Sectors

Additional Factors

The S&P 500 had an almost biblical upheaval to start 2023. The “last were first” and the “first were last.” In January, the 100 worst performing stocks of 2022 had an average return of +16.1% while last year’s 100 best performers posted +1.7%.

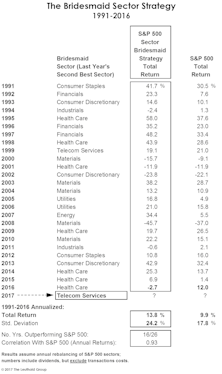

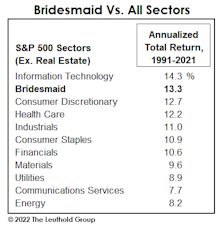

Bridesmaid Sector Track Record

As noted, the Bridesmaid sector strategy has underperformed what has become a more difficult benchmark in five of the last six years. Those poor results have cut the annualized excess return of this approach to just +2.1% since 1991.

Bridesmaid Strategy For Equity Managers

Once again, the idea is to dispense with macroeconomic trends, sector fundamentals, comparative valuations, and to base sector selection solely on the prior year’s total returns.

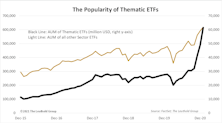

Newfound Popularity Of Thematic ETFs

We’ve noticed a small segment of equity ETFs, designated as “thematic,” that is increasingly gaining popularity. Thematic ETFs invest in baskets of stocks that share narrowly-defined business enterprises outside of the standardized GICS methodology.

Sector Bridesmaid Track Record

We’ve worried over the last several years whether momentum and other “alpha” factors have become exploited to the point of diminishing returns. It’s an arms race out there...

S&P 500 Dividends? Thank You, No!

Dividends are a cornerstone of equity investing and over the decades they have produced a significant portion of the stock market’s total return. Previous Leuthold research has identified a strong dividend influence on total returns for small and midcap companies. Looking at S&P 500 constituents, we see that dividend growers outperformed companies that had flat or declining dividends – an expected outcome. However, we also found that companies not paying dividends convincingly outpaced dividend payers. This is contrary to the results in other market segments, but the explanation for this becomes apparent in the course of our research.

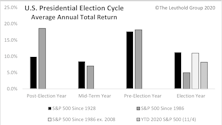

The Stock Market & U.S. Presidential Election Cycle Revisited

We crunch some numbers to see how 2020’s stock market trends have fared compared to the typical election year, and we slice and dice past post-election year trends at the sector and industry group levels to look at potential opportunities in the coming year.

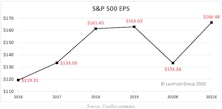

2021 Earnings: How Do We Get There?

According to FactSet estimates, S&P 500 earnings for 2020 are anticipated to come in near $133 per share, a drop of 18% from 2019 results. Given the widespread business disruptions and closures caused by the pandemic, one might have expected this year’s results to be much weaker.

Research Preview: 2021 Earnings Breakdown

Earnings estimates for 2021 are being projected above the records posted in 2018 and 2019. We ask the question, “How do we get there?” Here we present an introduction to this topic that we will examine at length and provide a full analysis in mid-October.

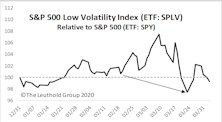

Popular Low/Minimum Volatility Strategies Disappoint

During the peak-to-trough market drawdown through mid-March, some of the most popular Low/Min Vol ETFs did not perform as anticipated. Stable and boring businesses, that weather downturns relatively well, are facing atypical vulnerabilities.

Is Passive Ownership Exacerbating The Sell-Off?

With the enormous popularity of ETFs, we’ve wondered if the high level of passive fund ownership could lead to stock price deviation from company fundamentals, and thus create greater price volatility.

Sector Bridesmaid Track Record

2019 was the fourth consecutive year of underperformance by the annual Bridesmaid sector pick. Those poor results have trimmed the annualized “alpha” of the strategy to just +2.2% since 1991.

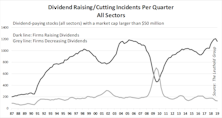

Return Implications Of Dividend Cuts

Last month we noted that current interest-rate expectations might indicate good timing for dividend investments; however, we strongly suggested being selective, and lean toward high-quality dividend payers.

Bridesmaid Strategy - Sectors

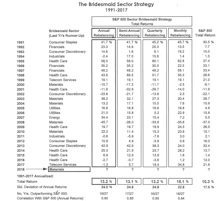

Our analysis of the Bridesmaid effect originated in 2006, but was based on S&P 500 sectors rather than asset classes.

Sector Rankings

The top-three rated sectors are Health Care, Communication Services, and Consumer Discretionary, with Information Technology dropping from the top-three. Rounding out the bottom end of the rankings, for the second consecutive month, are Materials, Energy, and Consumer Staples.

Market Observations

It’s been one of the worst years on record for diversification, with our hypothetical All Asset No Authority (AANA) portfolio down 7.2% YTD through yesterday. That’s the second-worst year for AANA since 1972, and there’s probably not enough time left for performance to undercut 2008 (-24.9%) for the bottom spot.

Sector Rankings

For the sixth consecutive month, the top-three rated sectors are Health Care, Consumer Discretionary, and Info Tech. Rounding out the bottom end of the rankings are Materials, Energy, and Consumer Staples.

Leuthold Sector Rankings; Attractive & Unattractive-Rated Industry Groups

For the fifth consecutive month, the top-three rated sectors are Health Care, Consumer Discretionary, and Info Tech. The newly launched Communication Services sector (which replaces Telecom Services) debuts with a strong ranking in fourth place. Rounding out the bottom end of the rankings are Utilities, Materials, and Real Estate.

