good for Small Caps with a +38.8% total return.

Global Valuations Rising, But U.S. Still At A Premium

The large valuation discount on foreign shares has narrowed a bit, reflecting better relative action in foreign shares over the past 14 months and relatively weaker foreign fundamentals.

Emerging Market Indicators Study—Premium/Discount Of Closed End Funds

Asset allocation portfolios continue to hold big positions in Emerging Markets. Jun Zhu presents an initial study exploring the use of Emerging Market Closed End Funds historical premium/discount levels as a predictor of future Emerging Market performance.