Quality

Factor Tilt Update—June 2023

This Leuthold Refresh updates our Factor Tilt analysis, an ongoing process to evaluate the attractiveness of commonly accepted investment styles. Factors are investment characteristics that have historically produced excess risk-adjusted returns, but relative results fluctuate over time.

Q'Val: A Factor Powerhouse

Quant researchers widely agree that Value offers a return premium over time (although not recently) and that High Quality also offers excess returns. The Quality angle seems contrary to intuition, in that investors generally prefer Quality companies and are willing to pay up for them, yet Quality regularly outperforms. Value and Quality are both well-respected investment factors, and we were curious to explore the interaction of these two smart beta stalwarts. Is Value enhanced by adding a layer of Quality, thereby avoiding value traps, or are Value investors better off buying junky, unattractive companies that have the most room to rebound from depressed prices?

Momentum: “New Junk” In The “Old Trunk”

March 23rd marked the one-year anniversary of the COVID-19 bear-market bottom. We are all eager to turn the page on the pandemic ordeal and move forward to brighter days ahead. Looks like some big help is coming our way.

Quality Stocks’ Stronghold

Despite higher volatility, market performance is still up in the high double-digits YTD. Interestingly, as our index of High Quality Stocks versus Low Quality Stocks shows, High Quality is prevailing in terms of relative performance.

Incongruities In High Quality

Quality is one of the most popular and successful of the smart beta factors. It is intuitively appealing and serves as a useful defensive strategy in market drawdowns.

Leverage Factor: A Tailwind For High Quality Stocks?

Following 2016 underperformance, High Quality stocks eked out an advantage over Low Quality stocks to begin 2017 (+5.3% versus +2.1%, respectively). Yet, the “Junk Rally” trend seems difficult to reverse.

Divergence Among Quality Factors

Performance and valuation of the three Quality factors are diverging. From a valuation standpoint, we might see a reversal in performance, with the Stability factor weakening and the Leverage factor strengthening.

High Quality Stocks Slightly Underperform YTD

Even though Low Quality spends the majority of time outperforming, investors benefit exponentially from holding High Quality during the bad times.

High Quality Stocks Shine Again During Market Tumult

On a relative basis, High Quality Stocks lived up to the reputation of providing a safe haven.

High Quality Outperforming, But Valuations A Concern

High Quality stocks had another winning quarter on a relative basis returning +0.1% in Q2, while Low Quality stocks lost 2.8%. Small Cap High Quality stocks also beat their counterparts.

High Quality Stock Leadership Stalled

Last time we updated this work, we were surprised by how much High Quality stocks had outperformed. In Q4 2014, High Quality stocks were up 9.6%, while Low Quality stocks had edged up only marginally (+0.3%).

High Quality Cycle In Force; Ideas For High Quality Energy Stocks

In early October 2014, we noted the momentum reversal of Low Quality stocks and a few signs of the likelihood of transitioning to another phase of the quality cycle. The official numbers of Q4 have confirmed this.

Quality Stock Rankings: High Quality Fared Better In Q3

During a tumultuous Q3, High Quality stocks proved to be resilient, losing only 2.0% compared to Low Quality stocks’ 7.5% loss in Q3. Low Quality stocks’ prior momentum seems to have broken down, especially in September when they slid by 7.1% for the month.

US Bond Market

Although the overall picture remains favorable for high grade credits, the increased exposure to interest rates with an ever thinner spread cushion does concern us. We will monitor closely for potential downgrades.

High Quality Stock Rally Cut Short

In December, we declared the market was likely entering into a cycle where High Quality stocks would shine. Unfortunately, market action since then reminds us of the virtue of being humble.

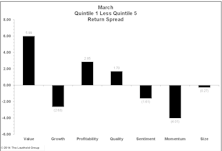

Quantitative Strategies: Factor Performance Reverses

Momentum suffered across almost every sector, but it was particularly bad for Health Care and Info Tech. Value factors finally rebounded after losing over the past year.

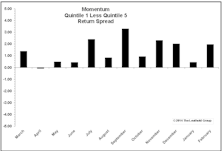

The State Of Momentum

Momentum has easily been the best quantitative factor over the last year. The only other factor with notable positive performance is Sentiment. Can this continue?

High Quality Stocks Rally Back

Stocks with High Quality rankings have outperformed those with Low Quality rankings for the past few months. The junk rally is at or near an end, and investors may want to shift their attention to High Quality stocks.

Life Sciences Tools & Services: Poised For Growth

This group moved back into the Attractive range in September. We like the group’s business model, industry M&A momentum, and stocks’ ability to generate free cash flow. All in all, companies in this group are good candidates for investors hunting for High Quality.

Low Quality Continues To Outperform

Despite rising market volatility, Low Quality stocks ended Q2 up 3.8%, slightly better than High Quality’s 3.4% gain. YTD, High Quality stocks are up 14%, just behind Low Quality stocks at +16.6%.

Quality As An Investable Stock Selection Concept

In this note, we discuss our market-level measure of quality, and highlight an expanded methodology for determining the “quality” of a stock and the performance implications associated with such a concept.

Leuthold Stock Quality Rankings

Our Stock Quality Rankings currently show that stocks with Low Quality rankings outperformed those with High Quality rankings.

Leuthold Stock Quality Rankings: Starting To Favor Low Quality

Our Stock Quality Ranking work currently shows stocks with low quality rankings outperforming those with high quality rankings.

Leuthold Stock Quality Rankings

Leuthold Stock Quality Ranking work is currently showing that High Quality stocks outperformed during the last quarter.

Leuthold Stock Quality Rankings

Leuthold Stock Quality Ranking work is currently showing that High Quality stocks outperformed during 2011. More upside for High Quality stocks going into 2012?

Leuthold Stock Quality Rankings—Tracking Quality And Risk Cycles

A new High Quality Cycle has clearly emerged and is going strong. Note that the previous High Quality Cycle started at the end of 2007 and lasted more than a year.

Leuthold Stock Quality Rankings—Tracking Quality And Risk Cycles

High Quality Stocks outperformed their Low Quality comparators in the second quarter, and we find signs that a new High Quality Cycle is starting to take off.

Leuthold Stock Quality Rankings—Tracking Quality And Risk Cycles

While Low Quality stocks have been beating High Quality, performance was on par in Q1. High Quality cheap relative to Low Quality and the tide may be turning.

A “Quality” Opportunity?

Low quality stocks led out of the past bear market, as typically occurs. Despite being the clear winners from the 2009 lows, it looks like the lower quality stocks can continue to outperform given current valuations and momentum.

Month In Review: The Quality Trade Returns

Quantitative factor performance throws yet another curve ball. Momentum works with Growth and Profitability for first time this year.

Go Back To Basics During An Economic Slowdown: Value & Quality

Given the discussion during August of a weakening economy and a potential double dip, Chun Wang looks at which of our quantitative factors do best during a slowdown.

High P/E Quality Stocks Now Cheap

High P/E Quality stocks are now very cheap on a relative basis, at least when compared to low P/E stocks. Unfortunately, our timing work does not yet show favorable market momentum developing for these issues.

.png?fit=fillmax&w=222&bg=FFFFFF)