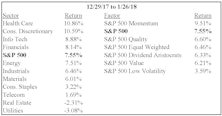

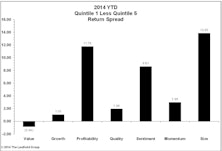

Research Preview: Sector-Adjusted Factor Returns

This article summarizes our current research into the interaction between factors and sectors. We find that sector weights have a significant influence on some factor results, while the true factor impact is the key driver for others. Watch for our full report coming next week.

Sector Ranking

Health Care remains the highest-rated sector followed by Info Tech and Consumer Discretionary. These sectors have ranked among the top three since June. At the low end of the rankings are Utilities, Telecom Services, and Materials, all of which have been among the bottom three positions for three consecutive months.

GS Sector Rankings

Read this month's Sector Rankings.

Sector Rankings

Following a seven-month stint as the highest-rated sector overall, Consumer Discretionary relinquished the throne to Health Care.

GS Score Sector Rankings With Attractive & Unattractive Rated Industry Groups

Consumer Discretionary can’t be topped; it has held on to the highest-rated spot for seven consecutive months. Utilities and Telecom continue to close out the bottom two.

Sector Rankings

Consumer Discretionary has held on to the highest-rated spot for six consecutive months. Coming in last (again) is Utilities. After rating among the lowest two positions between April 2017 and April 2018, Energy finally improved and now sits in 6th place—the middle of the pack.

The Ups and Downs of 2018

Ten weeks into 2018, we have already seen three mini-cycles in U.S. equities. A rip-roaring surge in January was followed in early February by one of the shortest corrections in history...

Bridesmaid Strategy: Sector Track Record

Table 3 shows annual performance results for the Bridesmaid sector strategy under all four rebalancing frequencies, along with the sector selection for the annual version of the strategy.

Sector Rotation: Momentum Versus Valuation Factor

For sector overweight/underweight decisions, applying a Momentum overweight with both EM and DM countries has been most successful.

The Many Faces Of Mo

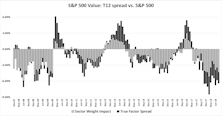

Momentum is one of the most widely accepted alpha-generating factors, used by quantitative and fundamental managers alike. Its biggest drawback, however, is high turnover. Herein we explore momentum from the perspective of sector weights.

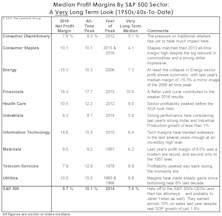

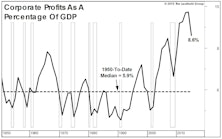

Sector Margin Checkup

U.S. companies hoping for a reduction in the corporate tax rate are not exactly doing a convincing job of demonstrating “need.”

Sector Profit Margins: A Long-Term Review

Despite real GDP growth of just 1.6% in 2016, the median S&P 500 company earned a net profit margin of 9.7%, only 40 basis points below the record high established in 2014.

Bridesmaid Sector Track Record

Table 4 shows the annual sector selection and accompanying performance results for the Bridesmaid approach dating back to 1991.

January’s GS Score Sector Rankings

A summary table detailing the Attractive and Unattractive sectors and industry groups going into 2017.

Sectors And Industry Groups On Our Radar

A look at various dynamics affecting sector results in 2016, and what we like going into 2017, both at the sector level and among groups.

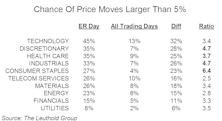

Earnings-Release Price Movement Among Sectors/Industries

Earnings season is not only important for fundamental investors, it can be equally so for quant managers. For quants that incorporate fundamental data, like us, historical trends and changes in consensus estimates may weigh heavily on model output.

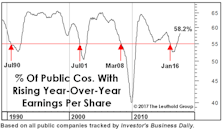

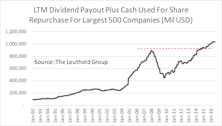

Can Companies Sustain Cash Payouts?

Companies are returning cash to investors at a level never before seen. Counting dividend payouts and outstanding share repurchases, the amount of cash returned back to investors crossed the $1 trillion mark for the first time in January 2016 (based on trailing twelve-months’ total for the largest 500 companies, Chart 1).

Bridesmaid Sector Strategy

Our original research on price momentum dates back to the late 1960s, and was based not on asset classes but on equity sectors and industry groups. We stumbled upon the Bridesmaid effect, in fact, while testing a handful of simple strategies about a decade ago.

Profit Margins At The Sector Level

A look at profitability trends at the broad sector level; only Utilities and Telecom Services are experiencing levels below their long-term medians.

2015 Leadership: An Early Take

Last year’s economically defensive winners held their grip on stock market leadership in January. This action is consistent with our view that the bull market is an aged, overvalued one that has begun a final “distribution” process that will eventually erupt into a cyclical bear.

Sector Margin Trends

The S&P 500 record median profit margin of 10.3% is now almost a full percentage point above the last cycle’s peak of 9.4% (second quarter of 2007). Trends across S&P sectors are not as uniform as one might expect, though, with only half of the ten sectors last quarter at profitability levels that exceeded their 2001-2007 expansion highs.

Quantitative Factor Performance: What Is Working?

Six of the seven factor categories we track have turned in positive performance so far in 2014; Value is the exception. Lost in the numbers is that most of the value has come from the short quintiles, so it has been hard for managers to take advantage of this trend.

.jpg?fit=fillmax&w=222&bg=FFFFFF)